Bitcoin could mirror gold’s rally, according to analysts, with spot ETFs bringing in new buyers and absorbing more than 100% of new issuance.

- On Monday, Bitcoin and Ethereum led the upside as Bitcoin jumped to $95,336, up 4.4% and Ethereum to $3,322 up 6.8%.

- The move was caused by a short squeeze, with $684.4 million in liquidations hitting the crypto market in 24 hours. Most of the shorts were flushed after the CPI print.

- Altcoins also edged up with Solana, XRP, Dogecoin, Cardano, and BNB all seeing big gains as short covering sped up across the board.

Nearly $700 million was liquidated across the cryptocurrency market in the last 24 hours as Bitcoin’s (BTC) price rallied after Tuesday’s inflation data eased near-term concerns around the Federal Reserve’s independence.

Bitcoin’s price jumped to $95,336, a 4.4% gain on the day. CoinGlass data showed BTC liquidation was led by $270.6 million in shorts, and $23.4 million on the long side, bringing the total liquidation for Bitcoin to $294 million. On Stocktwits, retail sentiment around Bitcoin improved from ‘bearish’ to ‘bullish’ territory as chatter remained in ‘normal’ levels over the past day.

Data showed a total of $684.4 million was wiped from the market, and shorts were heavily flushed out. Buyers attributed the gains to better macro clarity after CPI showed that inflation pressures are easing. Christoph Rieger, an analyst at Commerzbank, said that there is less immediate pressure for politically driven rate cuts, adding that the figures had served to stabilize risk sentiment across markets, according to Barron’s.

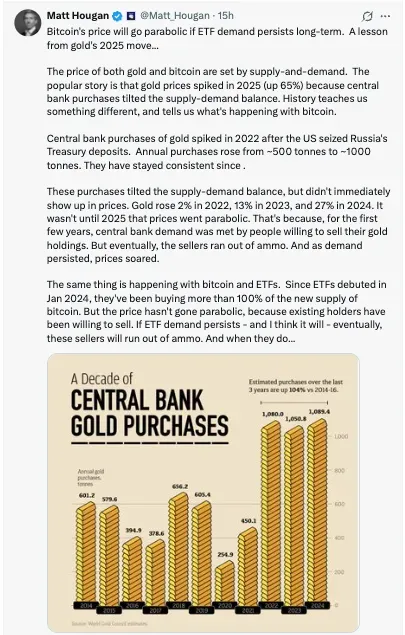

Bitwise CEO, Matt Hougan, said on X, “Bitcoin’s price will go parabolic if ETF demand persists long-term.

He said that when the central bank started buying gold in 2022, gold rallied 2% that year, and by 2024, the price of gold was up 27%. According to him, Bitcoin could also follow a similar path given its 2024 spot ETF launch. Many new buyers have entered the market and observed more than 100% of new issuance. The reason Bitcoin price has remained relatively orderly is that long-term holders and legacy supply have continued to meet that demand, noted Hougan. He said if ETF flows remain structurally strong, the available sell-side liquidity will eventually thin out and markets will reprice.

Altcoins Rally As Sentiment Remains Muted On Stocktwits

Ethereum (ETH) rose to $3,322, an increase of 6.8% over the past 24 hours. The second-largest altcoin also witnessed liquidations worth roughly $214.1 million, once more led by shorts at around $190.8M million versus longs’ $23.3 million. The largest single liquidation in the 24 hours preceding writing occurred on Binance for Ethereum’s ETH/USDT pair, at $12.9 million, according to Coinglass. On Stocktwits, retail sentiment around Ethereum moved from ‘extremely bearish’ to ‘bullish’ territory, as chatter around the coin improved from ‘low’ to ‘normal’ levels over the past day.

Solana (SOL) was trading at $145.36 and rose 5.0% in the day. Solana’s liquidations amounted to approximately $32.4 million, shorts running up the majority with $30.7 million and relatively small longs at 1.6m which can suggest that worth of gain was a structural recovery rather than leverage chasing. On Stocktwits, retail sentiment around Solana improved from extremely bearish to neutral territory, with chatter remaining in ‘normal’ levels over the past day.

Ripple’s XRP (XRP) climbed to $2.17, up 5.6% in the past 24 hours. Liquidations added up to about $6.13 million, again leaning towards shorts as is the case with larger market positioning dynamics. On Stocktwits, retail sentiment around XRP improved from ‘bearish’ to ‘neutral’ territory, as chatter changed from ‘low’ to ‘normal’ over the paast day.

Dogecoin (DOGE) also moved sharply higher, trading at $0.1494, up 9.05% over the past 24 hours. Liquidations totalled $7.73 million, with short positions accounting for $6.54 million, compared with $1.19 million in longs. This indicated that the move was largely driven by bearish traders being forced out of their positions. On Stocktwits, retail sentiment around Dogecoin improved from ‘bearish’ to ‘bullish’ territory, accompanied by ‘low’ chatter levels over the past day.

Cardano (ADA) followed a similar pattern, rising to $0.4226, a 9.1% gain on the day. About $2.41 million in positions were liquidated over 24 hours, overwhelmingly skewed toward shorts ($2.32 million) versus just $85,100 in long liquidations, reinforcing the short-squeeze dynamic. On Stocktwits, retail sentiment around Cardano remained in ‘neutral’ territory, as chatter levels remained in ‘low’ over the past day.

Binance Coin (BNB) also joined the broader move, trading at $951.07, up 4.99% in 24 hours. Liquidations reached approximately $3.14 million, with $3.03 million coming from shorts and only $107,600 from longs. The results again pointed towards the forced short covering rather than fresh speculative buying. On Stocktwits, retail sentiment around Binance Coin remained in ‘bearish’ territory, accompanied by ‘normal’ chatter levels over the past day.

Read also: Kraken-Linked SPAC Files For $250 Million Nasdaq IPO

For updates and corrections, email newsroom[at]stocktwits[dot]com.<