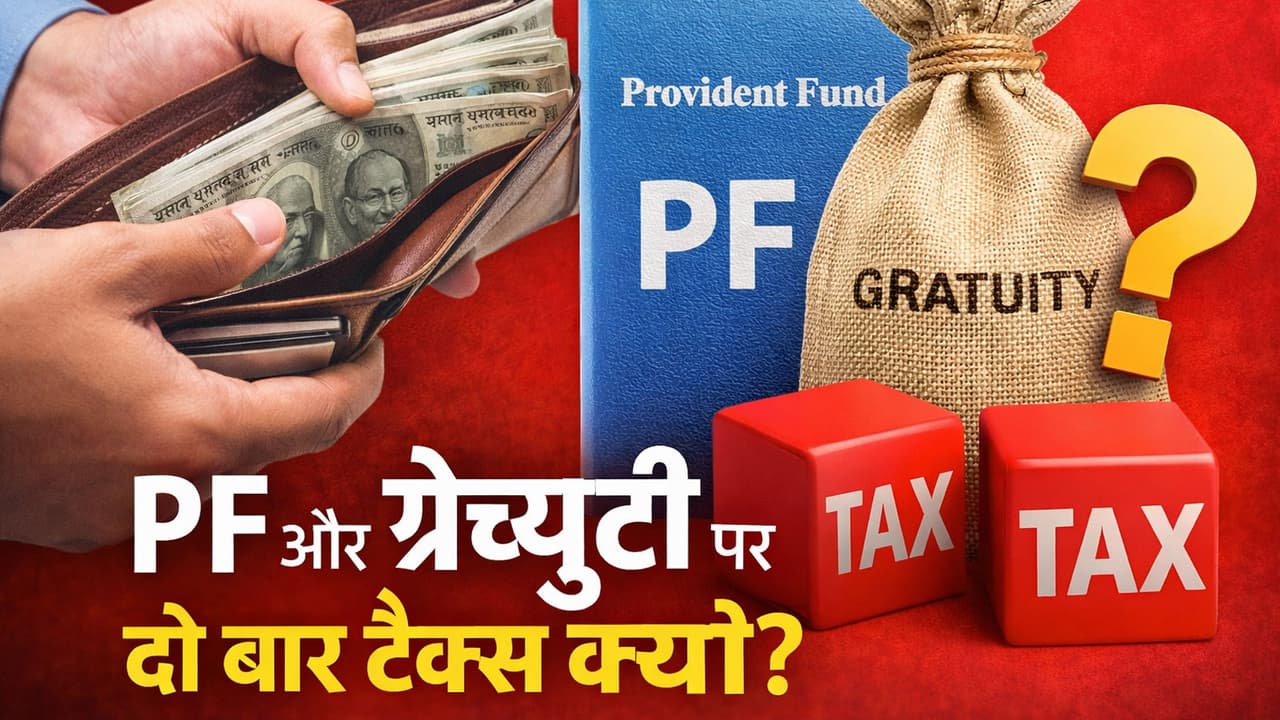

What is the rule regarding double tax?

According to the rules, if the employer’s contribution to an employee’s retirement fund like PF, NPS or gratuity exceeds Rs 7.5 lakh annually, then that extra amount is taxed in the same year. That means the money has not yet arrived in hand and the tax has been deducted. The real problem starts when the same employee withdraws his PF after retirement or at the time of leaving the job and if 5 years of service is not completed or certain conditions are not fulfilled, then tax is deducted again on the same amount. This is the reason why it is being called double taxation.