The brokerage downgraded Bajaj Auto’s stock to ‘Underweight’ from ‘Equal-weight’

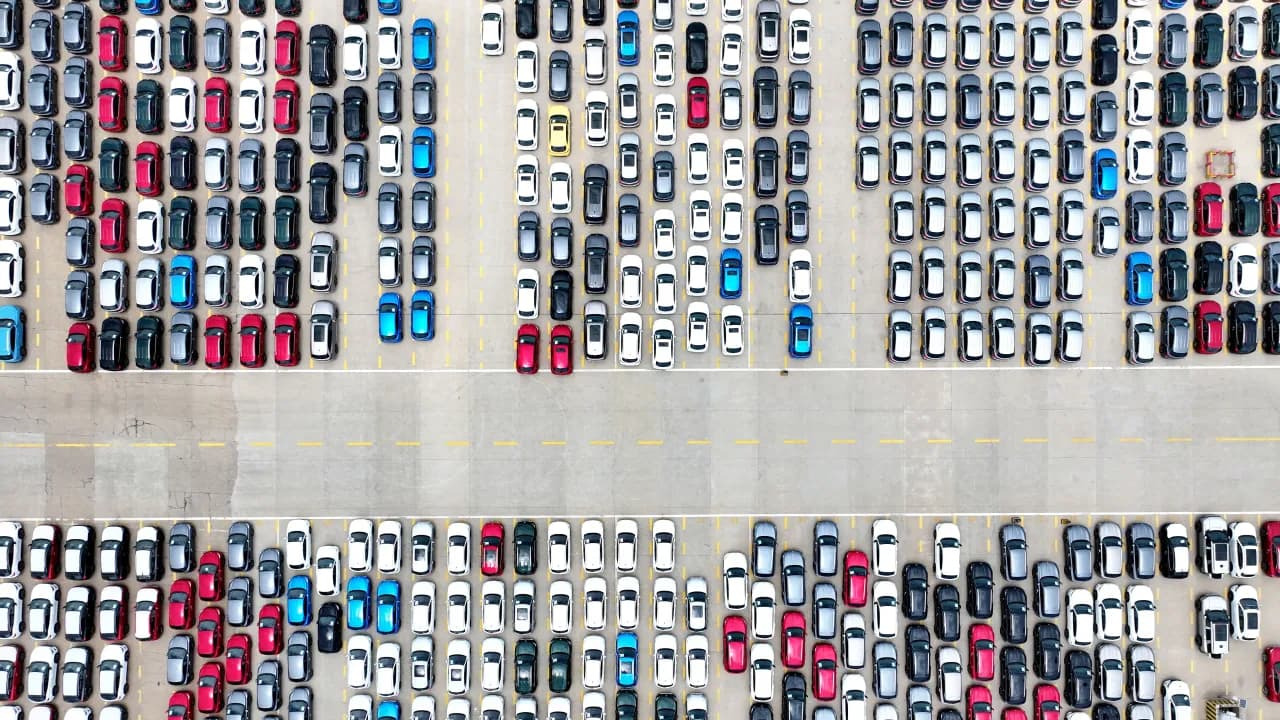

The Nifty Auto Index rose in early trade on Tuesday, marking a fifth consecutive session of gains, after Morgan Stanley issued a bullish outlook on the sector, citing benefits from the GST cuts.

Morgan Stanley turned optimistic on India’s auto sector, highlighting that GST rationalization could trigger price cuts on a scale never seen before. The brokerage added that supportive factors such as monetary easing and the implementation of the Eighth Pay Commission could further boost sales momentum in the coming quarters.

The report noted that auto sector valuations have historically peaked when margins are at their highs. With margins likely to surprise on the upside this cycle, Morgan Stanley expects the sector to witness a stronger re-rating. Companies such as Mahindra & Mahindra (M&M), TVS Motor, and Eicher Motors are already gaining market share, and GST-led price reductions could accelerate this trend.

The brokerage highlighted India’s low penetration levels of passenger vehicles, with only 13% of households owning PVs compared to 73% owning two-wheelers. It expects price cuts to stimulate both replacement demand and first-time buyers, with Maruti Suzuki positioned to gain from SUV launches and renewed entry-level PV demand.

Stock Calls

Maruti Suzuki: Morgan Stanley has maintained an ‘Overweight’ rating and sharply raised its target price to ₹18,360 from ₹14,262, citing stronger demand prospects.

Hyundai Motor India: The brokerage reiterated its ‘Overweight’ call, lifting the target price to ₹3,066 from ₹2,241.

Mahindra & Mahindra (M&M): Morgan Stanley continues with an ‘Overweight’ stance, revising the target price upward to ₹4,321 from ₹3,668.

Ashok Leyland: The firm holds an ‘Overweight’ rating, increasing the target price to ₹152 from ₹144.

TVS Motor: Backed by market share gains, Morgan Stanley retained its ‘Overweight’ view, raising the target price to ₹3,933 from ₹3,126.

Hero MotoCorp: The rating has been upgraded to ‘Equalweight’ from ‘Underweight’, with the target price significantly increased to ₹5,968 from ₹3,765.

Eicher Motors: Morgan Stanley has upgraded the stock to ‘Equalweight’ from ‘Underweight’, hiking the target price to ₹7,201 from ₹4,079.

Bajaj Auto: In contrast, the brokerage downgraded the stock to ‘Underweight’ from ‘Equal-weight’, trimming the target price to ₹8,075 from ₹9,117. The brokerage does not expect Bajaj Auto to gain as much as its peers from the auto sector recovery.

Stock Watch

Among the companies covered in the research note, only Bajaj Auto (-0.7%) and Ashok Leyland (-0.43%) were trading lower.

Eicher Motors shares were up 1.47% at ₹6,915.50, Maruti gained 0.62%, Hero was up 0.45%, Hyundai Motor India climbed 0.8% higher, and TVS Motor was up marginally at 0.1%.

The Nifty Auto index rose around 6% in the past four sessions. Despite the gains, retail sentiment on Nifty Auto was ‘bearish’. It was ‘neutral’ a week earlier.

GST Boost For Autos

Carmakers, including Tata Motors, Mahindra & Mahindra, and Maruti Suzuki, have announced significant price cuts for their vehicles following the GST Council’s decision to lower rates for most vehicle categories to 18%.

The GST Council reduced tax rates from 28% to 18% on small petrol, diesel, LPG, CNG, and hybrid cars with a length of under 4,000 mm, a segment that accounts for most vehicle sales in India. Meanwhile, the tax has been raised to 40% for larger and premium vehicles, while the 5% rate on electric cars remains unchanged.

For updates and corrections, email newsroom[at]stocktwits[dot]com. <