The company said it has chosen to voluntarily delist its common stock from the Nasdaq Capital Market and terminate the registration of its shares with the Securities and Exchange Commission.

- The company’s board determined that the costs and resources required to maintain SEC reporting obligations outweigh the benefits of a public listing.

- The company expects its shares to stop trading on Nasdaq on or about February 6, 2026.

- Last week, Madryn Asset Management acquired a 91% stake in the company.

Shares of Venus Concept Inc. (VERO) crashed more than 50% in pre-market trading on Wednesday after the company said that it has decided to voluntarily delist its common stock from the Nasdaq Capital Market and deregister its shares with the Securities and Exchange Commission (SEC).

While Venus Concept remains in compliance with Nasdaq’s listing requirements, its board determined that the costs and resources required to maintain SEC reporting obligations outweigh the benefits of a public listing for both the company and its shareholders.

Venus Concept has notified Nasdaq of its intent to file a Form 25, associated with its removal from listing, with the SEC around Jan. 30, 2026. The company expects its shares to stop trading on Nasdaq on or about February 6, 2026.

“We believe the reduced costs for compliance will help facilitate the Company’s ability to continue to execute our turnaround plan. Venus will continue to work together with Madryn Asset Management to position Venus for sustained, long-term financial success,” said Rajiv De Silva, CEO of Venus Concept.

Trading in VERO shares were halted at 07:25 am ET.

Last Friday, Venus Concept stock surged more than 450% after the company announced that Madryn Asset Management had acquired a 91% stake. Venus Concept said Madryn recently met with its board to discuss steps to reduce operating costs, including the possibility of delisting and deregistering its shares.

Madryn is a New York-based private equity firm focused on healthcare investments, while Venus Concept develops minimally invasive and non-invasive aesthetic and hair restoration technologies.

Retail Reaction

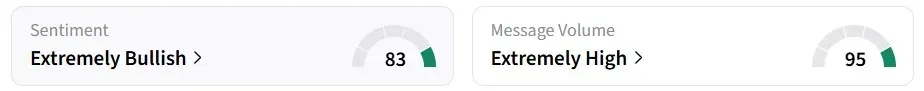

Retail sentiment on Stocktwits remained in the ‘extremely bullish’ territory amid ‘extremely high’ message volumes.

One user wrote about why trading in the stock was halted.

Another expects the stock to climb further.

VERO shares have gained over 18% in the past year.

Read also: PLTR Stock Garners Retail Attention On AI Infrastructure Deals At Davos

For updates and corrections, email newsroom[at]stocktwits[dot]com.<