The company unveiled a $200 million dilution alongside a $90 million investment from healthcare technology heavyweight Medtronic.

- The offering includes 34.8 million shares at $5.75, the stock’s closing price on Tuesday.

- Medtronic’s investment is expected to give it a post-offering ownership stake of between 16% and 19.99%.

- Proceeds from the transactions will be used to support Anteris’ clinical strategy, including R&D at v2vmedtech.

Shares of Anteris Technologies Global Corp. (AVR) jumped sharply in pre-market trading on Wednesday after the structural heart specialist unveiled a $200 million equity raise alongside a sizable strategic investment from healthcare technology heavyweight Medtronic.

AVR shares were up around 17% at the time of writing and were on track to open at their highest levels since March 2025.

Anteris announced a proposal to raise $200 million via a public offering of its common stock and grant underwriters a 30-day option to purchase up to an additional $30 million of shares at the public offering price.

In a separate release, the company said the offer is to sell around 34.8 million shares at $5.75, the stock’s closing price on Tuesday.

Medtronic Investment

Alongside the public offering, Anteris entered into a stock purchase agreement with Medtronic plc (MDT). Under the deal, Medtronic, through a wholly owned unit, will invest up to $90 million in Anteris common stock via a private placement priced in line with the public offering. The transaction is expected to give Medtronic a post-offering ownership stake of between 16% and 19.99% in Anteris.

Proceeds from the transactions will be used to support Anteris’ clinical strategy, including continued patient recruitment and execution of the global PARADIGM pivotal trial for the DurAVR Transcatheter Heart Valve (THV) in severe aortic stenosis, expanding manufacturing capacity, and funding ongoing research and development (R&D) at v2vmedtech, a privately owned medical technology company.

The DurAVR THV is a biomimetic valve designed to mimic the performance of a healthy aortic valve.

What Is Retail Saying?

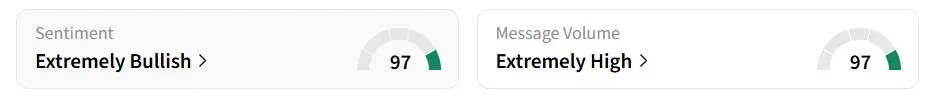

On Wednesday, retail sentiment for AVR flipped to ‘extremely bullish’ from ‘bearish’ a day earlier, while message volumes increased to ‘extremely high’ from ‘normal’ on Stocktwits. AVR was among the top trending tickers on the platform at the time of writing.

One user expects the stock to hit $20 on the ‘bullish news’.

However, another user was slightly skeptical about the dilution.

AVR stock has declined more than 4% over the past year but has gained around 12% so far in 2026.

Read also: Why Is Nvidia Stock Rising In Premarket Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.<