Foldable smartphones have been touted as the next big thing in mobile innovation, offering designs that are futuristic, versatile, and undeniably eye-catching.

Yet Apple, known for its disruptive impact on tech trends, has so far opted to stay out of this evolving market.

Judging by recent data from , Apple’s decision might have been a calculated move that pays off in the long run.

Foldable Market Trends: The Numbers Speak

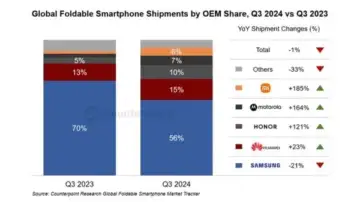

For the first time in its history, the foldable smartphone market saw a 1% year-over-year (YoY) decline in Q3 2024, after six consecutive quarters of growth. This marks a significant moment in the segment, signaling that the initial excitement around foldables may be hitting a plateau. Samsung, the global leader, retained a dominant 56% market share but faced a 21% YoY drop in shipments. Even its much-hyped Galaxy Z6 series fell short of expectations, with the Z Flip 6, in particular, struggling to match its predecessor’s sales.

Meanwhile, other brands like Xiaomi, Motorola, and HONOR reported notable growth. Xiaomi saw a staggering 185% YoY increase in shipments, thanks to its clamshell Mix Flip and expansion into markets outside China. Huawei continued its stronghold in China, buoyed by models like the Mate X5 and Pocket 2, though experimental designs like the Mate XT tri-fold saw lukewarm reception.

Despite these bright spots, the overall decline suggests that the foldable segment is grappling with high prices, limited accessibility, and competition from traditional flagship phones.

Competitive Dynamics in the Foldable Space

The foldable market is no longer Samsung’s playground. In China, where Samsung holds just 8% market share, Huawei dominates with models like the Mate X5. In North America, Motorola is gaining traction with its sub-$1,000 Razr flip phones, while HONOR’s slim Magic V book-type foldables are appealing to Western European consumers.

Why Apple Might Be Hesitant

Apple’s approach to new technologies is often marked by caution. The company has historically avoided being the first mover, opting instead to refine and perfect innovations before introducing them to the market. Here are a few factors that might be influencing Apple’s foldable strategy:

- Market Readiness: Foldables, while innovative, are still a niche market. Despite their potential, foldables represent a small fraction of global smartphone sales. The high price tags, durability concerns, and mixed consumer reception suggest that foldables haven’t yet reached mainstream adoption. Apple may be waiting for these challenges to stabilize before diving in.

- Durability Issues: Apple has built its reputation on delivering high-quality, reliable products. Current foldables face issues like screen creases, hinge durability, and long-term reliability. Apple likely wouldn’t release a foldable iPhone until it could overcome these challenges and ensure a seamless user experience.

- High Prices: With many foldables starting at over $1,000, affordability remains a major barrier. Apple might be assessing whether consumers are ready to embrace foldables at scale-or if they’d be better off sticking to traditional premium designs for now.

- Ecosystem Considerations: Apple thrives on its tightly integrated ecosystem. Any foldable device they launch would need to fit perfectly into this ecosystem, offering unique functionality that complements the iPhone, iPad, and Mac.

The Bigger Picture

The foldable market is clearly at a transitional stage. While brands like Samsung continue to dominate, their recent shipment declines highlight the growing competition and challenges in sustaining interest. Meanwhile, brands like Xiaomi and HONOR are pushing the boundaries of affordability and design, which could pave the way for broader adoption.

For Apple, the decision to enter-or delay entry-into this market is likely a calculated one. Whether they’re holding back intentionally or simply haven’t finalized a foldable product yet, one thing is certain: if Apple does step into the foldable game, they’ll do so on their terms.