Bitcoin is at a cycle high while Ethereum is much below. Liquid Capital founder Jack Yi put this discrepancy down to macroeconomic conditions, not a flaw in Ethereum’s fundamentals.

- Bitcoin has reclaimed cycle highs while Ethereum remains 50% below its last peak.

- Jack Yi said past cycles show ETH outperforming BTC during easing phases.

- He pointed to stablecoins and institutional adoption as structural shifts that favor Ethereum as a settlement layer.

Bitcoin (BTC) is hitting cycle highs while Ethereum (ETH) is still far from its last peak, and one prominent Ethereum bull says the divergence is structural, not a failure.

Liquid Capital founder JackYi said on Friday that Ethereum’s underperformance in comparison to Bitcoin reflects macro conditions and shifting market structure, rather than weakness in Ethereum’s fundamentals.

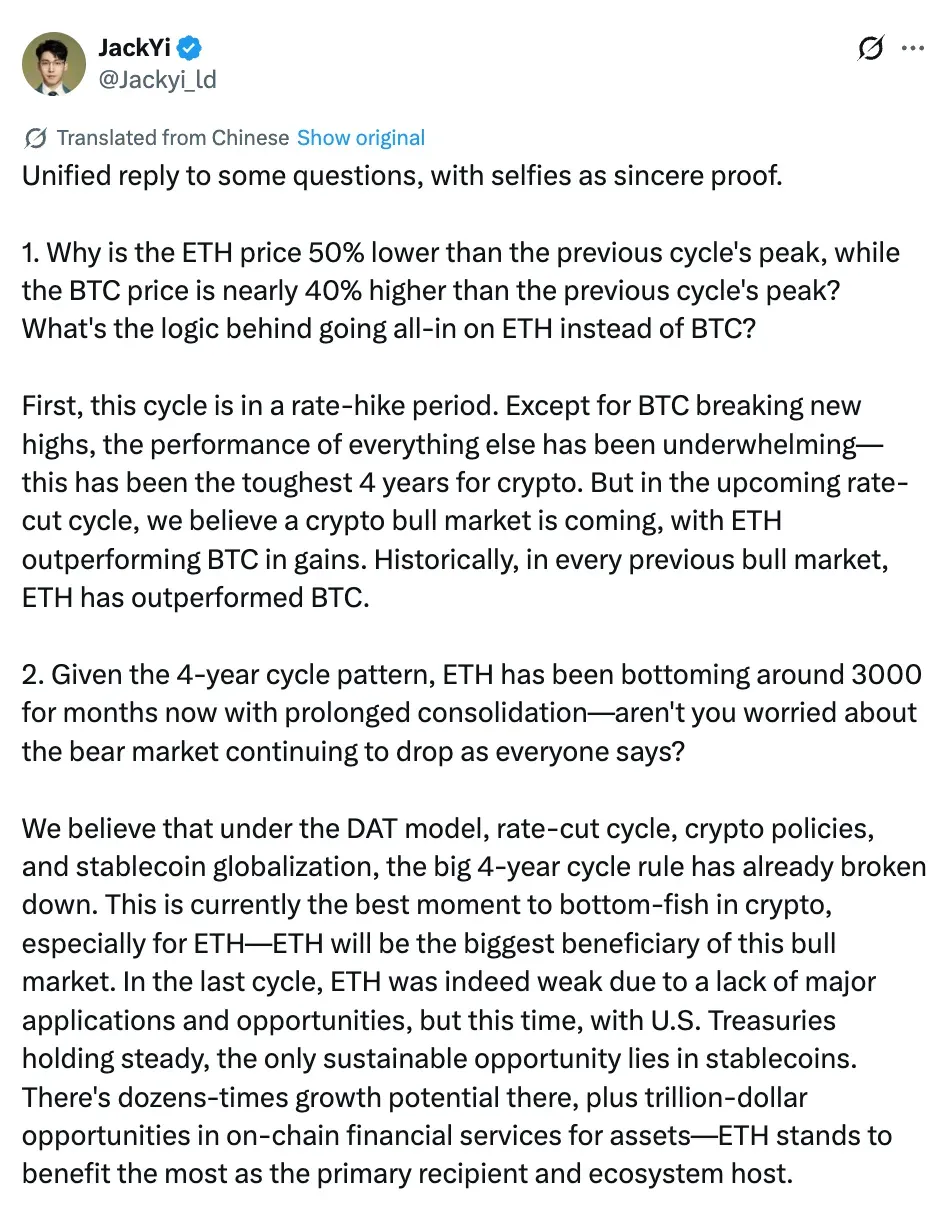

On X, JackYi responded to questions about why Ethereum remains nearly 50% below its prior cycle peak while Bitcoin trades roughly 40% above its previous high. He said the current cycle has been shaped by aggressive rate hikes, which limited performance across most crypto assets except Bitcoin.

According to JackYi, past crypto cycles show Ethereum outperforming Bitcoin during easing phases rather than tightening cycles. He said he expects that pattern to re-emerge once monetary conditions shift, adding that Ethereum has historically delivered larger gains during bull markets.

Ethereum (ETH) was trading at $2938, down by 0.5% over 24 hours. On the other hand, Bitcoin was trading at $88,663, down by 0.9% over 24 hours. On Stocktwits, retail sentiment around Ethereum dropped from ‘bearish’ to ‘extremely bearish’ territory, but chatter remained at ‘normal’ levels over the past day.

Bitcoin reached new all-time highs in October 2025 while most altcoins, including Ethereum (ETH), lagged, but the rebound occurred in quarter three of 2025, when Ethereum rose by 66%, reaching an all-time high of $4,946 in August.

Why JackYi Chooses Ethereum Over Bitcoin

JackYi said the traditional four-year crypto cycle has weakened due to structural changes, including the rise of stablecoins, shifting crypto policies, and growing institutional participation. He argued that Ethereum benefits most from these changes as the primary settlement layer for stablecoins and on-chain financial services.

He also addressed concerns around prolonged consolidation, saying Ethereum has spent months stabilizing near the $3,000 level. JackYi said he views this range as a base rather than a breakdown, noting that precise market bottoms are only clear in hindsight.

Responding to leverage concerns, JackYi said his positions are structured to withstand volatility, adding that his strategy allows borrowed exposure to be reduced if needed. He said Ethereum remaining above $1,000 would keep his positions “absolutely safe.”

He added that he does not expect his buying activity to influence market direction, describing his approach as positioning rather than price-setting.

Trend Research, backed by Jack Yi, has been one of the largest Digital Asset Companies (DATs) that has invested in Ethereum. Most recently, the firm borrowed $20 million USDT again and then put the money into Binance to buy 6,656 ETH, which were then sent to Aave (AAV). Trend Research owns 651,310 ETH, which is worth about $1.91 billion.

Read also: Bitcoin Environmental Debate Intensifies After New Scientist Labels It ‘One Big Disaster’

For updates and corrections, email newsroom[at]stocktwits[dot]com.<