The U.S. Food and Drug Administration recently requested additional information to assess Filspari’s clinical benefit.

- Travere said its responses are currently under agency review.

- FDA’s PDUFA target action date for full approval of Filspari in Focal Segmental Glomerulosclerosis is January 13.

- The company expects U.S. net product sales of about $127 million in Q4 and about $410 million for the full year 2025.

Shares of Travere Therapeutics Inc. (TVTX) slumped 30% in premarket trading on Tuesday after the company said the U.S. Food and Drug Administration (FDA) requested additional information to assess Filspari’s clinical benefit.

Travere said its responses are currently under agency review. Filspari is a treatment for adults with primary immunoglobulin A nephropathy, a progressive kidney disease that can ultimately lead to kidney failure.

FDA’s PDUFA (Prescription Drug User Fee Act) target action date for full approval of Filspari in Focal Segmental Glomerulosclerosis (FSGS) is January 13. A PDUFA date is the FDA’s target date to make a decision on a drug application. If approved, Filspari would be the first treatment for FSGS, and the company says it is well-positioned for a commercial launch.

How Did Stocktwits Users React?

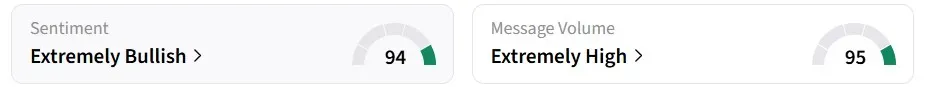

Despite the sharp premarket decline, retail sentiment on Stocktwits changed to ‘extremely bullish’ from ‘bullish’ a day back, accompanied by ‘extremely high’ message volumes. TVTX was among the top trending tickers on the platform at the time of writing.

One user said that the FDA’s request is ‘very common’.

However, one bearish user was skeptical about the timelines.

2026 Outlook

Travere Therapeutics provided an update on its sales outlook for the fourth quarter and full year 2025. The company expects U.S. net product sales of about $127 million in the fourth quarter (Q4) and about $410 million for the full year, based on preliminary and unaudited results. Travere ended 2025 with around $323 million in cash, cash equivalents, and marketable securities.

Clinically, the company plans to advance clinical evidence supporting FILSPARI as a foundational treatment for IgA nephropathy, also known as Berger’s disease, a chronic kidney ailment. Its partner, Chugai Pharmaceutical, is expected to submit a New Drug Application (NDA) for Sparsentan in Japan next year.

Meanwhile, the company is on track to restart Phase 3 HARMONY Study of Pegtibatinase in classical homocystinuria (HCU), a genetic metabolic disorder, in the first quarter of 2026 following manufacturing process improvements.

The stock has seen significant buying interest over the past year, gaining nearly 90%.

Read also: NVTS Stock Draws Retail Interest On AI Data Center Power Play

For updates and corrections, email newsroom[at]stocktwits[dot]com.<