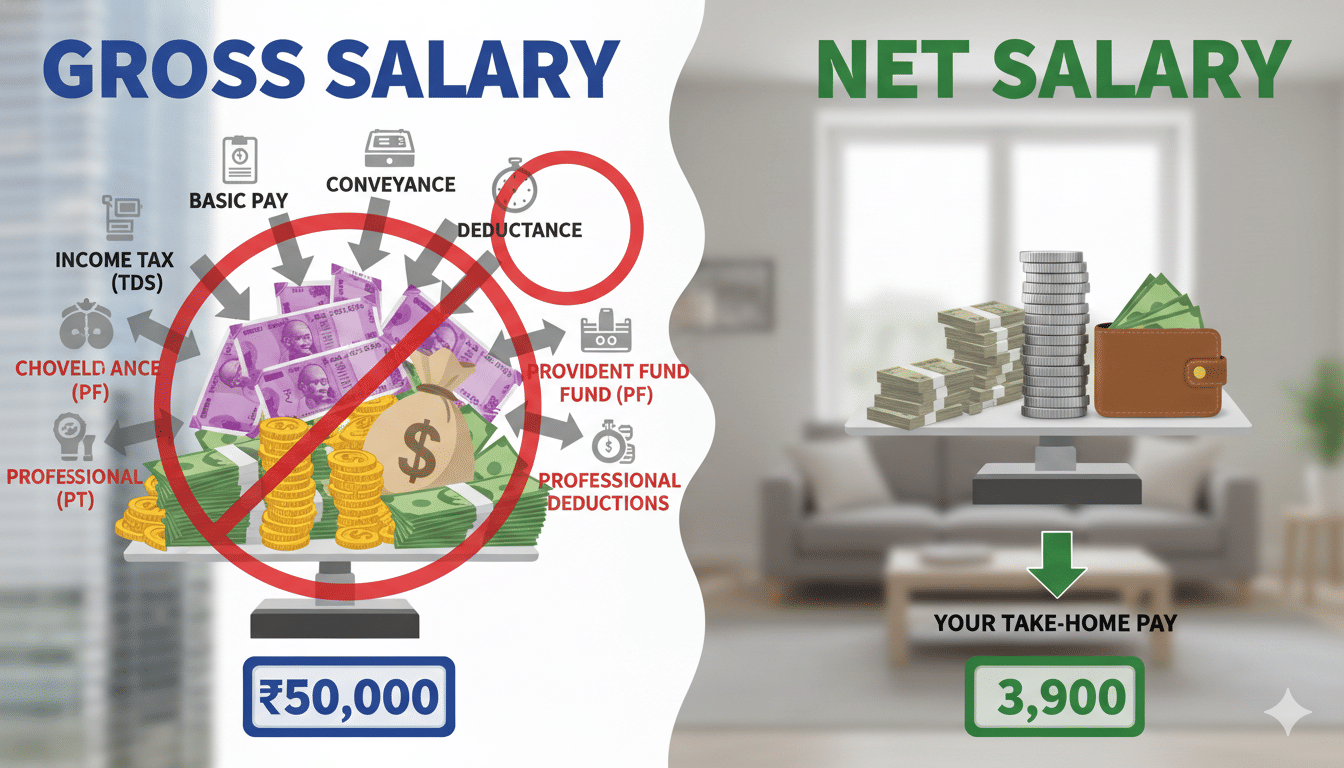

New Delhi: Scores of employees get confused with the two key terms – Gross Salary and Net Salary or Take-Home Pay. Often, when person get a new job, many assume the total amount (CTC) written in the offer letter to be their actual salary, but when the money is credited to the bank account, the amount is quite less than what is mentioned as CTC. In this article, we clear the doubts in regards to ‘gross salary’ and ‘net salary’, the terms which are very essential for the salaried class.

What is Gross Salary

Gross salary is the total amount that an employee is entitled to before the calculation of taxes and other deductions. The total of salary components like basic salary, house rent allowance (HRA), conveyance allowance, medical allowance, and other allowances is mentioned as Gross salary.

What is Net Salary or Take-Home Pay

Net salary is the amount that is credited by the company to an employee’s bank account on the salary day. Notably, the amount is paid after all deductions – like Provident Fund, Income Tax Deducted at Source (TDS), and other deductions.

Deductions from Salary

12 per cent of the employee’s basic salary is deposited into the PF account of the beneficiary.

Income Tax (TDS): As per the employee’s tax slab, the company deducts a certain amount every month, and deposits it with the Income Tax department.

The company contributes a portion to a gratuity fund which is paid to the employee when he leaves the job. The government has set guidelines for the Gratuity.

Small tax is generally imposed by state governments. It usually ranges between Rs 200 and Rs 300.

If an employee has opted for Insurance or Medical Policy from the company, a certain amount (premium) is deducted as from the salary.