Novo Nordisk submitted a supplemental New Drug Application (NDA) to the FDA in November, and under the CNPV program, a review decision is usually expected within one to two months after the filing is accepted.

- In an interview with CNBC on Wednesday, CEO Doustdar said people should expect the company’s share price to go down before it goes back up.

- NVO shares fell 4.5% in pre-market trading on Wednesday, extending Tuesday’s losses after the drugmaker issued a weak outlook for fiscal 2026.

- Novo attributed the outlook to pricing pressure, and rising competition.

Novo Nordisk (NVO) expects the U.S. Food and Drug Administration to decide on a higher-dose version of its Wegovy weight-loss drug in the first quarter of fiscal 2026.

“Novo Nordisk submitted the high-dose semaglutide 7.2mg to the FDA in November. It’s under the CNPV pilot program, and we anticipate a decision during the first quarter of 2026,” Novo’s CEO Mike Doustdar said in a call with analysts on Wednesday.

Novo Nordisk submitted a supplemental New Drug Application (NDA) to the FDA in November, and under the Commissioner’s National Priority Voucher expedited program, a review decision is usually expected within one to two months after the filing is accepted.

NVO shares were down 4.5% in pre-market trading on Wednesday.

Weak 2026 Outlook Weighs On Shares

The stock extended Tuesday’s losses of over 14% after the drugmaker issued a soft outlook for fiscal 2026, warning that sales and profit growth could decline amid mounting industry pressures. The company expects adjusted sales to fall between 5% and 13%, and operating profit could decline by up to 13%.

Novo attributed the outlook to pricing pressure, rising competition, and upcoming patent expiries for the active ingredients in blockbuster drugs Wegovy and Ozempic in certain markets outside the U.S.

In an interview with CNBC on Wednesday, Doustdar said people should expect the company’s share price to go down “before it comes back up.”

The cautious forecast follows a disappointing 2025 performance. Novo reported net sales of DKK 309.06 billion ($48.9 billion), up 6% year over year but well below analyst estimates of DKK 346.97 billion.

How Did Stocktwits Users React?

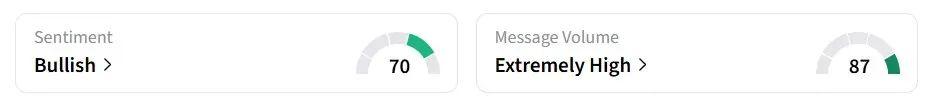

Despite the intraday decline, retail sentiment on Stocktwits turned ‘bullish’ from ‘bearish’ a day earlier, amid ‘extremely high’ message volumes.

One user said that the bearish guidance was a “self-inflicted wound.”

However, another user highlighted Novo’s strong grip in the diabetes and obesity markets.

NVO shares have plummeted around 40% over the past year.

Read also: LLY Stock Surges Pre-Market: Obesity, Diabetes Drugs Drive Strong FY26 Outlook

For updates and corrections, email newsroom[at]stocktwits[dot]com.<