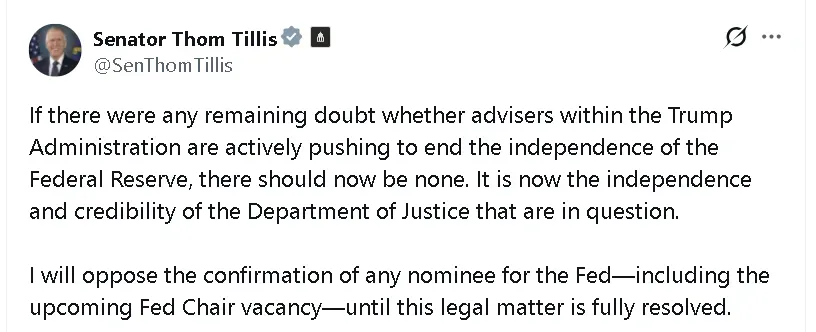

Sen. Thom Tillis said he will oppose any future nominee to the Fed “until this legal matter is fully resolved.”

- Futures linked to the equities market shook after the announcement, while precious metals and Bitcoin rallied.

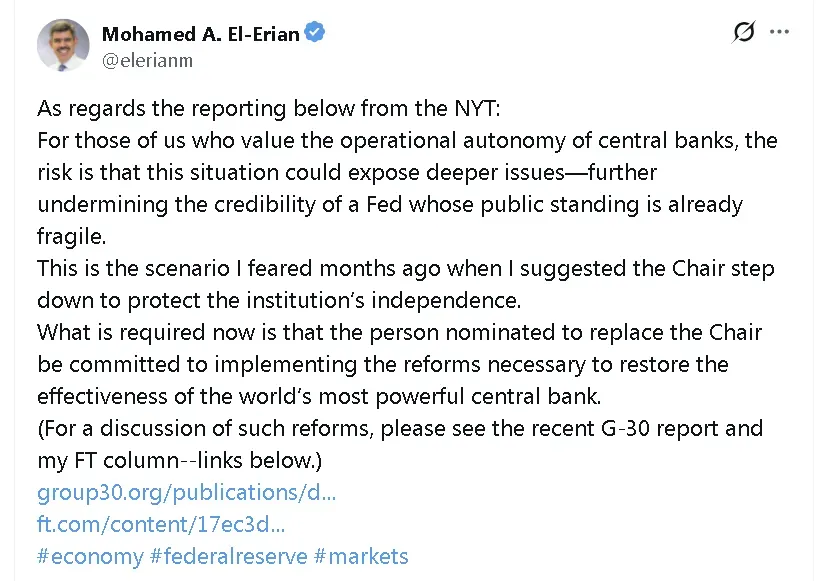

- Economist Mohammed El-Erian said the situation could “expose deeper issues” and further undermine the credibility of a central bank that was “already fragile.”

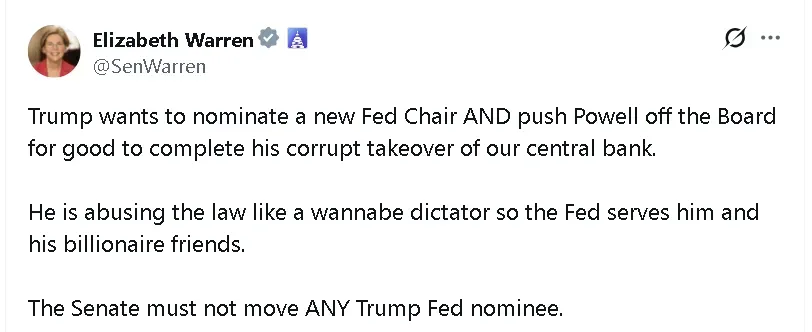

- Sen. Elizabeth Warren accused Trump of abusing the law and pushed for the Senate to move any Trump Fed nominee.

Federal Reserve Chair Jerome Powell confirmed reports of President Donald Trump’s subpoena on Sunday night, stating that the threat of criminal charges against him represents a direct challenge to the central bank’s ability to set interest rates free from political influence.

In a statement, Powell said the Department of Justice served the Federal Reserve with grand jury subpoenas on Friday, tied to testimony he gave before the Senate Banking Committee last June. That testimony addressed a multi-year renovation project involving historic Federal Reserve buildings. However, he believes those reasons are just “pretexts” to undermine the central bank’s independence.

“The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President,” Powell stated. “This is about whether the Fed will be able to continue to set interest rates based on evidence and economic conditions, or whether, instead, monetary policy will be directed by political pressure or intimidation.”

Senators Weigh In

Sen. Elizabeth Warren (D-Mass) accused Trump of abusing the law and pushed for the Senate to move any Trump Fed nominee.

Meanwhile, Sen. Thom Tillis (R-NC) also raised concerns, focusing on the Justice Department’s role in the dispute. “If there were any remaining doubt whether advisers within the Trump Administration are actively pushing to end the independence of the Federal Reserve, there should now be none,” Tillis said in an X post. He added that he would oppose confirmation of any Fed nominee until the legal matter is resolved.

Institutional Damage

Economists such as Mohammed El-Erian agree with Powell. In a post on X, the former Pimco CEO said the situation could “expose deeper issues” and further undermine the credibility of a central bank that was “already fragile.” He also noted that he had seen this coming months ago. At the time, he had suggested that the Fed Chair should step down to protect the institution’s independence.

“What is required now is that the person nominated to replace the Chair be committed to implementing the reforms necessary to restore the effectiveness of the world’s most powerful central bank,” he wrote.

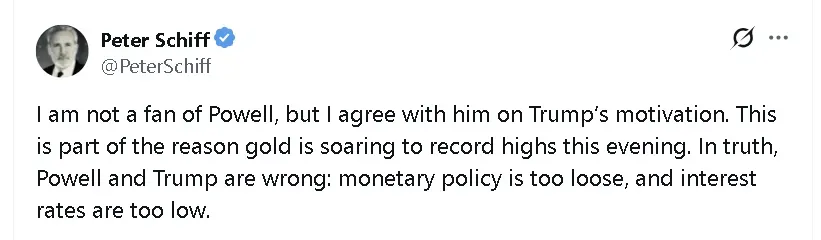

Others, like gold bull Peter Schiff, believe neither Trump nor Powell is correct. According to him, the situation highlights broader issues with the U.S. monetary policy. “Monetary policy is too loose, and interest rates are too low,” he wrote in a post on X. Schiff added that while he’s not a fan of Powell, he agrees with the Chair about Trump’s motivation.

Gold And Crypto Rally While Equities Take Blows

Stock market futures fell over 0.5% on Powell’s comments. The subpoena also comes as the Fed is expected to pause rate cuts again on January 28th. The CME Group’s Fed Watch Tool showed a 95% probability of rates staying the same. Powell has taken a stand on the Fed’s independence with six months remaining in his tenure at the helm.

While fallout between the White House and the Fed pressured equity markets, precious metals and crypto rallied on the uncertainty. SPDR Gold Shares ETF (GLD) and Bitcoin (BTC) were among the top trending tickers on Stocktwits at the time of writing. Gold’s price reached a record high of over $4,600 per ounce before paring gains to around $4,570 on Sunday night. However, retail sentiment around GLD fell to ‘bearish’ from ‘neutral’ over the past day as chatter dipped to ‘low’ from ‘normal’ levels.

Bitcoin’s price gained 1.4% in the last 24 hours to trade just under $92,000. Retail sentiment around the apex cryptocurrency remained in ‘bullish’ territory over the past day, with chatter at ‘normal’ levels.

Powell, who has served under four administrations from both parties, said he intends to continue carrying out his duties without political influence. “Public service sometimes requires standing firm in the face of threats,” he said. “I will continue to do the job the Senate confirmed me to do, with integrity and a commitment to serving the American people.”

Read also: S&P 500, Nasdaq Futures Dip As Powell Subpoena, Iran Risks Threaten To Hijack Earnings Week

For updates and corrections, email newsroom[at]stocktwits[dot]com.<