NSE CEO Ashish Chauhan underscored the urgent need to deepen India’s corporate bond market, terming it a ‘national financing necessity’ to fund long-term priorities like infrastructure and support the country’s ambitious growth plans.

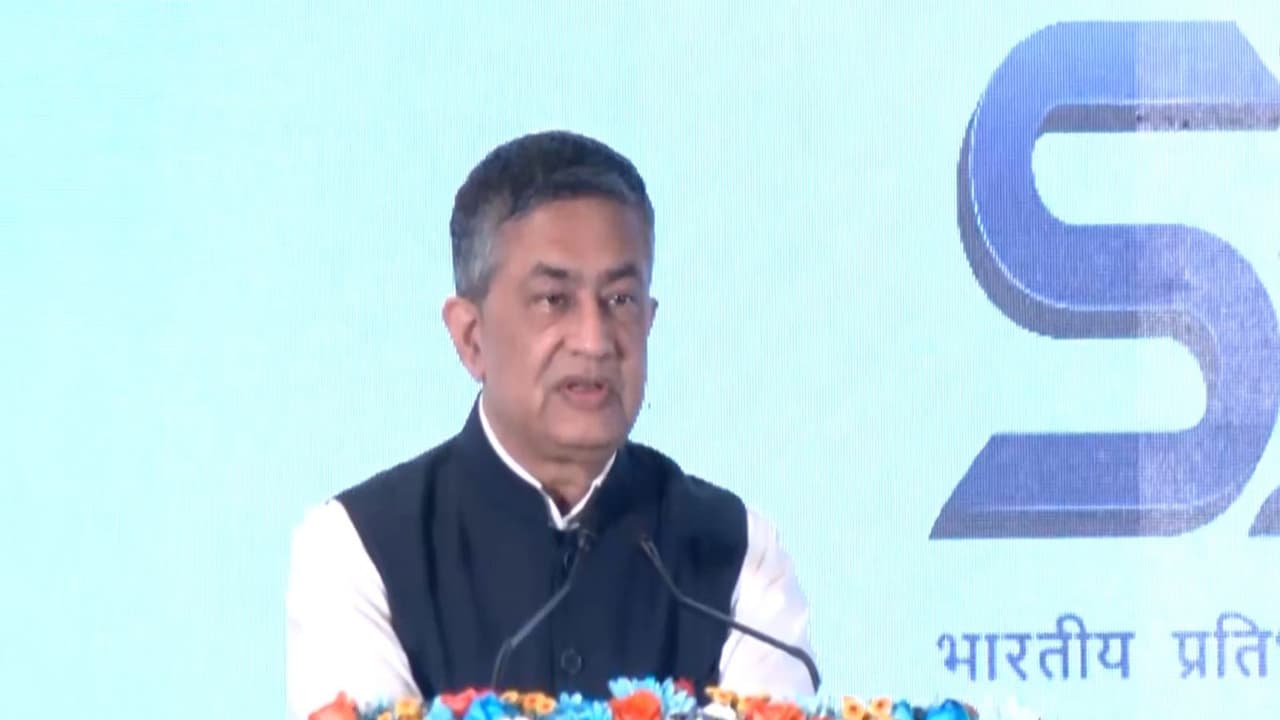

Emphasising the urgent need to deepen India’s corporate bond market, National Stock Exchange (NSE) Managing Director and CEO Ashish Chauhan on Tuesday said that India’s growth ambitions demand a strong, liquid debt market alongside its globally respected equity ecosystem. “For years, we have all been discussing the need to deepen the corporate bond market–but now the time for action is more pronounced because India’s growth ambitions and financing needs will not wait,” Chauhan said while addressing the Inaugural Pan-India Outreach Program for Corporate Bonds.

A National Financing Necessity

Underlining the structural role of debt markets, Chauhan said bonds are essential for financing long-term national priorities. “Banks are good for working capital and shorter-tenor credit. Bonds are essential for long-duration nation-building: infrastructure, housing, energy transition, and manufacturing,” he said.

He added that deepening debt markets is no longer optional. “This initiative matters today, because deepening bonds is not a ‘nice-to-have’ anymore, it is a national financing necessity,” Chauhan said.

Balancing Equity Success with Debt Market Growth

Highlighting India’s success in equities, Chauhan noted the scale already achieved by the equity markets. “India’s equity markets are globally respected, with market capitalisation crossing USD5 trillion in about three decades since NSE began operations,” he said.

However, he stressed that similar momentum must now be created in debt markets.

The Private Placement Imbalance

Drawing attention to fund mobilisation trends, Chauhan said debt already dominates capital raising, though largely through private placements. “Since FY22, NSE has enabled fund mobilisation of about Rs 76 lakh crore, of which about Rs 60 lakh crore has been raised through the debt platform,” he said.

He pointed out a key imbalance in the market structure, noting that “in 2025, public NCD issuances accounted for barely 0.15% of total debt raised,” and added, “The destination is clear: more listed public issuances, repeat issuers, and active secondary trading, so price discovery becomes continuous, not episodic.”

Shallow Market, High Growth Potential

Despite recent progress, Chauhan said India’s corporate bond market remains shallow by global standards. “India’s corporate bond market stands at only about 15-16% of GDP, well below global benchmarks,” he said.

He cited projections showing the scale of opportunity ahead, noting that “NITI Aayog projects this market can grow to Rs100-120 lakh crore by 2030.”

NSE’s Commitment to Market Development

Chauhan highlighted NSE’s infrastructure and commitment to developing transparent and liquid debt markets. “At NSE, we are committed to supporting you through the lifecycle, efficient primary issuance through our Electronic Bidding Platform, stronger secondary-market access through our RFQ ecosystem, and sustained issuer engagement,” he said.

He assured issuers of long-term partnership, stating, “If you are prepared to meet the standards of transparency and governance that build trust, NSE will be a steady partner in helping you diversify funding sources, broaden your investor base, extend maturities, and raise long-duration capital at scale.”

Debt’s Role in Nation-Building

Concluding his address, Chauhan drew a sharp distinction between equity and debt financing. “Equity finances aspirations, but debt finances commitment. Equity can forgive volatility, but debt does not forgive complacency,” he said, adding that when savings flow through trusted bond markets, “capital does more than earn returns, it builds the nation.”

(Except for the headline, this story has not been edited by Asianet Newsable English staff and is published from a syndicated feed.)