According to a Financial Times report, Verizon is looking to replace Sowmyanarayan Sampath, who had long been seen as the leading candidate for the CEO role.

- Sowmyanarayan Sampath leads Verizon’s largest business unit, the consumer division.

- He was widely viewed within the industry as the likely successor to former CEO Hans Vestberg.

- Wells Fargao raised the price target after highest postpaid phone additions since 2019 during Schulman’s first quarter at the helm.

Verizon Communications Inc. (VZ) is reportedly exploring leadership changes, amidst increasing competition from rivals and recent service disruptions that have tested customer loyalty.

According to a Financial Times report, Verizon is looking to replace Sowmyanarayan Sampath, who had long been seen as the leading candidate for the CEO role.

Shift At The Top

Sampath leads Verizon’s largest business unit, the consumer division. He was widely viewed within the industry as the likely successor to former CEO Hans Vestberg before the board tapped long-time director and ex-PayPal chief Dan Schulman to take the reins in late 2025, the report cited.

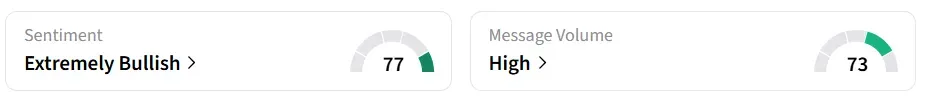

Verizon stock inched 0.5% lower in Monday’s premarket. On Stocktwits, retail sentimenta round the stock remained in ‘extremely bullish’ territory amid ‘high’ message volume levels.

Market Struggles Fuel Change

Insiders say Schulman, who was given a 27-month contract, is using the period to evaluate and potentially refresh the executive bench, according to the report.

Verizon’s move comes as the company struggles to keep pace with competitors, losing ground in the important postpaid phone segment to T-Mobile US (TMUS) and AT&T (T). The challenges have compounded following a major outage in January that left many users without service.

According to a CNET report, the service outage affected about 2 million users, prompting the company to provide a $20 credit to the impacted customers. The telecon giant said the issue was related to software and added that there is no sign of a cybersecurity breach.

Analysts’ Take

Wells Fargo analyst Eric Luebchow increased Verizon’s price target to $44 from $41 while maintaining an ‘Equal Weight’ rating, according to TheFly. The move comes after observing the highest postpaid phone additions since 2019 during Schulman’s first quarter at the helm, signaling strong customer retention and growth momentum.

Meanwhile, Morgan Stanley also lifted its price target to $49 from $47, keeping an ‘Equal Weight’ stance. The firm highlighted the updated 2026 outlook as balancing aggressive promotional strategies with disciplined financial management.

VZ stock has gained over 11% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<