Shares continue to slide after declining nearly 5% on Friday.

- Micron is in focus for its newly announced investment in its Singapore manufacturing operations.

- Memory stocks are in focus amid concerns of tight supply; SanDisk posted incredible results last week, further lifting optimism.

- Stocktwits sentiment for Micron has held up in the ‘extremely bullish’ zone for more than a week.

Micron Technology, Inc.’s shares declined 3% in early premarket on Monday, continuing their retreat from Friday amid focus on the company’s newly announced manufacturing expansion in Singapore and incredible gains in memory chip stocks across the board.

Analyst Moves

Last week, Micron announced plans to invest $24 billion over the next decade to expand its manufacturing capacity in the Asian nation. Following the move, Mizuho raised its price target on MU stock to $480 from $390, while keeping its ‘Outperform’ rating, although William Blair it won’t have a material change in the company’s prospects in the near term.

Over the weekend, Philip Securities initiated coverage on the stock with a ‘Buy’ rating and $500 price target.

Overall, 38 of the 44 analysts covering MU have a ‘Buy’ or higher rating, four rate it ‘Hold’ and two rate it ‘Sell,’ according to Koyfin. However, their average price target of $361.85 is 13% lower than the stock’s last close.

Memory Chip Stocks In Focus

Micron is also among the key beneficiaries of tight memory chip supply, as surging demand from AI data centers fuels expectations of price increases and resulting business gains. Last week, SanDisk reported quarterly results that beat analysts’ expectations by a wide margin.

Micron stock has gained by over 45% in January. They surged a whopping 240% over 2025.

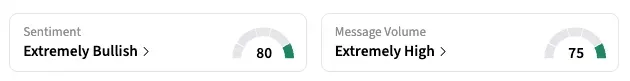

On Stocktwits, retail sentiment for MU has remained ‘extremely bullish,’ unchanged over the past week. Micron is scheduled to report its quarterly results on Feb. 11.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<