As the dollar weakens and BOJ policy draws focus, analysts argue Bitcoin is trading like a macro asset, setting up a potential liquidity-driven rotation.

- Analysts are increasingly viewing Bitcoin as a macro-asset tied to FX, rates, and global liquidity.

- Some macro traders see BOJ policy shifts and potential FX intervention as a catalyst.

- With global liquidity at cycle highs, bulls argue capitals could rotate from crowded defensive trades into higher convexity assets like Bitcoin.

Traders and allocators are starting to see Bitcoin (BTC) as a macro asset first and a crypto asset second. They are using the same lens to look at its price movement as they do for FX, rates, and cross-asset flows.

A growing number of analysts say that Bitcoin could be getting ready for a capital rotation as the dollar weakens, liquidity conditions get better, and traditional hedges look crowded.

Federal Reserve In Talk With Banks

The U.S. Dollar Index recently had one of its weakest weekly candles in months, which has led to speculation that policymakers are more open to currency depreciation. Global policymakers are paying more attention to Japan due to rising bond yields and a weakening yen. Marcus, a Delphi market researcher, said on Saturday that the BOJ intervention has acted as a liquidity release valve for global markets and US risk assets in particular.

If or when the BOJ credibly intervenes, either by smoothing the yield curve or regaining control of the long end of the curve, liquidity would equalize. Historically, Bitcoin has reacted more positively to BOJ interventions than gold itself. This is why the macro researcher thinks that Bitcoin isn’t competing with gold; when things get tough, it’s just waiting for the BOJ to turn off the “stress signal.”

Now, YouTube analyst Crypto Rover pointed out reports that the New York Fed talked to banks about the yen market, which the market sees as a possible sign that the Fed might step in. Rover said, “This is not just about Japan,” arguing that dollar weakness benefits risk assets broadly and tends to reward asset holders.

If the U.S. sold dollars to help boost the yen, it would inject dollar liquidity into the system. Arthur Hayes agreed with the thesis and said that the setup was “very bullish for Bitcoin.” He thinks that any kind of new liquidity, whether it’s from FX changes or more general policy changes, has always been good for Bitcoin.

Global Liquidity Hits New Cycle High

The macro data is making the background stronger. On Sunday, global money supply hit a new cycle high at $98 trillion, making the case that global liquidity is far from shrinking.

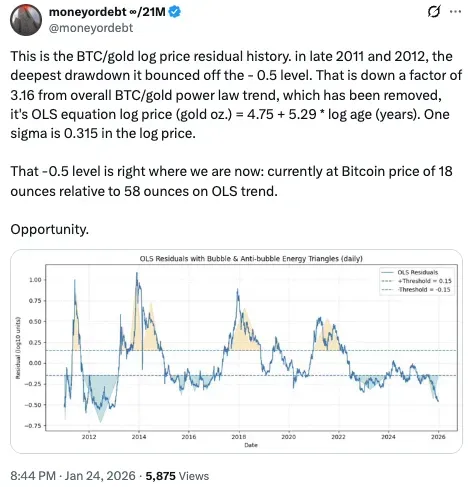

Bitcoin (BTC) was trading at about $88,503.49, and gold touched about $5,000 per ounce after a strong run. Some investors say that gold has already priced in monetary debasement, while Bitcoin has not. This is what is driving the relative-value narrative. On Stocktwits, retail sentiment around Bitcoin remained in ‘bearish’ territory, accompanied by ‘normal’ chatter levels over the past day.

One BTC buys about 18 ounces of gold at current prices. Bulls use this number to show that Bitcoin is still not getting enough attention compared to other macro hedges.

“The correlation between Bitcoin and gold has been almost non-existent over Bitcoin’s lifetime — around 0.14. Nonetheless, we believe Bitcoin is not only a risk-on asset driven by new technology, but also a risk-off asset: a hedge against inflation. Its supply growth rate is lower than gold’s growth rate, and while gold miners are now incentivized to extract more supply at higher prices, that simply cannot happen with Bitcoin.”

Cathie Wood, CEO Of ARK Invest

If liquidity stays strong, markets now think that capital could move from crowded defensive trades to higher-convexity assets like Bitcoin.

Read also: Cathie Wood’s ARK Invest Says Tokenized Assets Could Reach $11 Trillion In Next 5 Years

For updates and corrections, email newsroom[at]stocktwits[dot]com.<