Micron’s CEO Sanjay Mehrotra signalled confidence in AI demand for memory in an interview with CNBC TV, highlighting that memory growth is at the heart of everything AI drives.

- Mehrotra added that the company was looking at stronger-than-expected growth in memory and storage for PCs.

- Micron disclosed on Thursday that its director, Teyin Liu, had purchased shares worth $7.8 million in the company.

Micron Technology, Inc. (MU) shares rose over 6.6% on Friday, continuing its upward momentum after a recent insider purchase and an overall boost in the AI tech industry following blowout results from Taiwan Semiconductor Manufacturing Company.

Micron’s chief executive officer (CEO) Sanjay Mehrotra further signalled confidence in AI demand for memory in an interview with CNBC TV, buoying confidence in the company.

“Today, memory is not just a system component, it is actually a strategic asset because AI-driven systems need more memory,” he said.

“They need higher-performance memory in order to really do all the real-time contextual processing that AI systems require,” he added, highlighting that memory growth is at the heart of everything AI drives.

Future Outlook

Mehrotra told CNBC TV that Micron is spending $200 billion to increase production capacity in the U.S., including two fabs in Idaho and a large facility in Clay, New York, that broke ground on Friday. He emphasized that Micron was ‘working hard’ to produce more chips.

Mehrotra also added that the company was looking at stronger-than-expected growth in memory and storage for PCs. “We see that tightness continuing into 2027, so we see durable industry fundamentals over the foreseeable future, driven by AI demand,” he said.

Meanwhile, Micron disclosed on Thursday that its director, Teyin Liu, had purchased shares worth $7.8 million in the company over Tuesday and Wednesday.

How Did Stocktwits Users React?

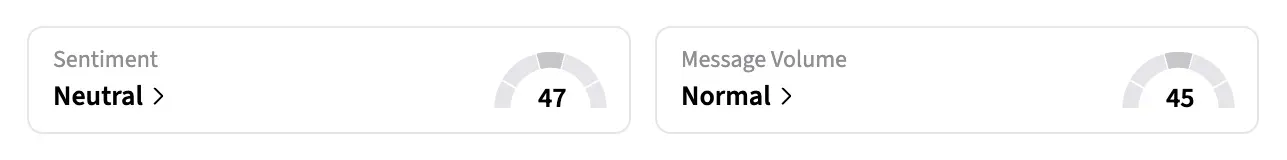

On Stocktwits, retail sentiment around MU stock jumped to ‘neutral’ from ‘bearish’ territory over the past day amid ‘normal’ message volumes.

One user praised the CEO’s vision, adding that the company may be in the early cycles of growth.

A bullish user commented how it was rare for an insider to buy at such high prices, indicating it was a positive sign.

Another bullish user predicted the shares would rally to $450 in the next month. Shares of MU were trading around $359.7 at the time of writing.

MU stock has gained over 250% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<