For fiscal year 2026, the company projects total revenue of $1.452 billion to $1.462 billion, representing 18% to 19% Year-over-Year growth.

- The AI-powered work platform provider has forecast first-quarter fiscal 2026 revenue of $338 million to $340 million, reflecting approximately 20% year-on-year growth.

- In the fourth quarter, the company reported revenue of $333.9 million, a 25% year-over-year increase, and adjusted earnings per share (EPS) of $1.04.

- Overall, the company maintained a 110% revenue retention rate from existing customers in Q4.

Monday.com (MNDY) stock is on track to hit November 2022 lows on Monday after the company issued its first-quarter (Q1) and 2026 outlook, which came in below the Street’s expectation.

The AI-powered work platform provider has forecast first-quarter fiscal 2026 revenue of $338 million to $340 million, reflecting approximately 20% YoY growth. For fiscal year 2026, the company projects total revenue of $1.452 billion to $1.462 billion, representing 18% to 19% YoY growth.

However, both the Q1 and fiscal 2026 projections are below the consensus estimates of $342.87 million and $1.48 billion, respectively, according to Koyfin.

How Did Stocktwits Users React?

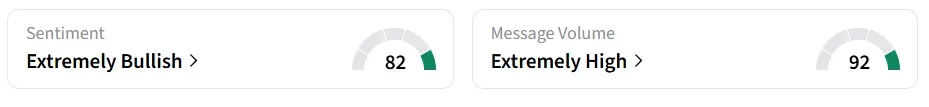

Following the earnings, Monday.com stock traded over 23% lower on Monday, after the morning bell. However, on Stocktwits, retail sentiment around the stock jumped to ‘bullish’ from ‘neutral’ territory the previous day amid ‘extremely high’ message volume levels.

A Stocktwits user suggested buying the fear and added that the stock could bounce 10% to 20% in a week.

Another bullish user lauded the company’s business model.

Q4 Financial Performance

In the fourth-quarter (Q4) fiscal 2025, the company reported revenue of $333.9 million, marking a 25% year-on-year (YoY) increase, and adjusted earnings per share (EPS) of $1.04. Both revenue and EPS exceeded the analysts’ consensus estimates of $329.66 million and $0.92, respectively, according to Fiscal AI data.

“While foreign exchange rates have created some near-term pressure on margins, the underlying fundamentals remain healthy, and we continue to see momentum with larger customers.”

-Eliran Glazer, CFO, monday.com

Customer Growth And AI Platform Expansion

Overall, the company maintained a 110% revenue retention rate from existing customers in Q4, with clients having more than 10 users achieving 114% retention, and those generating over $50,000 or $100,000 in annual recurring revenue (ARR) reaching 116%.

Clients with annual recurring revenue (ARR) above $50,000 rose 34% YoY, and those exceeding $100,000 climbed 45% YoY. Customers with ARR over $500,000 saw the largest YoY increase, up 74%.

MNDY stock has declined by over 69% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<