For the financial year 2026, income tax slabs will remain unchanged for both the new and old tax regimes. The new regime, which is the default option, features lower tax rates and a basic exemption of up to Rs 4 lakh but offers fewer deductions.

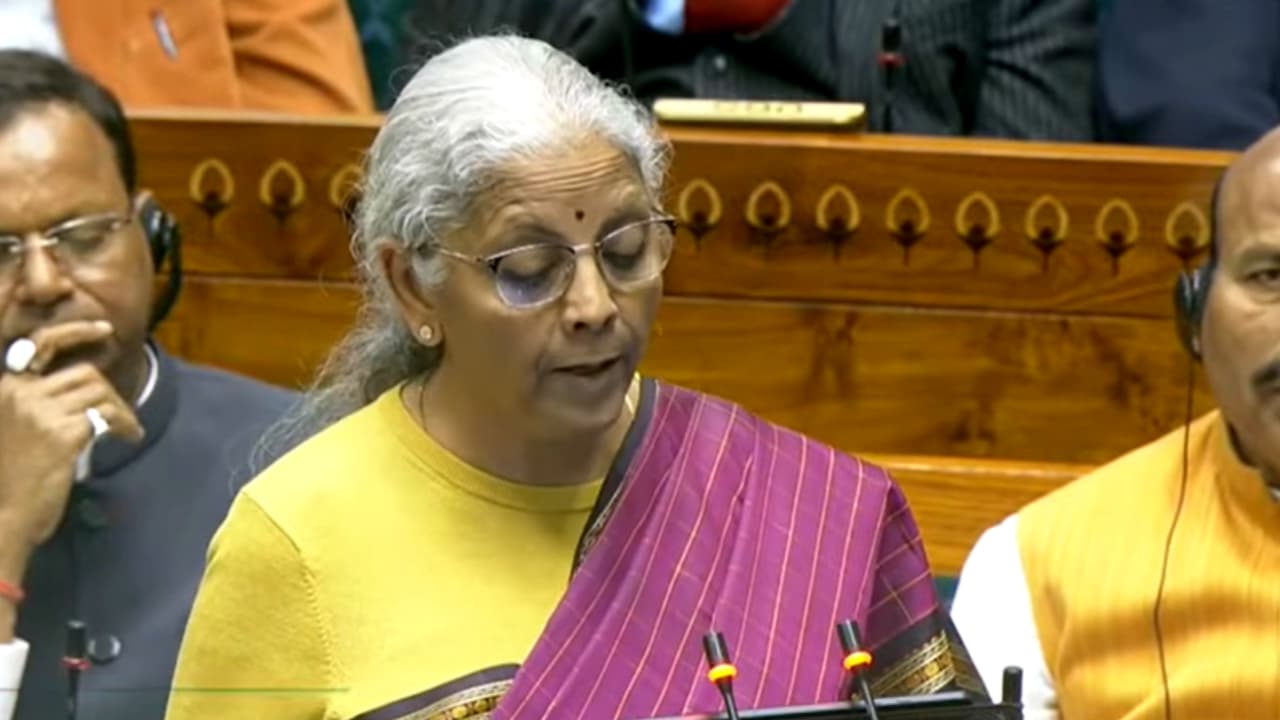

If you were hoping for a last-minute tax surprise in Budget 2026, here’s the short answer: nothing changes. Finance Minister Nirmala Sitharaman has kept income tax slabs unchanged for FY 2026–27 under both the new and old tax regimes. So for taxpayers, it’s business as usual when it comes to slab rates next year.

The move wasn’t unexpected. Last year’s Budget had already revamped the new tax regime, and with a new Income Tax Act set to roll out soon, the government has chosen stability over tinkering.

Here’s what taxpayers need to know.

New Tax Regime: Same Slabs, Still the Default

The new tax regime will continue to be the default option for filing income tax returns. It offers a higher basic exemption and lower rates, but fewer deductions.

New Tax Regime Slabs for FY 2026–27

- Income up to Rs 4 lakh: No tax

- Rs 4 lakh to Rs 8 lakh: 5%

- Rs 8 lakh to Rs 12 lakh: 10%

- Rs 12 lakh to Rs 16 lakh: 15%

- Rs 16 lakh to Rs 20 lakh: 20%

- Rs 20 lakh to Rs 24 lakh: 25%

- Above Rs 24 lakh: 30%

In simple terms, someone earning around Rs 1 lakh a month still pays zero income tax under this regime. The top tax rate of 30% applies only once annual income crosses Rs 24 lakh.

There are no special slabs for senior or super senior citizens here.

Old Tax Regime: Unchanged, But Needs to Be Chosen

The old tax regime also stays exactly the same. However, taxpayers must actively opt for it while filing their returns. Miss the July 31 deadline, and you’re automatically pushed into the new regime.

This system still appeals to those who make full use of deductions—but higher tax rates kick in earlier.

Old Tax Regime Slabs for FY 2026–27

- Up to Rs 2.5 lakh: No tax

- Rs 2.5 lakh to Rs 5 lakh: 5%

- Rs 5 lakh to Rs 10 lakh: 20%

- Above Rs 10 lakh: 30%

These slabs apply to resident individuals below 60 years of age.

Relief for Seniors Under Old Regime

One area where the old regime still scores is higher exemptions for senior citizens:

- Age 60–80 years: Exemption up to Rs 3 lakh

- Age above 80 years: Exemption up to Rs 5 lakh

This makes the old regime more attractive for retirees with pensions, interest income, or medical expenses.

Deductions That Keep the Old Regime Alive

Those sticking with the old regime can still claim several popular tax breaks, including:

- Standard deduction

- House Rent Allowance (HRA)

- Leave Travel Allowance (LTA)

- Section 80C (PF, PPF, ELSS, NPS, etc.)

- Extra Rs 50,000 under NPS

- Health insurance under Section 80D

- Savings interest under Section 80TTA

- Donations under Section 80G

- Home loan interest benefits