The standoff ended when the EU granted conditional approval, sending shares up 42% on Wednesday.

- Short interest hit a record 13.7% of free float between Feb. 13-19 as investors braced for the European Commission’s decision on Anktiva.

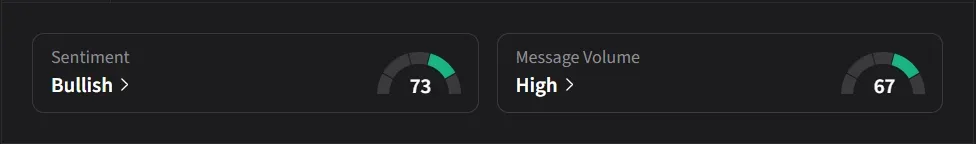

- Retail traders flipped from ‘bearish’ to ‘bullish’ over the same period.

- Bullish options activity spiked, including over 30,000 calls traded on Feb. 18 and a put-call ratio near 0.09.

ImmunityBio, Inc.’s (IBRX) stock became a high-stakes battleground in February, with short interest climbing to a record high amid the European drug regulator’s make-or-break decision on the company’s flagship cancer therapy.

Shorts Piled Into IBRX Ahead Of Europe’s Call

Shares of ImmunityBio entered February under mounting pressure as bearish positioning steadily intensified. Between Feb. 13 and Feb. 19, short interest rose to 13.7% of the free float, marking an all-time high and up from 12.9% between Jan. 30 and Feb. 12, according to data from Koyfin.

Investors were awaiting a final decision from the European Commission on Anktiva, ImmunityBio’s immune-activating therapy for an early-stage form of bladder cancer that no longer responds to standard BCG treatment. The European Medicines Agency had already issued a positive opinion in December, but uncertainty around final approval, conditions, and timing kept bears crowded.

Retail Traders Bet Against The Shorts

As short interest climbed to record levels, retail sentiment moved in the opposite direction. Over the same Feb.13- Feb. 19 window, Stocktwits sentiment flipped from ‘bearish’ to ‘bullish’, while message volume jumped more than 300% as traders positioned themselves for a potential European approval.

Retail chatter began picking up as early as last week, with users speculating that approval could arrive within days and warning that short sellers could be caught offside. Several posts highlighted elevated short positioning and growing call activity.

Options markets echoed that shift. According to The Fly, ImmunityBio saw unusually heavy and directionally bullish call flow during the week, with more than 30,000 calls trading on Feb. 18 alone, roughly twice normal volume. Implied volatility rose close to five points to around 129%, with the most active contracts concentrated in Feb. 26 $7.50 calls and puts. The put-call ratio was near 0.09.

Saudi Momentum Builds Before Europe Acts

In the days leading up to the European decision, ImmunityBio also received supportive signals from Saudi Arabia. This week, the Saudi Food and Drug Authority encouraged the company to submit a regulatory filing for its recombinant Bacillus Calmette-Guerin therapy to help address treatment shortages and expand access.

The company also disclosed discussions with Saudi regulators to broaden Anktiva’s use in combination with checkpoint inhibitors across multiple tumor types. Saudi Arabia had already granted accelerated approval in January for Anktiva in metastatic non-small cell lung cancer and for BCG-unresponsive bladder cancer.

FDA Criticism Raises The Stakes

Over the weekend ahead of the European decision, executive chairman Patrick Soon-Shiong added fuel to the debate by publicly criticizing the U.S. Food and Drug Administration (FDA). In an interview, Soon-Shiong said the FDA was applying stricter standards to Anktiva than to Merck’s Keytruda, arguing that regulators were requiring randomized trials across multiple tumor types while allowing Keytruda to expand based on single-arm studies.

He said thousands of patients were seeking access to Anktiva outside its approved bladder cancer indication and described the approval pathway as creating a regulatory bottleneck.

EU Approval Breaks The Standoff

On Wednesday, the standoff broke. ImmunityBio shares surged 42% after the European Commission granted conditional marketing authorization for Anktiva in combination with BCG for adult patients with BCG-unresponsive non-muscle invasive bladder cancer with carcinoma in situ, with or without papillary tumors.

The decision cleared the drug for use across all 27 European Union member states, as well as Iceland, Liechtenstein and Norway, expanding Anktiva’s total footprint to 33 countries. The authorization requires ImmunityBio to submit long-term safety and efficacy data to the European Medicines Agency as part of ongoing follow-up.

Wall Street Backs IBRX Even As Shorts Press

Throughout January and early February, analysts reiterated bullish views, with firms such as Piper Sandler, BTIG and HC Wainwright maintaining ‘Overweight’ or ‘Buy’ ratings and raising price targets as regulatory and clinical updates unfolded.

At the same time, short interest climbed steadily from 11.1% in early January to record levels by mid-February. Several events during this period fueled the bear case.

In late January, director Simon Barry sold more than 151,000 shares for approximately $1.1 million. ImmunityBio also amended a $505 million convertible note with Nant Capital to allow greater flexibility for debt-to-equity conversion, raising concerns about potential future dilution. Alongside these developments, the company was advancing a broad pipeline spanning bladder cancer, lung cancer, glioblastoma, and multiple blood cancers.

How Are Stocktwits Users Reacting Now?

Retail sentiment on Stocktwits is currently in the ‘bullish’ zone amid a 209% surge in 24-hour message volume.

One user said, “Today was great, better than what I expected. Tomorrow can be huge, I hope we have follow-through!!! Typically, we have pulled back, but now I think we really have higher lows and much higher highs!! Let’s go and crush the shorts!”

Another user joked, “Shorts probably working on ‘go fund me’ schemes.”

IBRX stock has surged 331% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<