Spot gold (XAU/USD) powered past $4,800 an ounce for the first time, rising as much as 2.6% to $4,888.5 per ounce.

- Gold futures for February 26 deliveries climbed 2.1% higher to $4,866.1 per ounce.

- Spot silver (XAG/USD) was up 0.3% at $94.9 an ounce, while futures for March 2026 deliveries climbed 0.2% to $94.8 per ounce.

- U.S. equities were trading marginally lower in pre-market on Wednesday, while major European markets slipped on rising geopolitical tensions.

Gold surged to a fresh high on Tuesday, continuing its historic rally, as investors sought safe-haven assets amid renewed trade-war concerns fueled by rising tensions between the United States and NATO over Greenland.

Spot gold (XAU/USD) powered past $4,800 an ounce for the first time, rising as much as 2.6% to $4,888.5 per ounce.

At the time of writing, the XAU/USD pair was up 1.8% at $4,851.2 per ounce, while gold futures for February 26 deliveries climbed 2.1% higher to $4,866.1 per ounce.

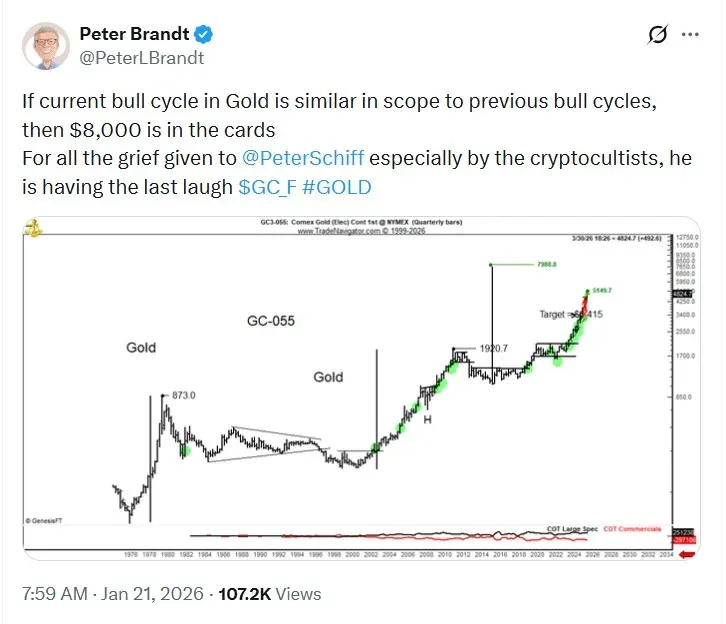

Veteran trader Peter Brandt said gold prices reaching $8,000 is on the cards if the current bull cycle is similar to the previous ones.

The pace of the current gold rally has already pushed prices beyond levels many banks were pencilling in for much later.

Analyst Take

Earlier this month, Morgan Stanley said gold could reach $4,800 an ounce by the fourth quarter, driven by falling interest rates, changes at the Federal Reserve, and sustained buying from central banks and funds.

Prior to that, Goldman Sachs projected gold would climb to $4,900 an ounce by December 2026, with further upside if private investors increase allocations. Goldman also pointed to structurally strong central bank demand and expected Fed rate cuts as powerful tailwinds for the metal.

Spot gold prices have gained 14% so far this year.

Meanwhile, spot silver (XAG/USD) was up 0.3% at $94.9 an ounce, while futures for March 2026 deliveries climbed 0.2% to $94.8 per ounce.

Markets Watch

Major European markets slipped on Wednesday as investors assessed rising geopolitical tensions after U.S. President Donald Trump threatened to impose tariffs on goods from eight European countries unless an agreement is reached over what he described as the “complete and total purchase of Greenland.” Trump said the tariffs would start at 10% on February 1 and increase to 25% by June.

U.S. equities were trading marginally lower in pre-market on Wednesday, with the SPDR S&P 500 ETF (SPY) down by 0.1%, while the Invesco QQQ Trust ETF (QQQ) and the SPDR Dow Jones Industrial Average ETF Trust (DIA) declined 0.2%.

Read also: This Microcap Company Announced Plans To Delist Just Days After The Stock Surged 450% — What Happened?

For updates and corrections, email newsroom[at]stocktwits[dot]com.<