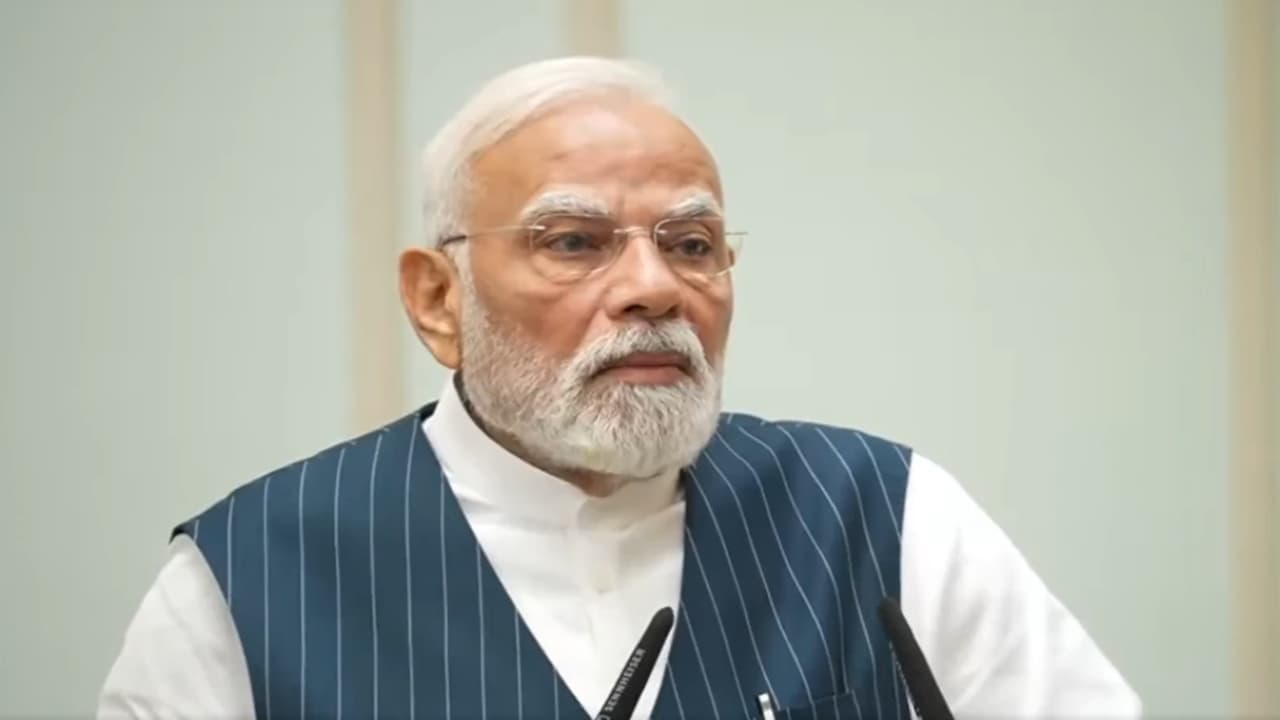

On reducing the GST rates, PM Narendra Modi said that 5% tax has been imposed on everyday goods of common people. Before 2014, the Congress government also used 21% tax on children’s toffee.

GST Rate Cut: Prime Minister Narendra Modi on Thursday interacted with the National Award winning teachers. During this, he mentioned the reducing GST rates by the central government. Targeting the Congress, PM Modi said that before 2014, 21% tax was also charged on children’s toffee.

PM Modi said these 10 big things on GST cut

1- Now GST has become even more simple. GST is mainly left for two rates. 5% and 18%. It will come into force on the first day of Navratri on 22 September. The needs of crores of families of the country will become cheaper by Navratri. This time the beauty of Dhanteras will be more. The tax on dozens of things has now reduced greatly.

2- 8 years ago when GST came into force, the dream of several decades came true. It was discussed earlier, it was not done. This independent was one of the biggest economic reforms in India. The country was liberated from many types of tax nets.

Scroll to load tweet…

3- Some media companions are calling it GST 2.0, but it is actually a double dose for the country’s support and growth. Saving the general family of the country on the one hand and new strength to the economy of the country on the other. Every family of the country will benefit greatly from the new GST reform.

4- Poor, new middle class, middle class, farmers, women, students, youth will all benefit from reducing GST. From cheese to soap, everything will be cheaper than before. Your month’s expenditure will be reduced.

5- Tax has also been reduced on scooter-car. This will benefit the youth who are starting their jobs right now.

6- If you remember the tax rates before GST, then the decisions taken tomorrow will look more enjoyable. Before 2014, the government of that time used to impose tax on almost every item.

7- Be it kitchen goods or farming, things related to farming, or medicines and life insurance, the Congress government used to take different taxes on many such things.

8- If you had been the same period, you would have to buy something of 100 rupees, then you would have to pay a tax of 20-25 rupees. Now our emphasis is on how to save more.

Also read- What for the common man by decreasing GST? Learn how and how much benefit

9- Congress government used to take 27% tax on tooth paste, soap, hair oil. There was 18% -28% tax on food plates, spoon, such items. Tooth powder 17% tax. Everyday everything was taxed on the era of that Congress.

10- The condition was that Congress people also used to pay 21% tax on children’s toffee. There was a 17% tax on the cycle and 16% tax on the sewing machine. Now 5% tax is levied on every such goods and service.