Last week, during its Investor Day, Ondas raised its 2026 revenue outlook to a range of $170 million to $180 million, 25% above its previous $140 million target.

- Ondas stock traded over 4% higher in Thursday’s premarket.

- Ondas expects the fourth-quarter of 2025 to generate roughly $27 million to $29 million in revenue.

- Stifel increased its price target, stating that the recent investor presentation helped clarify the company’s long-term strategy.

Ondas Holdings Inc. (ONDS) stock has been attracting increased attention, with retail chatter on Stocktwits rising 131% over the past week, as traders, investors, and analysts expressed optimism about the defense infrastructure provider’s growth.

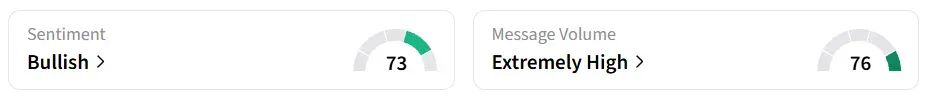

Ondas stock traded over 4% higher in Thursday’s premarket. At the time of writing, retail sentiment around the stock remained in ‘bullish’ territory with message volume improving to ‘extremely bullish’ from ‘bullish’ levels in 24 hours.

Some bullish Stocktwits users expected the stock to reach $15.

Another user considered the stock to be their personal favourite.

Revenue Outlook

Last week, during its Investor Day, Ondas raised its 2026 revenue outlook to a range of $170 million to $180 million, 25% higher than its previous $140 million target.

Ondas expects the fourth-quarter of 2025 to generate roughly $27 million to $29 million in revenue, and 2025 revenue between $47.6 million and $49.6 million, both results surpassing prior internal goals.

Street Opinion

On Wednesday, Stifel increased its price target to $18 from $17 and maintained a ‘Buy’ rating on the stock, according to TheFly. Analyst Jonathan Siegmann said the company’s guidance and execution timeline exceeded his team’s initial expectations.

The firm emphasized that the recent investor presentation helped clarify the company’s long-term strategy and the differentiated nature of its autonomous systems portfolio, particularly in drone and related defense segments.

H.C. Wainwright, Oppenheimer, Lake Street, and Needham also raised their price targets on Tuesday, taking a bullish stance on the company’s diversified autonomous systems platform.

The stock has gained 429% over the past 12 months, driven by a slew of investments and defense-related deals in 2025. Ondas develops advanced autonomous systems and private wireless technology through its units Ondas Autonomous Systems (OAS), Ondas Capital, and Ondas Networks.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<