Rezolve Ai said it now expects full-year 2025 revenue to reach at least $40 million, and forecasts roughly $350 million in revenue for 2026 as enterprise deployments scale globally.

- Rezolve also reaffirmed its plan to exit 2026 with at least $500 million in annual recurring revenue.

- Rezolve said it ended 2025 with approximately $209 million in ARR after posting a record December.

- December marked the firm’s first profitable period, highlighting an improvement in its operating leverage.

Rezolve Ai (RZLV) on Tuesday signaled sharply higher growth expectations as more large enterprises adopt its AI-driven commerce and customer engagement platform.

The company projected tenfold evenue growth in 2026 from market expectations as demand picks up across retail, financial services and payments.

Growth Expectation

Rezolve Ai said it now expects full-year 2025 revenue to reach at least $40 million, and forecasts roughly $350 million in revenue for 2026 as enterprise deployments scale globally.

The 2025 outlook matches the analysts’ consensus estimate while that of 2026 exceedes the estimate of $126 million, according to Koyfin data. Despite the outlook boost, Rezolve Ai stock traded over 9% lower on Tuesday morning.

The company also reaffirmed its plan to exit 2026 with at least $500 million in annual recurring revenue (ARR). That milestone would translate to about $40 million in monthly revenue by the end of next year.

Operational Momentum Builds

Rezolve said it ended 2025 with approximately $209 million in ARR after posting a record December, when revenue surpassed $17 million. December marked the firm’s first profitable month, highlighting improving operating leverage as volume rises.

The company said it grew its workforce to more than 1,000 employees across 24 offices worldwide in 2025. It now serves over 650 enterprise customers, with its infrastructure handling more than 51 billion API calls and reaching roughly 340 million unique users globally.

“2025 was the year Rezolve proved that enterprise AI-driven commerce is no longer experimental, it is live, scaled and delivering ROI.”

– Daniel M. Wagner, Founder, Chairman and CEO, Rezolve Ai

How Did Stocktwits Users React?

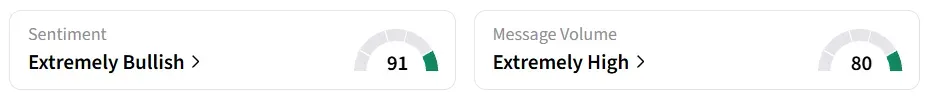

On Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ territory with message volume changing to ‘extremely high’ from ‘high’ levels in 24 hours.

A bullish Stocktwits user called the stock a “long term play,” while urging investors not to be bothered by short-term volatility.

Some other users said they are buying the dip as the stock was cheap.

RZLV stock has gained 53% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<