Faraday Future unveiled three humanoid and quadruped AI robots at NADA, signaling a Tesla-style pivot beyond EVs.

- Faraday Future unveiled three humanoid and quadruped AI robots at NADA, signaling a Tesla-style pivot beyond EVs.

- The strategy mirrors Tesla’s Optimus push and deepens Faraday’s alignment with Tesla’s AI and autonomy ecosystem.

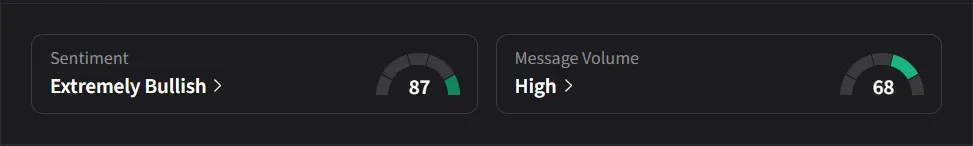

- Retail sentiment has turned ‘extremely bullish’ on Stocktwits amid ‘high’ message volume, but analyst coverage remains thin.

Faraday Future is pitching a Tesla-like future built around humanoid AI, debuting a lineup of robots for work, security, and companionship. Retail traders have taken notice, but Wall Street’s response has been tepid so far.

Faraday Future’s Tesla-Style Humanoid AI Pivot

Faraday Future unveiled three series of embodied AI robots at the National Automobile Dealers Association show in Las Vegas on Wednesday, marking its most explicit push yet beyond EVs and into humanoid and quadruped robotics.

The lineup includes the FF Futurist, a full-size humanoid robot intended for professional and commercial applications, FF Master, an affordable humanoid designed for general companionship use, and FX Aegis, a quadruped robot targeting companionship and security applications. Pricing starts at around $2,499 for FX Aegis and goes up to nearly $35,000 for the FF Futurist without including ecosystem software packages.

The company said the first batch of deliveries is targeted for the end of February, with more than 1,200 units backed by non-binding but paid B2B deposits. Faraday also said its robotics unit has entered the production preparation phase, with customization, testing, and data training underway in parallel.

Faraday Aligns With Tesla On AI

The strategy places Faraday squarely in territory that investors increasingly associate with Tesla, which is preparing to roll out its third-generation Optimus humanoid robot in the first quarter and has framed robotics and AI as a core long-term growth pillar.

Tesla said its next-generation humanoid robot is designed for mass production, with CEO Elon Musk outlining a path to annual output of up to one million units and suggesting the robot could be available for public purchase by 2027. Musk has repeatedly framed robotics and AI as Tesla’s most important long-term value drivers, alongside autonomy.

Faraday has leaned into that comparison before. Founder and co-CEO Y.T. Jia has publicly aligned the company with Tesla’s autonomy philosophy, urging collaboration around Full Self-Driving technology and describing autonomy as a matter of technological inclusion rather than competition. Faraday has also confirmed that its future FX vehicles will be compatible with Tesla’s Supercharger network, further tying its EV roadmap to Tesla’s ecosystem.

However, Faraday argues that robotics could require lighter capital investment, enable faster delivery cycles, and potentially generate positive operating cash flow sooner than vehicles.

Retail Excitement For FFAI Builds, Analyst Conviction Still Limited

On Stocktwits, retail sentiment around Faraday Future flipped to ‘extremely bullish’ following the robotics announcement amid ‘high’ message volume. Message activity surged about 140% over the past 24 hours, rose roughly 85% over the past week, and climbed about 50% over the past month. Despite the recent spike, volumes have fallen 65% over the last year.

That short-term burst contrasts with longer-term retail trends. Watcher counts have been largely unchanged over the past three months and are down about 5% over the past year.

On the other hand, analyst coverage remains thin. According to Koyfin data, just one analyst actively covers Faraday Future, with a ‘Strong Buy’ rating and a $5 price target, implying an upside of over 380% on paper.

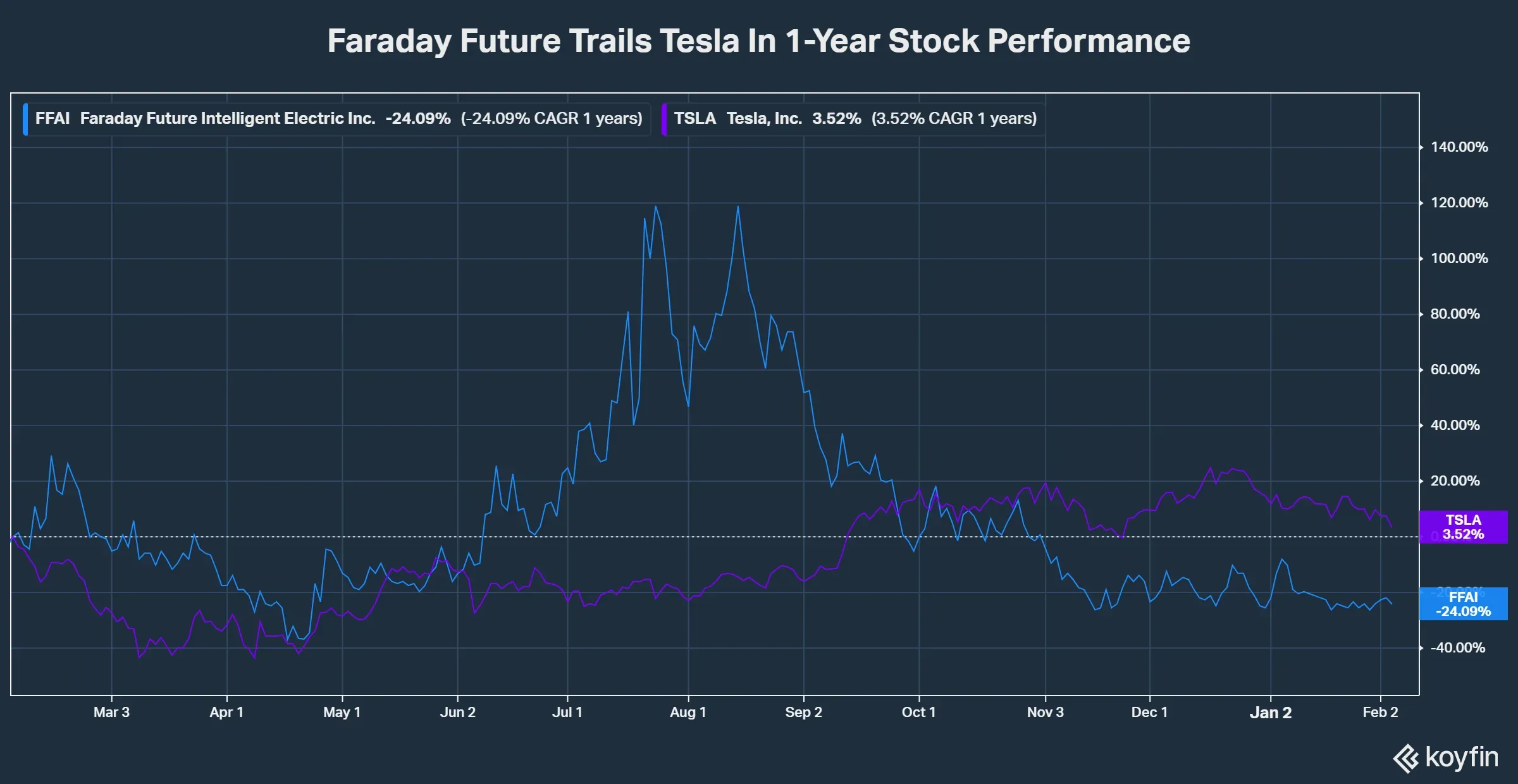

Faraday Future stock is down 24% over the past 12 months and up about 2% year to date, compared with a roughly 4% gain for Tesla over the same 12-month period.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<