The CBO expects tariffs to raise about $3 trillion over a decade, but will be outweighed by roughly $4.7 trillion in costs from Trump’s tax law and $500 billion from immigration policies.

- Imports surged in January and March ahead of new duties, pushing the deficit to a record $140.5 billion in March.

- After reciprocal tariffs of at least 10%, and much higher rates on countries including China, took effect in April, imports fell sharply.

- Customs revenue reached $264 billion in 2025, up about $185 billion from a year earlier, helping trim the annual budget deficit to $1.67 trillion.

U.S. President Donald Trump on Wednesday touted a 78% decline in the U.S. trade deficit under his tariff regime, citing a striking figure that hinges on a selective reading of turbulent monthly trade data.

In a Truth Social post, Trump said, “The United States trade deficit has been reduced by 78% because of the tariffs being charged to other companies and countries. It will go into positive territory during this year, for the first time in many decades. Thank you for your attention to this matter!”

Trump’s Math Behind His Claim

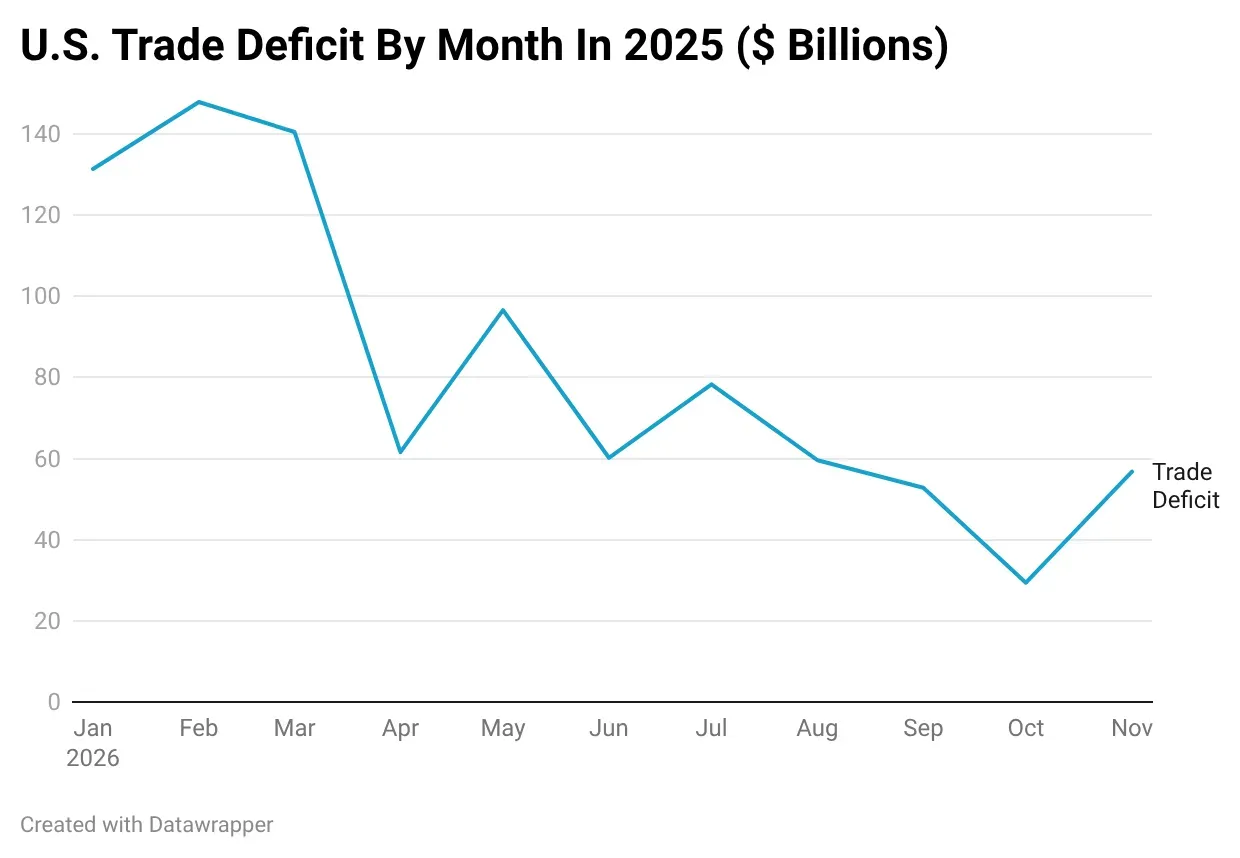

The U.S. trade deficit widened to a near-record $131.4 billion in January 2025, according to Commerce Department data, as companies rushed to import goods ahead of sweeping tariffs promised by the Trump administration. By October 2025, the monthly deficit had narrowed to about $29.4 billion, the smallest since 2009, marking a pullback in imports.

A comparison between January’s $131.4 billion deficit and October’s $29.4 billion gap yields a drop of about 78%, a calculation that appears to underpin Trump’s claim. However, the comparison pairs a peak in import front-loading ahead of tariffs with a subsequent decline in imports, rather than reflecting the full-year trade picture.

Through November 2025, the year-to-date trade deficit stood at roughly $833 billion, which is 4.1% higher than the same period in 2024.

Why Monthly Trade Numbers Swung So Sharply

The large swings in 2025 were closely tied to tariff timing. In January and March, companies accelerated imports, particularly pharmaceuticals, industrial supplies and gold, ahead of anticipated tariff increases. March alone saw the trade gap widen to a record $140.5 billion as businesses raced to secure goods before new duties were announced.

In early April, Trump unveiled reciprocal tariffs of at least 10% on all exporters to the U.S., with higher rates on about 60 nations. China faced tariffs of well above 50% on many goods, while the European Union, Japan, and Vietnam were also targeted with elevated duties.

Following the April rollout, imports dropped sharply. In April, the trade deficit narrowed by a record 55.5% from the prior month as imports fell the most on record. By August, the monthly deficit had narrowed to $59.6 billion, and by October it had fallen further to $29.4 billion, signaling the post-tariff import slowdown.

Gold imports, in particular, distorted the picture. Heavy inflows of non-monetary gold helped push the U.S. trade deficit to a record $140.5 billion in March. When those shipments reversed, the monthly gap narrowed sharply, falling to $59.6 billion in August and $29.4 billion in October.

What The Full-Year Picture Shows

Even with October’s drop to $29.4 billion, the cumulative figures tell a different story. Through November 2025, the cumulative deficit reached about $833 billion, up 4.1% from the same period in 2024.

Bilateral balances moved sharply month on month: the goods deficit with China narrowed to $24.8 billion in March and fell further in June, while the shortfall with Ireland more than doubled to $29.3 billion in March before retreating as pharmaceutical imports cooled.

The narrowing in specific months also boosted short-term GDP calculations. Net exports shaved almost 5 percentage points off first-quarter GDP as imports surged, before flipping to contribute about 5 percentage points to growth in the second quarter as imports fell back and the monthly trade gap narrowed.

Higher Tariffs Narrow Budget Gap

Tariffs have also increased customs revenue. For calendar year 2025, tariff revenue totaled $264 billion, up roughly $185 billion from the previous year, helping narrow the federal budget deficit to $1.67 trillion, the smallest in three years.

However, the Congressional Budget Office estimates that higher tariffs could reduce deficits by about $3 trillion over the next decade. Trump’s 2025 tax law and immigration policies are projected to increase deficits by $4.7 trillion and $500 billion, respectively. Net outlays on interest are also projected to surge, pushing total deficits higher over time.

The CBO has warned that the U.S. remains on an “unsustainable” fiscal path, with deficits projected to exceed 5% of GDP for years to come.

However, legal uncertainty still hangs over the durability of the tariff regime itself. The Supreme Court has twice declined to issue a ruling on the legality of President Donald Trump’s tariffs after hearing oral arguments in October and November 2025. The court has scheduled Feb. 20, as well as Feb. 24 and 25, as upcoming opinion days where justices may finally release their decision.

How Did Stocktwits Users React?

On Stocktwits, retail sentiment toward the SPDR S&P 500 ETF Trust (SPY) and SPDR Dow Jones Industrial Average ETF Trust (DIA) was ‘neutral’ amid ‘high’ message volume, while sentiment toward the Invesco QQQ Trust (QQQ) was ‘neutral’ amid ‘normal’ message volume.

One user said, “The idea that this administration won’t admit Americans pay the tariffs is the most 1984 esq thing this country has ever witnessed from our government.”

Another user suggested that an upcoming Supreme Court opinion day could focus on Trump’s reciprocal tariffs.

So far this year, DIA has outperformed, up 3.5%, compared with SPY up 0.6% and QQQ down 1.4%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<