The company has secured Ghana’s parliament’s formal approval of the extensions for its key offshore petroleum licenses.

- The approvals push the licenses out to 2040 and clear the path for new development activity.

- The extended terms are expected to unlock as much as $2 billion in additional capital spending.

- Kosmos said that the J74 well has reached full output, generating roughly 13,000 barrels per day.

Kosmos Energy (KOS) shares rose sharply on Friday after Ghana’s parliament formally approved the extensions for its key offshore petroleum licenses. The ratified expansions cover the Jubilee and TEN fields and push the operating rights out to 2040.

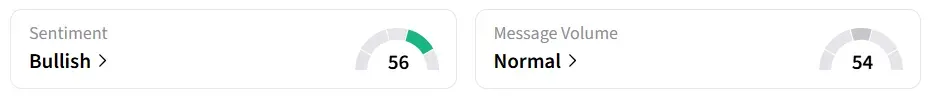

Following the update, Kosmos Energy stock traded over 10% higher in Friday’s premarket. On Stocktwits, retail sentiment around the stock jumped to ‘bullish’ from ‘neutral’ territory the previous day amid ‘normal’ message volume levels.

Long-Term Investment In Ghana: 20 New Wells Planned

The extended terms are expected to unlock as much as $2 billion in additional capital spending, according to the company. The revised Jubilee development blueprint allows for up to 20 new wells, a step the company believes will lift its proven and probable reserves at the field.

“Jubilee is a world‑class oil field with significant remaining potential that can be unlocked through continued investment, regular drilling and high facility reliability, supported by the latest seismic acquisition and processing technologies.”

-Andrew G. Inglis, Chairman and CEO, Kosmos Energy

Production Momentum At Jubilee Builds

Operationally, Kosmos said that the J74 well, which began producing in January, has reached full output. The well is producing roughly 13,000 barrels per day, pushing average gross production at Jubilee above 70,000 barrels per day so far in February.

Meanwhile, the J75 well, the first in a five-well drilling program scheduled for 2026, has been drilled. The company expects to complete J75 across three zones and bring it online by the end of the first quarter.

At the TEN fields, partners have agreed to purchase the floating production, storage, and offloading vessel for $205 million in total, with Kosmos’ share estimated at about $40 million. The transaction is slated to close in early 2027 and is projected to lower operating costs beginning in 2026.

KOS stock has declined by over 47% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<