UBS cited developments in Microsoft’s AI infrastructure deployments as a key driver of future cloud expansion.

- UBS reduced its price target to $600 from $650 and kept a ‘Buy’ rating.

- The firm highlighted progress in the company’s build-out of large Fairwater AI data centers in Atlanta and Wisconsin as catalysts.

- Microsoft is scheduled to report second-quarter fiscal 2026 earnings on January 28.

Microsoft Corp. (MSFT) saw its price target trimmed by UBS in the lead-up to the company’s fourth-quarter earnings, reflecting evolving views on its growth drivers as AI demand continues to shape investor expectations.

The firm reduced its price target to $600 from $650 and kept a ‘Buy’ rating, according to TheFly. However, Microsoft stock traded over 4% higher by Friday mid-morning.

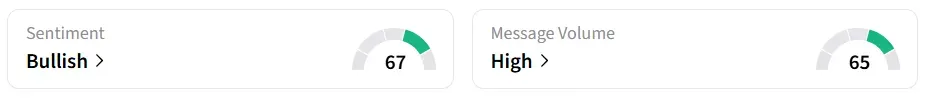

On Stocktwits, retail sentiment around the stock remained in ‘bullish’ territory amid ‘high’ message volume levels.

Analyst Rationale

UBS pointed to developments in Microsoft’s AI infrastructure deployments as a key driver for future cloud expansion. The firm highlighted progress in the company’s build-out of large Fairwater AI data centers in Atlanta and Wisconsin as a meaningful catalyst for the company’s Azure cloud unit.

The Wisconsin facility is expected to become operational in the first quarter of 2026, which the firm says should support Azure’s revenue growth momentum.

UBS emphasized the ongoing launch of these hyperscale AI hubs as a positive sign for the cloud business, which sits at the core of Microsoft’s earnings potential.

Microsoft is scheduled to report second-quarter (Q2) fiscal 2026 earnings on January 28. Analysts expect a revenue of $80.278 billion and earnings per share (EPS) of $3.91, according to Fiscal AI data.

Cloud One Contract

On Wednesday, Microsoft secured a firm-fixed-price task order valued at $170.4 million tied to the Air Force’s Cloud One initiative. Under the agreement, Microsoft will deliver Azure cloud services to support Cloud One and its user base. The work will take place at Microsoft-designated locations throughout the continental United States, with completion scheduled for Dec. 7, 2028.

Many firms, including Citigroup, Mizuho, and TD Cowen, have lowered their price targets on Microsoft stock over the past week.

Still, analysts have an average target of $618.2, according to Koyfin data, implying a potential 37% upside from the stock’s last close. Fifty-seven out of 58 analysts recommend ‘Strong Buy’ and ‘Buy’ for the stock.

MSFT stock has gained over 4% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<