The GST 2025 slab revisions bring changes to tax rates on essential and luxury goods, leading to consumer savings and lower prices on everyday items. The new system will be effective from September 22nd.

GST Reforms: The central government recently implemented significant reforms to the Goods and Services Tax (GST). The 12% and 28% slabs have been eliminated, leaving primarily two slabs: 5% and 18%. Luxury products and health-damaging goods like pan masala fall under the 40% GST slab. These changes have raised questions about the benefits compared to the previous tax system. The government has provided an easy way to find out.

Scroll to load tweet…

How to Calculate Your GST Savings?

- Want to know how much you’re saving on everyday items and expensive products like ACs and refrigerators under the new GST system?

- Visit https://savingswithgst.in/ to compare with the previous VAT system.

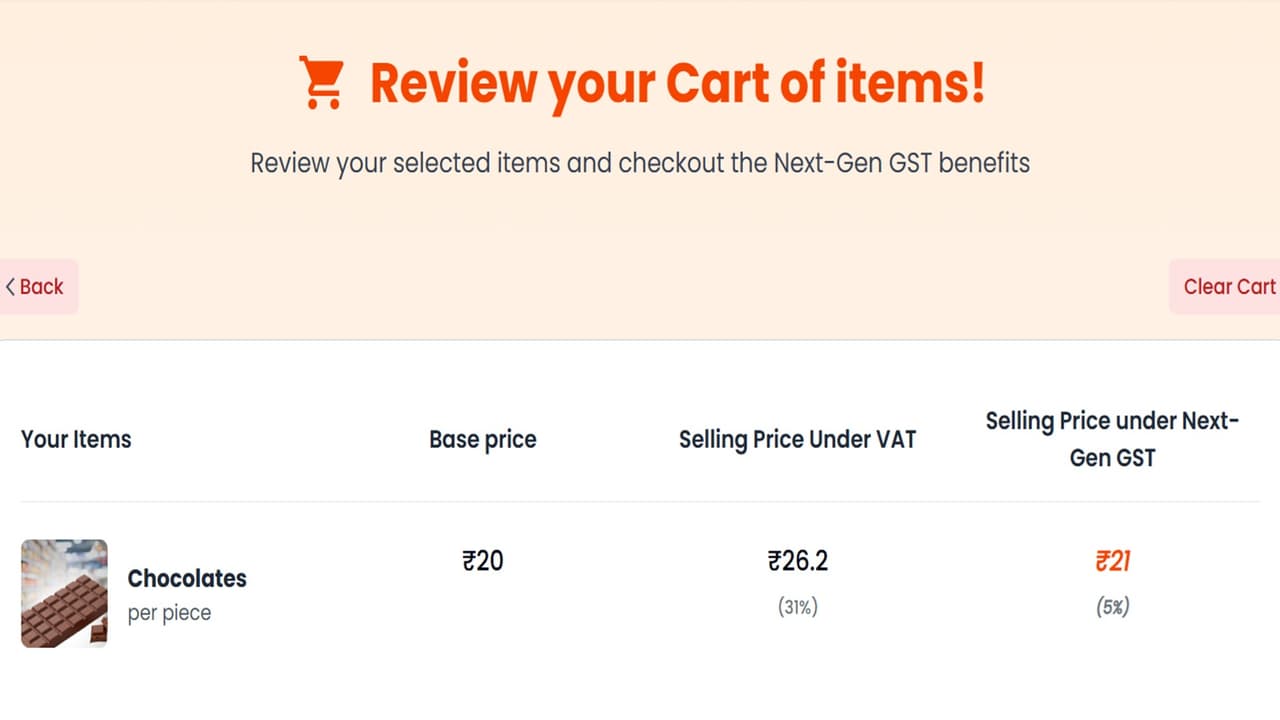

- On savingswithgst.in, select products ranging from flour and sugar to chocolates, ACs, and refrigerators.

- Click “Add to Cart” below each product.

- Click “View Cart.”

- You’ll see the price of the selected items, the base price, the VAT percentage and corresponding price, and the current GST amount and price.

Also Read- New GST Rate List: Cheaper Everyday Items from September 22, 2025