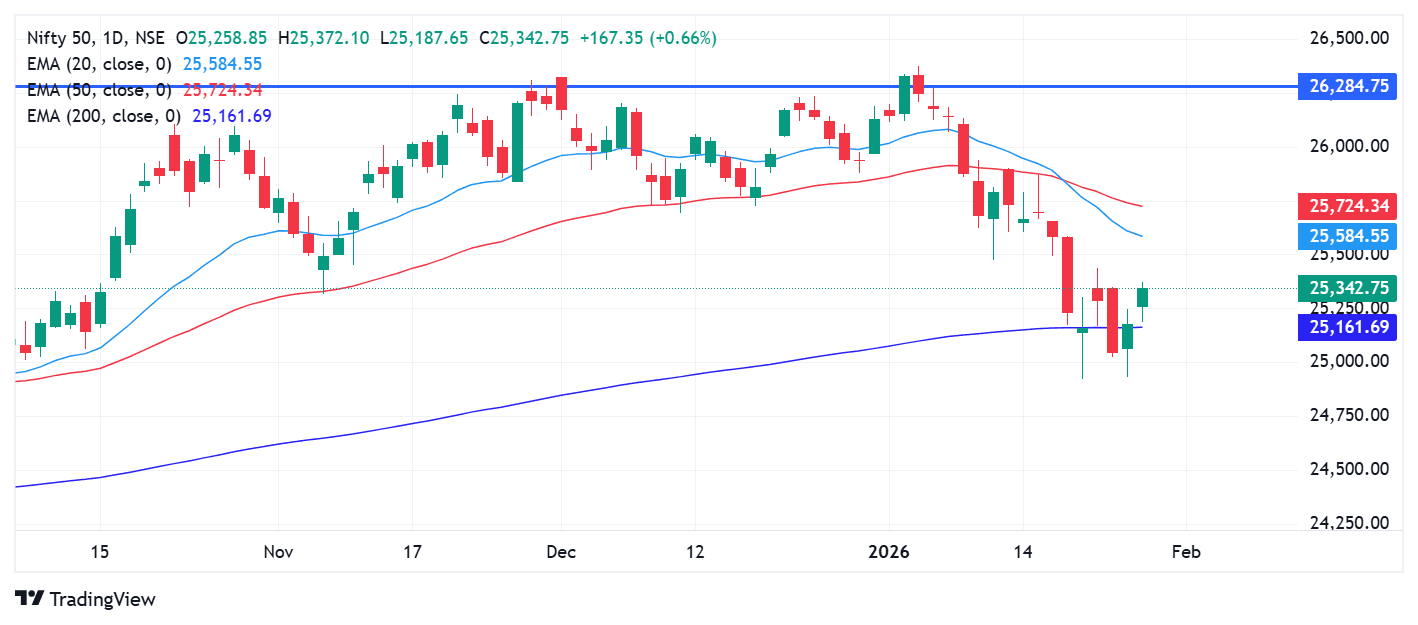

The index closed in green for the second consecutive session on Wednesday. The index bounced back from the crucial psychological support levels of 25,000 in the previous two sessions. The India-EU trade deal boosted the overall sentiment in the Indian markets.

On the technical side, the NIFTY50 held the 200 EMA support level for the second day consecutively, showing the signs of reversal from the bearish trend to bullish trend. Experts believe, for the medium term outlook to change the index should cross 25,500 levels. Ahead of the budget session, the market volatility is expected to remain at high level, owing to sharp rise in India Vix.

On the options data front, 25,000 puts witnessed strong open interest buildup and held the highest open interest for the coming weekly expiry, indicating a strong support. On the other hand, the 25,500 calls hold the highest open interest, indicating a strong resistance.

Stock Scanner

Long buildup: – BEL, ONGC, Coal India, Eternal

Short buildup: Asian Paints, TATA Consumer

Top traded futures contracts: BEL, Maruti

Top traded options contracts: TCS 3,300 CE

F&O securities under ban:

F&O securities out of the ban:

To access a specially curated smartlist of the most traded and active stocks, as well as the OI gainers and losers, simply log in: https://pro.upstox.com/ ➡️F&O➡️Options smartlist/Futures smartlist In Futures and Options or F&O, long build-up means an increase in Open Interest (OI) along with a price increase, and short build-up means an increase in Open Interest(OI) along with a price decrease-source: Upstox and NSE.