India’s services sector gained momentum in January, with the HSBC Services PMI reaching a two-month high of 58.5. The Composite PMI also rose to 58.4, driven by a steady influx of new orders, leading to increased hiring and optimism.

India’s services sector activity strengthened in January, with the Services Purchasing Managers’ Index (PMI) rising to a two-month high of 58.5, while the Composite PMI, which combines manufacturing and services, increased to 58.4, according to data released by HSBC.

Services PMI Hits Two-Month High

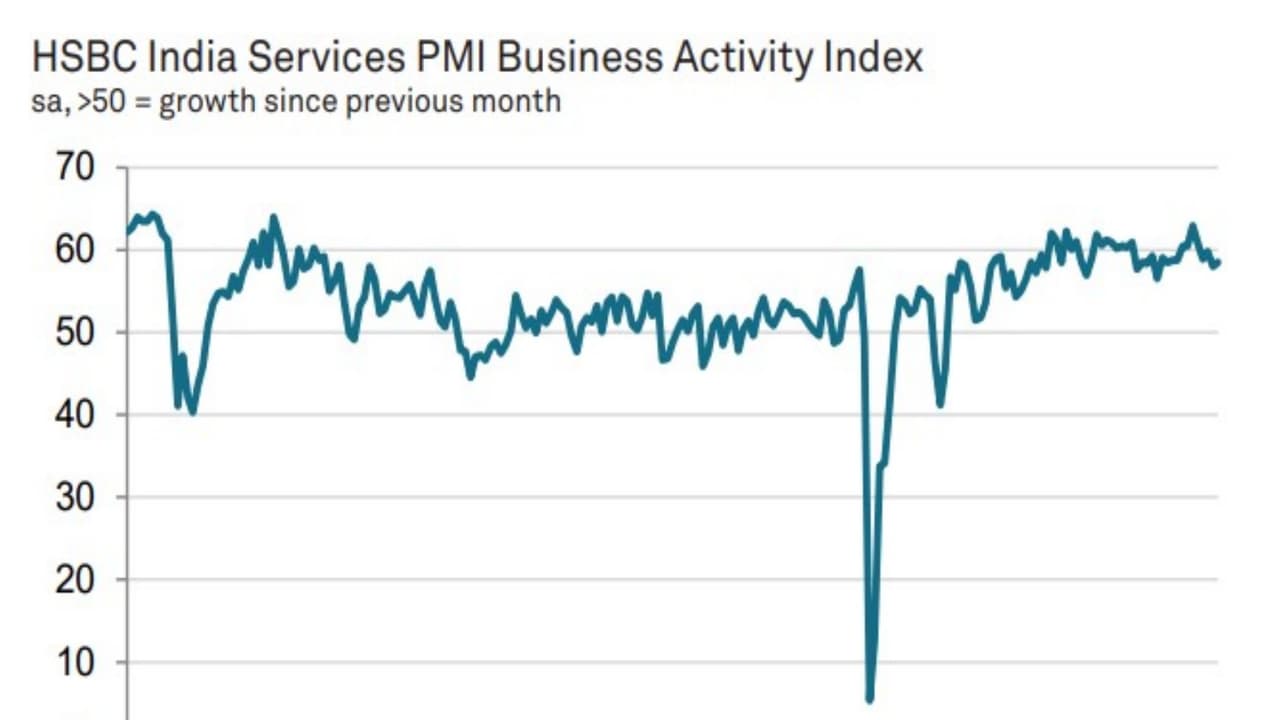

The seasonally adjusted HSBC India Services PMI® Business Activity Index, which is based on a single question assessing changes in business activity compared to the previous month, rose to 58.5 in January from December’s recent low of 58.0. The latest reading was consistent with a historically sharp rate of expansion.

HSBC noted that January data showed the domestic market remained the main source of new business gains, although international orders also rose at a solid pace. The pace of overall expansion was the strongest in three months.

It stated “India’s services PMI rose to 58.5 in January, up from 58.0 in December, signalling sustained momentum in the sector. Robust output growth was driven by a steady influx of new orders”.

It also mentioned that service providers across the country reported a recovery in growth during January, supported by quicker expansions in new business intakes and output. Firms were also more optimistic about the outlook and increased hiring during the month.

Composite Output Rebounds as Costs Rise

On the pricing front, input costs and selling charges rose at a quicker, though still moderate, pace.

Meanwhile, the HSBC India Composite PMI Output Index climbed from December’s 11-month low of 57.8 to 58.4 in January. The reading signalled a sharp rate of expansion, supported by stronger growth in both manufacturing and services.

Improved demand conditions across the two sectors also lifted overall sales, taking the pace of expansion to a two-month high.

HSBC also shared that similar to output trends, new orders increased at the fastest pace in two months, after growth had slipped to an 11-month low at the end of 2025. Companies cited stronger client interest and an improved online presence as key factors driving higher sales.

Segment-wise data showed that Finance and Insurance topped the growth rankings for both output and new orders, despite being the only segment to register slowdowns since last December. Services firms reported higher prices for items such as eggs, electronic goods, meat, paper, parts and vegetables. Overall, input costs rose at the fastest pace since last September, although the increase remained moderate and below the long-run average.

The data also indicated broadly stable levels of outstanding business across the services sector. The seasonally adjusted index for pending workloads stood only marginally above the neutral 50.0 mark in January.

(Except for the headline, this story has not been edited by Asianet Newsable English staff and is published from a syndicated feed.)