XPeng shares fell in Hong Kong after a recent analyst price target cut weighed on sentiment.

- CEO He Xiaopeng said XPeng’s first ET1 humanoid robot unit has rolled off the production line.

- The company previously said it aims to mass-produce high-level humanoid robots by the end of 2026.

- Shares slipped after Macquarie cut its price target to $26, citing a transition year and slowing EV demand in China.

XPeng Inc. shares traded lower in Hong Kong on Tuesday, even after the Chinese EV maker confirmed progress on its humanoid robotics program, as investors weighed a recent price target cut on the company.

Robot Milestone Confirmed By CEO

XPeng CEO He Xiaopeng said the company has completed its first ET1 humanoid robot prototype developed to automotive-grade standards.

“Today, the first unit of our ET1 robot, developed to automotive-grade standards, has successfully rolled off the production line,” He wrote on X on Monday. “With the team, we spent the entire day observing and discussing the details behind it. This marks a critical step toward the large-scale mass production of advanced humanoid robots this year.” He did not provide further technical details or share images of the prototype.

XPeng’s Humanoid Robot Push

XPeng has been steadily expanding its ambitions beyond electric vehicles into AI and robotics.

At its AI Day event in November 2025, the company said it aims to achieve mass production of high-level humanoid robots by the end of 2026. During the event, XPeng unveiled its next-generation Iron humanoid robot, which drew attention for its natural, fluid “catwalk” movements and highly realistic human posture.

The Iron humanoid robot features a humanoid spine, bionic muscles, flexible skin, a 3D curved display on its head, and hands with 22 degrees of freedom. It is powered by XPeng’s second-generation Vision-Language-Action (VLA) model and three in-house-developed Turing AI chips, delivering 2,250 TOPS of computing power.

According to XPeng, the robot uses all-solid-state batteries to enable lightweight design, high energy density, and improved safety. The company said initial applications will focus on commercial service scenarios.

XPeng first unveiled its earlier-generation Iron humanoid robot at its 2024 AI Day event. That model stood 178 cm tall, weighed 70 kg, and was designed to closely resemble human movement and posture.

Analyst Target Cut Weighs On Shares

The robot update came days after Macquarie lowered its price target on XPeng to $26 from $32, while maintaining an ‘Outperform’ rating.

Macquarie said 2026 is expected to be a transition year for the company as it expands its product portfolio with up to four new models amid slowing demand in China’s EV market. The brokerage firm added that the net income breakeven could vary depending on the revenue structure tied to Volkswagen volume-based fees.

Robotics Race Draws Broader Attention

XPeng’s robotics push has unfolded alongside growing global interest in humanoid robots among EV makers.

Tesla CEO Elon Musk has described the company’s Optimus humanoid robot as its “biggest product of all time,” predicting it could one day scale to tens of billions of units. Musk has said Optimus robots are already operating autonomously within Tesla facilities.

In November 2025, He responded on X after Musk shared a video featuring Tesla’s Optimus robot alongside another humanoid that appeared visually similar to XPeng’s Iron model. “Let this stand as the final proof: the robot that mastered the catwalk is built by a Chinese startup,” He wrote. “The journey continues, and we will advance, step by step.”

How Did Stocktwits Users React?

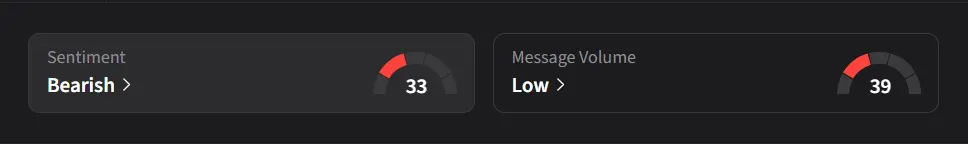

On Stocktwits, retail sentiment for XPeng was ‘bearish’ amid ‘low’ message volume.

XPeng’s U.S.-listed stock has risen 49% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<