The outcome could affect companies such as Coinbase and Circle, both of which have exposure to stablecoin-related revenue streams.

- Crypto industry representatives and Washington officials reportedly plan to meet again this week to address the stalemate over the CLARITY Act and stablecoin yield rules.

- Banking groups have proposed banning any yield or rewards tied to stablecoins.

- Crypto industry participants have countered with guidelines that would allow payment stablecoins to generate yield within DeFi.

Crypto industry leaders and officials in Washington are reportedly set to meet again on Thursday to discuss the current stalemate over the CLARITY Act and debate over stablecoin yields.

According to journalist Eleanor Terrett, two sources familiar with the matter said another meeting is likely to take place on February 19, but no plans have been finalized yet. A little over one week remains before the end-of-month deadline kicks in for the banking and crypto industry to agree on the final terms.

This comes after Patrick Witt, the White House Crypto Council’s executive director, told Yahoo Finance on Friday that another meeting could take place as soon as this week, but did not indicate which day.

The Debate Over Stablecoin Yields

The two sides have met twice so far, with last week’s meeting also ending without a deal in place. Subsequently, representatives from the banking industry circulated a one-page document titled “Yield and Interest Prohibition Principles,” which effectively stated that any yield or rewards tied to stablecoins should be banned. Meanwhile, representatives on the crypto side released their own set of guidelines that would let payment stablecoins generate yield within decentralized finance (DeFi).

The final decision is likely to have a bearing on companies like Coinbase (COIN), which offers rewards to its users for holding stablecoins, and Circle (CRCL), issuer of the second-largest stablecoin in the market USDC (USDC). COIN’s stock was up 1.3% in pre-market trade after Cathie Wood picked up more shares, and CRCL’s stock gained more than 2%.

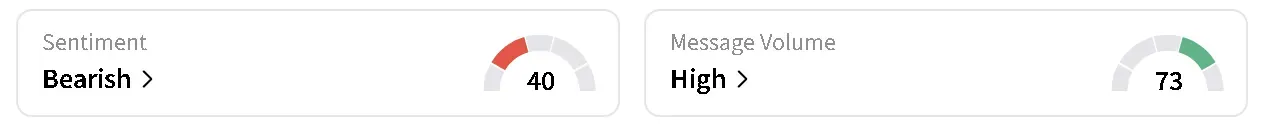

Retail sentiment on Stocktwits around USDC and largest stablecoin in the world, Tether (USDT), trended in ‘bearish’ territory over the past day, accompanied by ‘high’ levels of chatter.

Meanwhile, the cryptocurrency market remained rangebound. Bitcoin’s (BTC) price was trading flat on Wednesday morning at around $68,000. On Stocktwits, retail sentiment around the apex cryptocurrency trended in ‘bearish’ territory over the past day.

Ethereum (ETH) and Dogecoin (DOGE) led gains among the top 10 cryptocurrencies by market capitalization, up more than 2% each in the last 24 hours, with Ethereum’s price finally breaking past the $2,000 mark. Ripple (XRP) also outperformed Bitcoin, up 1.8%, trading at around $1.49.

Read also: MSTR’s Michael Saylor Says ‘Bitcoin Is Winning’ Amid Crypto Winter, Sees ‘Glorious Summer’ Ahead

For updates and corrections, email newsroom[at]stocktwits[dot]com.<