The remarks came as the company faces increased attention following its shift toward a digital-asset treasury model and recent changes to its capital allocation strategy.

- Incoming CEO Eric Jackson said there is no decision at present on a reverse stock split, calling ongoing speculation “noise.”

- Jackson said capital-structure actions would only be considered through a transparent, shareholder-led process if proposed in the future.

- The comments come as SRx Health prepares to complete its reverse merger with EMJ Crypto Technologies in early 2026.

SRx Health Solutions Inc. shares rose over 2% in premarket trading on Tuesday after incoming CEO Eric Jackson moved to address investor concerns surrounding a potential reverse stock split, saying no decision has been made.

Jackson, who is expected to become chairman and CEO following the company’s pending reverse merger with EMJ Crypto Technologies, posted a detailed message on X in response to growing online speculation about the company’s capital structure.

Jackson Responds To Reverse Split Chatter

In his post, Jackson said there is “no decision today regarding a reverse split,” adding that capital-structure actions should not be viewed as indicators of success or failure.

He said such decisions are made based on long-term platform credibility, liquidity, and access to capital, rather than short-term price movements. “I will not pre-commit to or rule out tools years in advance, and I will not run the company based on fear shaped by unrelated past experiences,” Jackson added.

“If and when any capital-structure change is ever proposed, it would be done transparently, legally, and with shareholder process. Until then, speculation is noise. If this level of uncertainty is uncomfortable, this may not be the right investment for you, and that’s okay,” the incoming CEO said.

Debate Builds Ahead of Shareholder Vote

Formerly known as Better Choice Company, SRx Health rebranded last year and, in December, said it would acquire EMJ Crypto Technologies. The deal shifts the company from pet wellness products toward a digital-asset treasury platform that uses AI, quantitative models, and systematic risk controls to manage crypto assets.

Investor scrutiny has remained elevated following public criticism last month from George Noble, a former associate of Peter Lynch, who questioned the strategic shift and urged the company to consider a reverse stock split, saying it could make the shares easier to short.

A reverse merger has been approved by SRx Health’s board and remains subject to shareholder approval, with the transaction expected to close in the first quarter of 2026.

Opendoor Stake Part Of Broader Allocation Plan

On Friday, SRx Health said it invested in Opendoor Technologies Inc.’s common stock as part of its broader capital allocation strategy.

The company said it aims to deploy excess liquidity into publicly traded equities, digital assets, and commodities such as gold and silver that management believes are undervalued and offer attractive risk-adjusted return potential. SRx Health added that it may adjust its ownership position in Opendoor over time, depending on market conditions, valuation, and other strategic considerations, and noted that the investment does not impact its core operational focus.

How Did Stocktwits Users React?

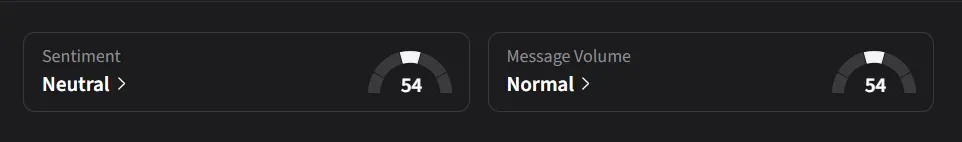

On Stocktwits, retail sentiment for SRx Health was ‘neutral’ amid ‘normal’ message volume.

One user said, “There’s room to run higher, but there’s plenty of room to go way lower.”

Another user expects the stock to be “the only one green at open.”

SRx Health’s stock has slumped 91% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<