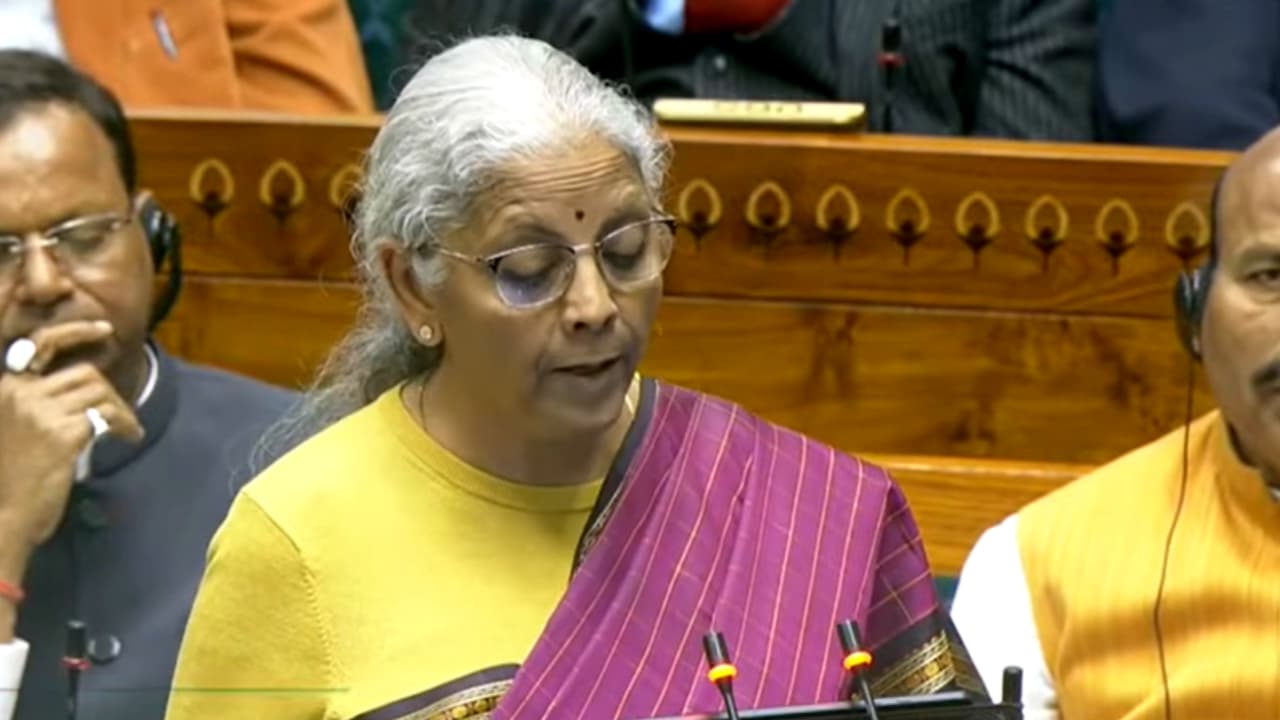

Finance Minister Nirmala Sitharaman’s Union Budget 2026 addresses potential price changes amid global economic uncertainty.

Union Finance Minister Nirmala Sitharaman on Sunday (February 1, 2026) presented her record ninth consecutive Union Budget, amid global uncertainties, trade tensions, and economic volatility. While much attention is on income tax changes, businesses and consumers alike are keen to see which sectors will benefit and which may feel the pinch.

Export-oriented industries, especially those affected by last year’s US tariffs—like gems and jewellery, ready-made garments, and leather—were hoping for relief. Funding for exploration and processing of critical minerals such as lithium, cobalt, and rare earth magnets also topped the wishlist.

Markets Open on a Positive Note

The stock market responded cautiously but optimistically on Budget Day. The BSE Sensex rose 272 points to 82,542, while the NSE Nifty edged up 66.9 points to 25,387 in morning trade, reflecting investor optimism amid early fluctuations.

What Could Become Cheaper?

Consumers may see some relief in key areas if the government reduces customs duties or raises tax incentives:

- Smartphones and tablets made in India, supporting the Make-in-India initiative.

- Home loan interest may get higher tax relief, easing the burden amid soaring property prices.

- Health insurance, electric vehicles, cancer drugs, and domestically manufactured home appliances could also become more affordable.

What Could Become Costlier?

Imported products and luxury items may see price hikes if customs duties are increased:

- Luxury watches, footwear, and foreign-made clothing.

- Premium imported automobiles.

- Gold and silver jewellery, depending on any changes to import duties.

- Imported beauty and skincare products.