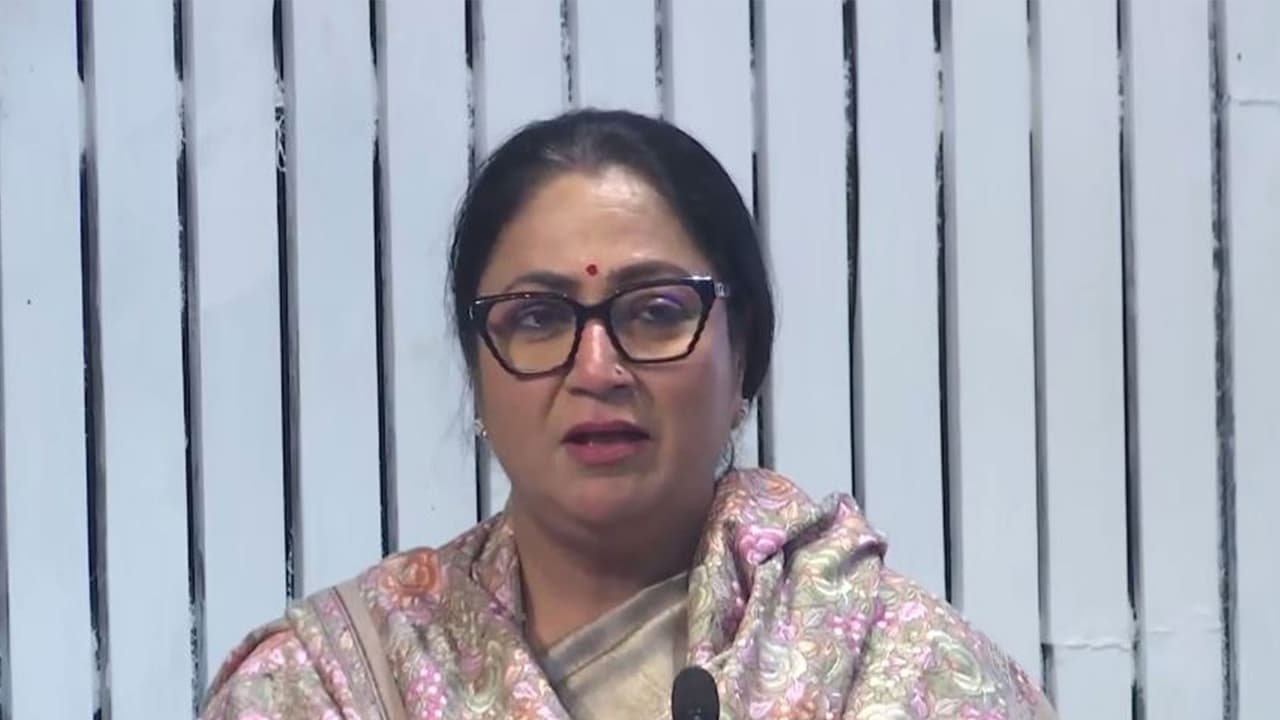

The Delhi government and CGTMSE have signed an MoU to provide collateral-free loans up to Rs 10 lakh for startups. CM Rekha Gupta stated that over 1 lakh people will benefit, with the centre and state governments providing guarantee coverage.

Chief Minister Rekha Gupta on Tuesday said that the MoU signed between the Delhi government and the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) will enable startup owners to obtain collateral-free loans up to Rs 10 lakh.

MoU to Benefit Over 1 Lakh Entrepreneurs

The Chief Minister emphasised the significance of the MoU, stating that more than one lakh people will benefit from the facility, and underlined that the centre will provide 75% to 90% of the guarantee coverage in the scheme. The remaining guarantee coverage will be provided by the state government.

“This MoU is very important. I understand that in Delhi, there are lakhs of young people with innovative ideas who want to start a good business, a good job, a good industry, or some initiatives in the service sector. There are many such startups that want to move forward, but there is no one to support them. Through this MoU, the fact that they will be able to get collateral-free loans is very significant. We are making this entire process available, where individuals can get loans of up to Rs 10 crore,” Gupta said.

“More than 1 lakh people will benefit from this facility. I am very grateful for the way the central government is providing 75% to 90% of the guarantee coverage in this entire scheme, and the remaining segment of the guarantee of 5% to 20% of the loan will be provided by the Delhi government,” she added.

‘Historic’ Scheme with Additional Relief

Delhi Minister Manjinder Singh Sirsa termed the MoU “historic” and said that the scheme provides relief to the minority community. “It is a historic MoU under which, in Delhi, the MSMEs will be provided with a loan worth Rs 10 crore without any guarantee. This scheme provides additional relief to SC families and women. This year, around 1 lakh businesses will be able to take advantage of the scheme,” he said.

How the Guarantee Scheme Works

Manish Sinha, CEO of CGTMSE, said that an additional 5% to 20% will be provided to micro and small enterprises in Delhi, with no collateral or third-party guarantee required. “In today’s MoU, an additional guarantee of 5-20% will be provided, so all the micro and small enterprises in Delhi who want the loan will be guaranteed by 95%. They do not have to provide any collateral or third-party guarantee,” he said.

Further, he said that there is no limiting factor in the scheme. “Small businesses usually face problems with obtaining loans, because collateral is required, which they don’t have. Due to this, several worthy enterpreneurs don’t get appropriate funding for their businesses. The scheme will provide 95% guarentee and small businesses will get loans easily. There is no limiting factor in this,” he added.

(Except for the headline, this story has not been edited by Asianet Newsable English staff and is published from a syndicated feed.)