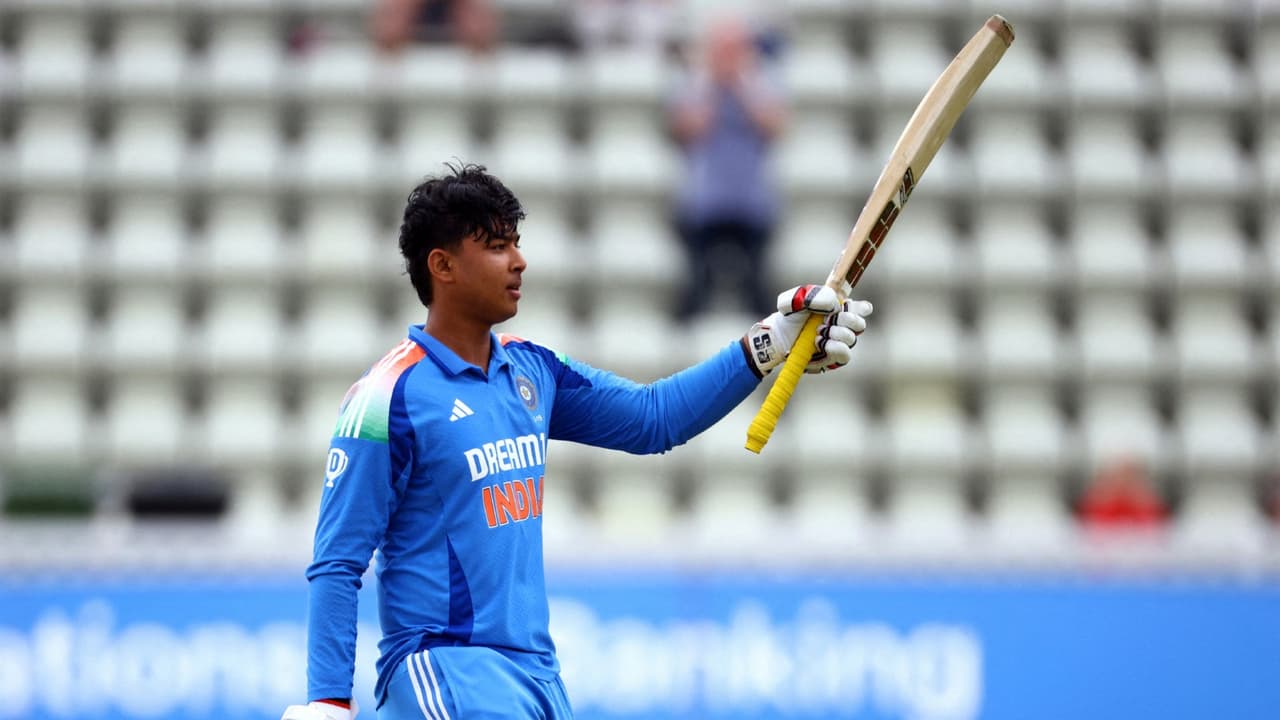

Vaibhav Suryavanshi’s sensational 175 off 80 balls powered India to its sixth ICC U19 World Cup title. The rising star was named Player of the Match and Tournament, dedicating the win to the support staff after India beat England by 100 runs.

Following his side’s sixth ICC Under-19 World Cup triumph, India’s rising star Vaibhav Suryavanshi, who smashed a blistering 175 in 80 balls, dedicated his ‘Player of the Match’ and ‘Player of the Tournament’ titles to the support staff and spoke of his confidence in his skillset and big-match ability.

Suryavanshi’s sensational 175 in 80 balls, with 15 fours and 15 sixes, outclassed a valiant century by Caleb Falconer as the rising Bihar star saved his best for the very last, powering India to a match-winning total of 411/9. England fell 100 runs short, courtesy a collapse from 142/2 to 177/7, with RS Ambrish taking three wickets and Kanishk Chauhan getting two as well.

Suryavanshi on Preparation and Self-Belief

Speaking during the post-match presentation, Suryavanshi said, “Feeling really good. All the preparation, the effort from the support staff, all the games we played – the Asia Cup and the series leading up to this – everything has brought us to this moment. I want to dedicate this award to the entire support staff. The main goal was not to put too much pressure. We focused on believing in ourselves and trusting the process we have been following since the beginning of the tournament. The preparation started from the Asia Cup and even before that. For the last eight to nine months, the support staff and the team have been working together. That preparation has played a huge role in getting us to where we are today. I am very confident in the skill set I have developed. I know I can perform in big games and under pressure, so I stayed confident and kept believing.”

A Record-Breaking Tournament for Suryavanshi

Suryavanshi ended up as the second-highest run-getter with 439 runs in seven innings at an average of 62.71 and a strike rate of 169.49, with a century and three fifties and a whooping 30 sixes, the most by a batter in the U19 WC edition. This performance also earns him the ‘Player of the Tournament’ title. His century is the second-fastest in the tournament’s history, and his 15 maximums are the highest in a U19 WC inning.

India’s Dominant Batting Display

After India opted to bat first, a stunner, record-shattering Vaibhav Suryavanshi masterclass (175 in 80 balls, with 15 fours and 15 sixes), a half-century from skipper Ayush Mhatre (53 in 51 balls, with seven fours and two sixes) and a knock from Abhigyan Kundu (40 in 31 balls, with six fours and a six) guided India to a massive 411/9.

England’s Valiant Chase Falls Short

England lost an early wicket but went from 142/2 courtesy a fine knock from Ben Dawkins (66 in 56 balls, with seven fours and two sixes) and a partnership with skipper Thomas Rew (31 in 18 balls, with four boundaries and a six), but collapsed to 177/7 as they progressed. Falconer (115 in 67 balls, with nine fours and seven sixes) put on a spectacular show of power, but all in vain, as they are yet to win the title since the 1998 edition. (ANI)

(Except for the headline, this story has not been edited by Asianet Newsable English staff and is published from a syndicated feed.)