New Delhi: The GST Council meeting on Wednesday approved a dual tax structure of 5% and 18% and eliminated the 12% and 28% slabs. The changes will come into effect from September 22, the first day of Navratri.

Once the meeting was over, Finance Minister Nirmala Sitharaman addressed a press conference in which she said that reforms have been done keeping the common people in mind. She said, “This decision has focused on the complete reduction of GST for common and middle-class items.”

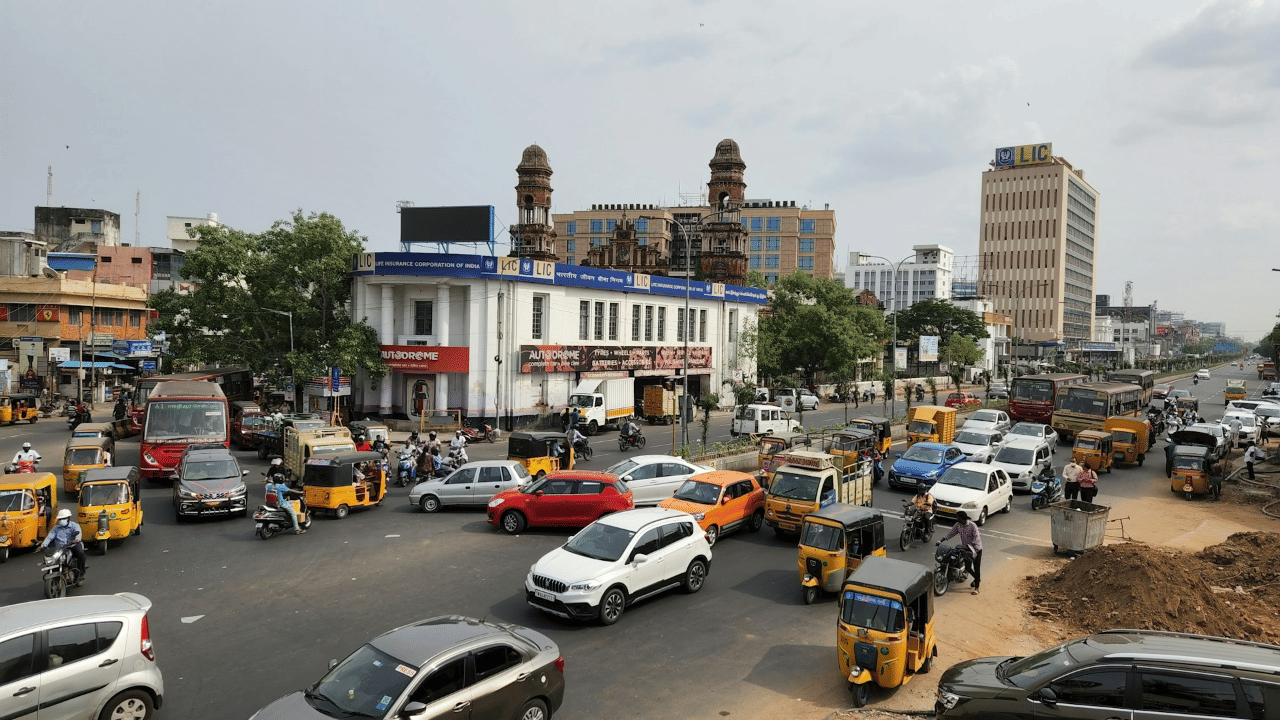

GST reduction in the auto sector

The automobile sector of the country has much to rejoice in following the announcement of GST rate cuts. Notably, the GST on small cars and motorcycles equal to or less than 350 cc has been reduced from 28% to 18%. Also, the GST on all auto parts has been reduced to 18%. It means the GST on electrical ignition or starting equipment of a kind used for spark-ignition or compression-ignition internal combustion engines, generators, and cut-outs of a kind used in conjunction with such engines has been reduced. The GST on the motor parts of tractors has been reduced to 5%.

The GST on fuel cell motor vehicles, including hydrogen vehicles based on fuel cell technology, have been reduced from 12% to 5%, and the same goes for tractors, except road tractors for semi-trailers of engine capacity more than 1800 cc, in a boost to farmers.

The GST on motor vehicles that transport ten or more people, including the driver, except buses used as public transport, has been reduced from 28% to 18%. However, the GST on some motor cars and other motor vehicles principally designed for the transport of persons, including station wagons and racing cars, has been increased from 28% to 40%. Also, petrol-driven motor vehicles with engine capacity exceeding 1200cc or of length exceeding 4000 mm will attract 40% GST, and the same is applicable for diesel cars with engine capacity exceeding 1500cc or of length exceeding 4000 mm.

The GST on petrol, LPG, or CNG driven motor vehicles of engine capacity not exceeding 1200cc and of length not exceeding 4000 mm have been reduced from 28% to 18% and the same goes for diesel-driven motor vehicles of engine capacity not exceeding 1500 cc and of length not exceeding 4000 mm.

Also, the GST on motor vehicles cleared as ambulances has been reduced from 28% to 18%. However, motorcycles with engine capacity exceeding 350 cc have increased from 28% to 40%. Also, there is 40% GST on aircraft for personal use.