- EBIT margin maintained between 17-18%

The IT giant’s order book swelled by 17% sequentially and 43% annually to $3 billion in the third quarter.

The attrition was at 12.4%, down from 12.6% in the previous quarter amd 13.2% in Q3 of last year.

Click here for more details.

HCL Technologies announced an interim dividend of Rs 12 for the third quarter of the FY26.

The record date for determining eligible shareholders for the payout is Jan. 16, and the amount will be paid to them on Jan. 27, as per the company’s exchange filing.

HCL Technologies Ltd.’s net profit fell sequentially in the third quarter of the current financial year due to a one-time impact of new labour codes.

The New Labour Codes resulted in an estimated one time increase in provision for employee benefits of Rs 956 crore, the statement said.

- Constant Currency (CC) Revenue up 4.2% QoQ & up 4.8% YoY

- Advanced AI Revenue at $146M, up 19.9% QoQ CC

- Q3 FY26 EBIT Margin includes 81 bps impact of restructuring cost

- TCV (New Deal wins) at $3,006M, up 17.0% QoQ & up 43.5% YoY

HCLTech Q3 Highlights (Cons, QoQ)

- Profit down 3.8% at Rs 4,076 crore versus Rs 4,235 crore

- Revenue up 6% at Rs 33,872 crore versus Rs 31,942 crore

- EBIT up 14.2% at Rs 6,285 crore versus Rs 5,502 crore

- EBIT Margin at 18.6% versus 17.2%

The net profit of the company was a major miss from Bloomberg analysts’ estimates. Profit went down to Rs 4,076 crore missing analyst estimate of Rs 4,702 crore by 13.3%.

An interim dividend of Rs. 12 per fully paid up equity share of Rs 2 each of the company has been declared, according to the regulatory filing.

HCLTech’s net profit for Q3 went down 3.8% to Rs 4,076 crore, compared to Rs 4,235 crore in the preceding quarter.

TCS’s annualised AI services revenue at $1.8 billion; up 17.3% QoQ in Constant Currency.

HCLTech Ltd. is expected to report stronger sequential growth in the December quarter, with margins seen expanding on the back of software seasonality, even as wage hikes and restructuring costs weigh on profitability. The company will announce its quarterly results on Monday.

Check full preview here.

Total headcount for TCS fell by 11,151 to 5,82,163 in Q3 from 5,93,314 in Q2.

TCS’s attrition rate marginally rose to 13.5% in the third quarter, compared to 13.3% in the previous quarter.

From Q1FY26 after the restructuring announcement, employee count down 30,906.

For more TCS updates click here.

Investors eyeing TCS’s bumper dividend should note that Jan. 17, 2026 is the record date for the same.

The third interim dividend and the special dividend shall be paid on Tuesday, Feb. 3, 2026 as per the regulatory filing.

TCS’s order book stood at $9..3 billion in the December quarter.

TCS’s attrition rate marginally rose to 13.3% in the third quarter, compared to 13% in the previous quarter

TCS says one-time provisioning of labour codes in Q3 at Rs 2,128 crore.

On November 21, 2025, the Government of India notified the four Labour Codes – the Code on Wages, 2019, the Industrial Relations Code, 2020, the Code on Social Security, 2020, and the Occupational Safety, Health and Working Conditions Code, 2020 – consolidating 29 existing labour laws.

- Revenue up 2.0% to Rs 67,087 crore versus Rs 65,799 crore

- Net Profit down 12% to Rs 10,657 crore versus Rs 12,075.00 crore

- EBIT up 2% to Rs 18,269 crore versus Rs 17,978 crore

- Margin flat at 25.2%

Tata Consultancy Services Ltd. posted a net profit of Rs 10,657 crore in the quarter ended December 2025, which marked a slump of 11.7% as against Rs 12,075 crore in the preceding quarter. The bottom-line has fallen short of the estimate of Rs 12,868 crore, as projected by the analysts tracked by Bloomberg.

Read More Here.

The IT giant declared two separate dividends: An interim dividend of Rs 11 and a special dividend of Rs 46.

In total, the company will be paying out Rs 57 in dividend.

- Net Profit at Rs 10,657 crore versus estimates of Rs 12,868 crore

- Revenue at Rs 67,087 Crore versus estimate of Rs 66,893 crore

- EBIT at Rs 16,889 crore versus estimate of Rs 16,659 crore

- EBIT margin at 25.2% versus estimate Of 24.9%

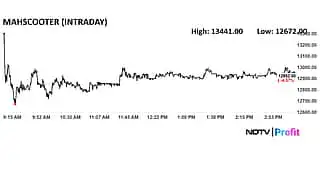

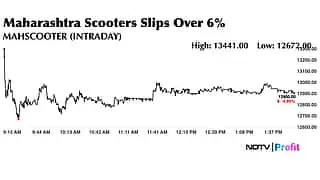

After falling 6.63% intraday, Maharashtra Scooters’ closed 4.57% at Rs 12,952 apiece.

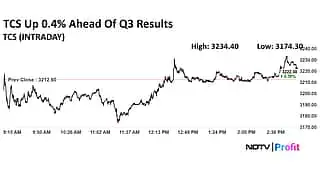

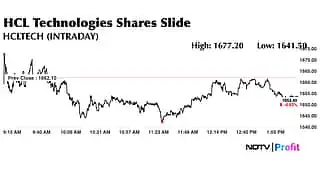

The shares of IT giants Tata Consultancy Services Ltd. and HCL Technologies Ltd. closed in the green on Monday ahead of their third quarter results.

The shares of IT giants Tata Consultancy Services Ltd. and HCL Technologies Ltd. closed in the green on Monday ahead of their third quarter results.

HCL Tech closed 0.33% higher at Rs 1667.60 apiece, while TCS closed 0.84% higher at Rs 3239.60 apiece.

TCS was trading 0.4% higher ahead of its results as of 3:13 p.m. The stock has fallen 24.39% in the last 12 months.

Analysts broadly agree that the December quarter remains seasonally weak for IT due to fewer billing days, but note that delays and deferrals have eased compared with previous years.

Analysts broadly agree that the December quarter remains seasonally weak for IT due to fewer billing days, but note that delays and deferrals have eased compared with previous years.

According to Investec, Tier-1 IT firms are likely to post sequential growth of 0.8%-2.4%, with HCLTech and Wipro among those expected to perform relatively better.

The brokerage also expects the lower end of guidance to be raised at Infosys and HCLTech, supported by stronger deal pipelines and momentum in artificial intelligence-led engagements.

- Expect 2.4% quarter-on-quarter growth in constant currency and 2.3% growth in US dollar terms.

- Growth driven by the products and platforms business, with services revenue growth of about 1% sequentially.

- Margins expected to improve by around 100 basis points due to software seasonality, partly offset by an estimated 80 basis point impact from wage hikes.

- Expect the lower end of services revenue growth guidance to be raised to 4.5%-5% from 4%-5%.

Shares of Bajaj-owned Maharashtra Scooters fell as much as 6.63% to Rs 12,672 in intraday trade on Monday, ahead of their Q3 results.

- December quarter likely to remain modest for IT services companies.

- Commentary from Accenture does not yet indicate a recovery in discretionary spending.

- Sector outlook remains cautious, though early signs of improvement are emerging.

- Prefers Infosys and HCLTech among large caps, and Persistent Systems and Mphasis among mid-tier firms.

Shares of HCL Technologies are currently trading 0.56% down at Rs 1,652.80 apiece ahead of their Q3 results.

While demand recovery remains uneven across geographies and verticals, brokerages expect management commentary to turn more constructive during the December quarter. Focus areas are likely to include deal pipelines, artificial intelligence-led engagements, and budget visibility for calendar year 2026. Margins may see support from foreign exchange movements, partly offset by furloughs in the quarter.

While demand recovery remains uneven across geographies and verticals, brokerages expect management commentary to turn more constructive during the December quarter. Focus areas are likely to include deal pipelines, artificial intelligence-led engagements, and budget visibility for calendar year 2026. Margins may see support from foreign exchange movements, partly offset by furloughs in the quarter.

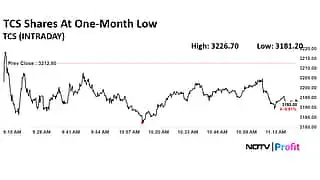

TCS shares hit one-month low ahead of its third quarter results that are to be announced later today. The scrip fell as much as 0.98% to Rs 3,181.20 apiece on Monday, lowest level since Dec. 11. It pared losses to trade 0.61% lower at Rs 3,193.10 apiece, as of 11:23 a.m. This compares to a 0.69% decline in the NSE Nifty 50 Index.

It has fallen 25.18% in the last 12 months and 0.43% year-to-date. Total traded volume so far in the day stood at 0.26 times its 30-day average. The relative strength index was at 41.87.

Track live market updates here.

GTPL Hathway reported a 12% YoY rise in total income to Rs 964.9 crore in Q2FY26 from Rs 862 crore in Q2FY25. Total expenditure grew 14% YoY to Rs 854.8 crore in Q2FY26 from Rs 748.2 crore in Q2FY25. Profit after tax declined 28% YoY to Rs 9.3 crore in Q2FY26 from Rs 12.9 crore in Q2FY25.

GTPL Hathway reported a 12% YoY rise in total income to Rs 964.9 crore in Q2FY26 from Rs 862 crore in Q2FY25. Total expenditure grew 14% YoY to Rs 854.8 crore in Q2FY26 from Rs 748.2 crore in Q2FY25. Profit after tax declined 28% YoY to Rs 9.3 crore in Q2FY26 from Rs 12.9 crore in Q2FY25.

- Revenue expected to grow 2.9% quarter-on-quarter in constant currency, driven by seasonality in the software business and partly offset by furloughs.

- Services segment expected to grow 1.0% sequentially, while the software segment may see sharp sequential growth.

- EBIT margin may expand by about 60 basis points, supported by high-margin software, offset by two months of wage hike impact and restructuring costs.

- Expects FY26 overall and services revenue growth guidance of 4%-5% and margin guidance of 17%-18% to be maintained.

- Focus areas include FY26 guidance revision, calendar year 2026 budgets, deal wins, discretionary spending, and the impact of the H-1B visa fee hike.

- Revenue seen 5% higher at Rs 33,262 crore versus Rs 31,820 crore

- EBIT seen 8% higher at Rs 6,020 crore versus 5,562 crore

- EBIT Margin seen at 18.09% versus 17.47%

- Profit seen 11% higher at Rs 4702 crore versus Rs 4244 crore

- Total throughtput rose 10.8% to 14 lakh TEUs annually.

Source: Exchange filing

TCS Q3 Preview (Bloomberg Estimates) (Consolidated, QoQ)

- Revenue 2% higher at 66,849 crore versus Rs 65,799 crore

- EBIT seen 8% higher at Rs 16,732 crore versus Rs 15,430 crore

- EBIT margin seen expanding to 25.02% versus 23.45%

- Profit seen 8% higher at Rs 13,006 crore versus Rs 12,075 crore

TCS reported a 2.4% year-on-year rise in revenue to Rs 65,799 crore in Q2 FY26 from Rs 64,259 crore.

Total expenditure grew 0.9% to Rs 49,234 crore, from Rs 48,794 crore in the same period in the previous financial year.

Net profit increased 8.36% to Rs 12,904 crore from Rs 11,909 crore in Q2 FY25.

Hello, and welcome to the first week of earnings of the December quarter with NDTV Profit!

Today, IT giants Tata Consultancy Services and HCL Technologies are in focus, as they gear up to kick off the Q3 earnings season. Stay tuned for all the updates.