New Delhi: Sony’s gaming business is sending a mixed but telling signal in early 2026. Console shipments are slowing, a pattern seen across a maturing hardware cycle, yet the PlayStation ecosystem keeps pulling in more players than ever before.

Fresh financial disclosures show that engagement across the PlayStation Network hit a new peak in December 2025, even as PlayStation 5 console sales slipped year on year. For Sony, the numbers point to a business that is leaning harder into software, subscriptions, and digital spending rather than pure box sales.

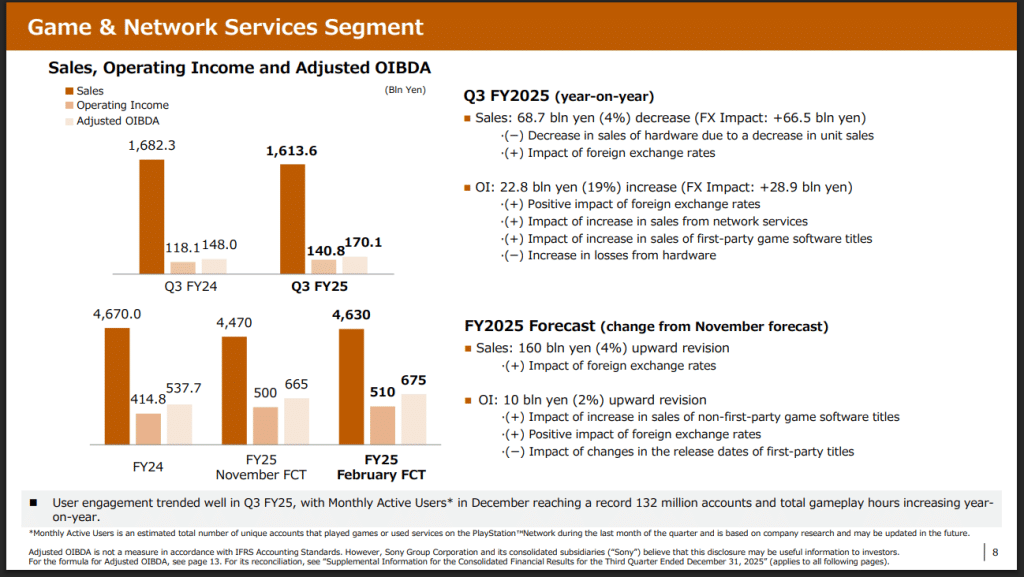

Source: Sony

Hardware sales soften as user base grows

According to Sony Group Corporation, the PlayStation 5 sold 8.0 million units in the quarter ending December 31, 2025, down from 9.5 million units a year earlier. Over the first nine months of the fiscal year, total PS5 sales stood at 14.4 million units, compared to 16.2 million units in the same period last year.

At the same time, monthly active users on PlayStation Network reached a record 132 million in December.

Sony said in its earnings presentation, “User engagement trended well in Q3 FY25, with Monthly Active Users in December reaching a record 132 million accounts and total gameplay hours increasing year-on-year.”

That single line says a lot. Fewer consoles are shipping, yet more people are playing.

Digital games and services lift profits

Sony’s Game and Network Services segment reported:

Sales of ¥1,613.6 billion

Operating income of ¥140.8 billion, up 19 percent year on year

Digital full-game downloads and add-on content together generated over ¥760 billion during the quarter. Network services, which include PlayStation Plus subscriptions and advertising, rose 13 percent year on year to ¥199.3 billion.

The digital download ratio for full games stayed at 76 percent, showing how firmly players have moved away from discs.

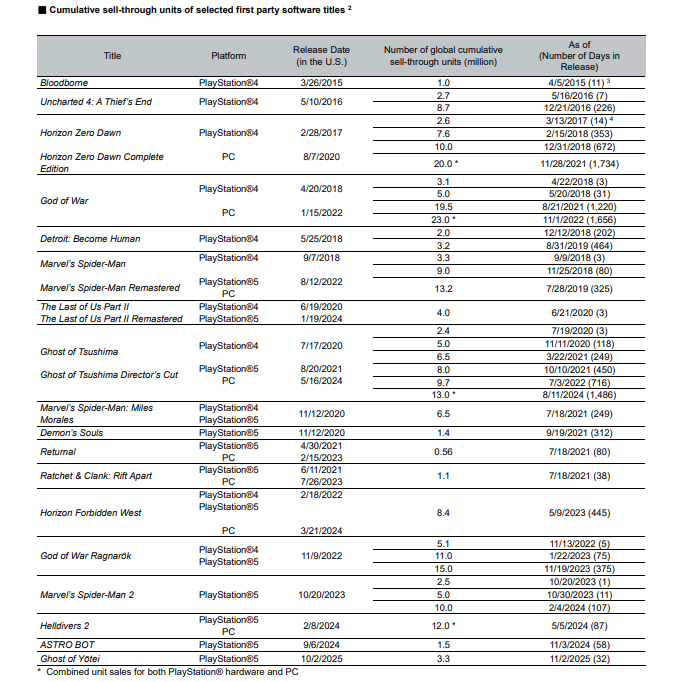

PlayStation 1st Party Games

First-party hits drive momentum

Software sales across PS4 and PS5 reached 97.2 million units in the quarter. First-party titles alone sold 13.2 million units, up 14 percent year on year.

Sony highlighted strong performances from titles such as Helldivers 2, Marvel’s Spider-Man 2, and God of War Ragnarök.

For many players, these exclusives are still the main reason to stay inside the PlayStation ecosystem. I see the same pattern among friends. Fewer are rushing to buy new hardware, but everyone keeps buying games, DLC, and subscriptions.

What this shift means for Sony

Sony has raised its full-year operating income forecast for Game and Network Services to ¥510 billion. The company says the improvement comes from stronger non-first-party software performance and currency effects.

With 132 million people active each month, Sony has a huge base to monetise over time. Even if PS5 sales cool further, the platform looks far from cooling down.