Shares of Strategy and Bitmine Immersion Technologies fell in pre-market trade as on-paper losses surged following the weekend crypto crash.

- The crypto market saw around $590 million wiped out on long bets and another $230 million on the shorts’ side.

- MSTR and BMNR shares fell in pre-market trade and were among the top trending tickers on Stocktwits, following the crypto rout as on-paper losses surged.

- Crypto miners and other DATs were also pressured by the broader crypto selloff and weakness in the equity markets.

Bitcoin (BTC) recovered to around $77,000 on Monday morning, but the wave of liquidations from the weekend crypto crash remained elevated at over $800 million, with the overall cryptocurrency market slipping to a valuation of $2.67 trillion.

Traders will be watching developments in Washington, with crypto industry leaders set to meet with White House officials on Monday afternoon to hash out the U.S. Banking Committee’s part of the crypto market structure bill after it stalled earlier this month on disagreements over how rewards accrued from stablecoins would work.

According to CoinGlass data, around $818.71 million in forced unwinds occurred in the last 24 hour,s with around $590 million wiped out on long bets and another $230 million on the shorts’ side. Ethereum (ETH) led the selloff with $308 million in liquidations, while Bitcoin followed with $271 million, largely driven by long-side positioning.

The move extends a broader liquidation cycle that saw more than $2.2 billion wiped out on Sunday, after Bitcoin’s price fell to around $74,500 – its lowest level in more than a year. At the time of writing, Bitcoin had recovered to around $77,750, still down 1.1% in the last 24 hours.

Bitcoin Drags Down MSTR Stock, Crypto Miners

BTC was the top trending ticker on Stocktwits on Monday morning. Retail sentiment around the apex cryptocurrency fell to ‘extremely bearish’ from ‘bearish’ territory over the past day, with chatter at ‘extremely high’ levels.

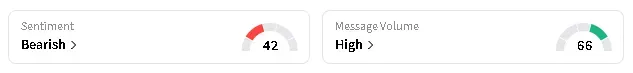

The drop weighed on Bitcoin proxy Strategy’s (MSTR) share price, which fell more than 7% in pre-market trade and was also among the top trending tickers on Stocktwits. Retail sentiment around MSTR’s stock fell to ‘bearish’ from ‘neutral’ territory over the past day, with chatter sustained at ‘high’ levels.

Traders are watching for the company’s latest Bitcoin purchase, typically announced on a Monday. Executive chairman Michael Saylor hinted that “more orange” might be on the cards in a Sunday post on X.

Other Bitcoin-based digital asset treasuries (DATs) were also in the red during pre-market trade. Strive (ASST) fell by over 6% and Nakamoto (NAKA) dropped around 4%. Crypto miners like CleanSpark (CLSK), MARA Holdings (MARA) and Riot Platforms (RIOT) dipped more than 5% each in pre-market trade following Bitcoin’s decline and broader weakness in the stock market.

Ethereum Leads Losses As BMNR, SBET Stocks Take A Hit

Ethereum’s price led losses on Monday morning, down 4.4% in the last 24 hours to around $2,200 – more than a six-month low for the leading altcoin. It was last seen trading at these levels in June last year. On Stockwits, retail sentiment around Ethereum remained in ‘bearish’ territory as chatter rose to ‘extremely high’ from ‘high’ levels over the past day.

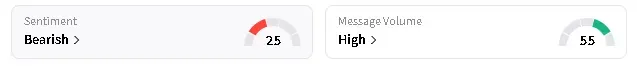

The dip has put Bitmine Immersion Technologies’ (BMNR) holdings at an estimated $6.8 billion paper loss. BMNR’s stock plummeted more than 10% in pre-market trade and was behind Bitcoin as the top trending ticker on Stocktwits. Retail sentiment around the shares on the platform remained in ‘bearish’ territory amid ‘normal’ levels of chatter.

Sharplink Gaming’s (SBET) shares, which also hold Ethereum in its treasury, fell by around 10%. Chatter around SBET’s stock rose to ‘high’ from ‘normal’ levels over the past day, while retail sentiment remained in the ‘bearish’ zone.

What Are Retail Traders Saying?

One trader said that investors might not have been so disappointed with BMNR if Chairman Tom Lee hadn’t put up such high price predictions for Ethereum.

Another bearish MSTR trader said that Saylor was grifting the market and that a Bitcoin proxy is an inefficient way to gain exposure to the apex cryptocurrency.

Solana, XRP In The Red Despite Recovery

Solana (SOL) was down around 2% in the last 24 hours to around $102, recovering from an intra-day low of around $96. On Stocktwits, retail sentiment around SOL was in ‘bearish’ territory over the past day with chatter at ‘high’ levels.

Ripple’s XRP (XRP) dipped 1.5% to $1.62, up from lows of $1.54 over the weekend. Retail sentiment around the altcoin was also in the ‘bearish’ zone but chatter saw a decline, falling to ‘normal’ from ‘high’ levels over the past day.

Dogecoin (DOGE), Tron (TRX) and Cardano (ADA) outperformed Bitcoin, with losses at under 1% each.

Read also: Why Crypto Is Crashing Has More To Do With Gold Than Binance Or ETFs, Raoul Pal Says

For updates and corrections, email newsroom[at]stocktwits[dot]com.<