Initial public offerings (IPOs) were a defining theme for the Indian startup ecosystem in 2025, with 18 startups making their public market debuts.

While these , their investors like Peak XV, Tiger Global, Y Combinator, among others, minted hefty returns on their bets on startups like Groww, Meesho and Lenskart.

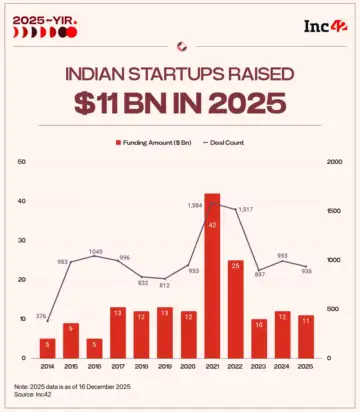

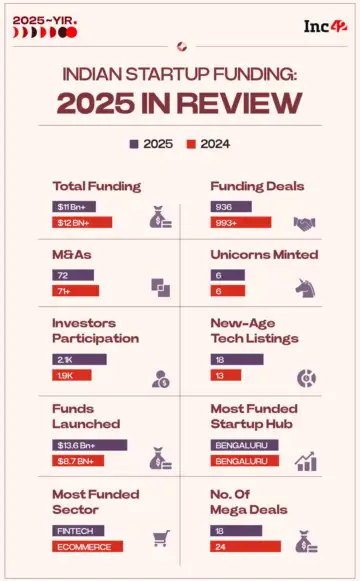

Amid all these, the private fund infusion in the Indian startup ecosystem stabilised in 2025. According to Inc42’s “Annual Indian Startup Trends Report, 2025”, Indian Startups cumulatively raised $11 Bn across 936+ deals during the year. While this figure represents an 8% decline from the $12 Bn raised across 993 deals in 2024, it needs to be viewed alongside the IPO spring. For context, Indian startup funding stood at $10 Bn in 2023 amid the funding winter.

However, private funding numbers are still a far cry from the $42 Bn raised across 1,584 deals in 2021. It is also less than half of the $25 Bn raised across 1,517 deals in 2022. It is pertinent to mention that investors, in the past, have described 2021 and 2022 as aberrations, adding that the funding activity seen after the peak years represents the new normal.

According to YourNest Venture Capital’s venture partner Ranjeet Shetye, total funding remained steady but disciplined this year. “What changed was the quality of capital. Domestic funds, family offices, and corporate investors played a much larger role this year,” he noted.

The thesis that the Indian startup funding ecosystem has entered a structurally different phase in 2025, moving beyond the era where scale narratives and population-led opportunity alone could unlock capital, is echoed throughout the industry.

The overall funding volumes appear muted compared to peak years, as investors have become much more selective. This shift is being supported by a maturing entrepreneurial ecosystem, rather than cyclical capital flows alone. Improved internet access, wider distribution of technical talent beyond metros, better institutional education and the rise of structured incubators and research-linked centres across India have expanded the pipeline of investable founders and ideas.

“The funding ecosystem itself is growing. Every wealthy individual now has a ‘family office,’ and there’s a global rush into VC/PE. Stocks and bonds are boring; private investing is popular among the wealthy. While there’s stupidity, it’s still net positive,” Zerodha’s Nithin Kamath said in a post on LinkedIn recently.

So, let’s take a deep dive into the key startup funding trends this year.

Growth Stage Funding Rises, Late & Seed Stage Take A Hit

With many mature startups now raising capital from the public markets, private funding at the late stage declined 14% YoY to $6 Bn across 122 deals in 2025. Startups at this stage had raised over $7 Bn across 150 deals last year.

While the number of late stage deals declined by more than 19% YoY this year, the median ticket size improved 13% YoY to $27 Mn this year.

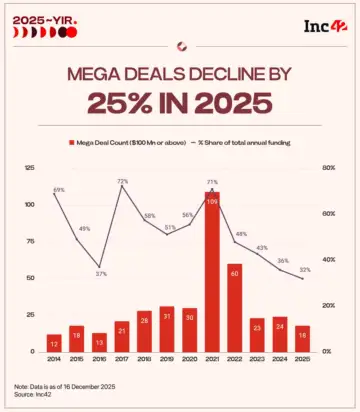

The fall in late stage funding was primarily due to a decline in the number of mega funding deals this year. Funding deals of over $100 Mn declined 25% YoY to 18 this year. This represented a 92% crash from 2021’s peak of 109 deals.

Zepto , InMobi , and MoEngage were among the startups which saw mega deals this year.

Despite the decline in total capital infusion at the late stage, the number of late stage startups that . Jumbotail, Fireflies AI, Drools, Porter, Netradyne and Dhan saw their valuations zoom past the $1 Bn mark this year. At the end of the year, 126 unicorn startups called India their home.

One of the reasons for the decline in late stage capital infusion was marquee investors such as SoftBank and Tiger Global pulling back their India investments in recent years. In 2025, the two investors made zero investments in India.

However, this is expected to change soon. SoftBank India’s managing partner Sumer Juneja recently told ET that the investment firm is looking to make a significant return to India’s tech scene. It will focus on AI-driven investments from 2026 and look to write smaller, strategic cheques in the next growth cycle.

While late stage focussed investors took a back seat this year, early and growth stage investors like Peak XV Partners, Accel, and Kalaari Capital were active this year.

As a result, growth stage funding rose 14% to $4 Bn across 269 deals in 2025 from $3.5 Bn raised across 287 deals last year.

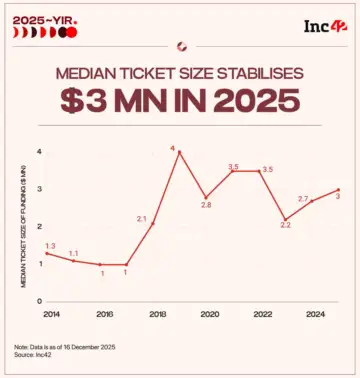

Similar to late stage investments, the median ticket size for growth stage grew 13% YoY to $9 Mn. Overall, media ticket size across stages improved by 11% YoY to $3 Mn.

Meanwhile, seed stage funding saw a decline, with early stage startups raising $793 Mn, down 12% YoY, across 433 deals in 2025. The decline signalled increasing investor selectivity, with capital being deployed into fewer early stage startups.

At the same time, sectors such as AI, deeptech, climate tech, space, defence, biotech and advanced manufacturing – where long-term, asymmetric returns remain plausible – attracted a larger share of funding this year.

Fintech, Enterprise Tech, Ecommerce Remain Top Capital Magnets

With over $2.5 Bn raised across 120 deals, fintech continued to lead sectoral investments this year. The total funding raised by fintech startups in 2025 was almost unchanged from 2024. However, the number of deals fell 42% YoY to 120.

Enterprise tech retained its second spot, with startups in the segment raising $1.8 Bn this year. However, the deal count halved YoY to 82 this year. Ecommerce funding remained steady at $1.7 Bn in the year, with the sector witnessing the highest number of deals at 206.

It is pertinent to note that these three sectors together account for 30 of the 56 new-age tech companies that have gone public, 28 of the 44 planned IPOs, and 50% of acquisitions in 2025.

Meanwhile, investments in AI and deeptech stood out this year. Advanced hardware and technology (deeptech), real estate tech, and AI sectors saw a capital infusion of about $500 Mn this year each. While investment volumes in these sectors were lower than those in healthtech ($700 Mn), consumer services ($700 Mn) and cleantech ($600 Mn), they entered the top 10 funded sectors for the first time.

Besides, the deeptech segment recorded the third-highest deal count at 87 during the year. This was more apparent when looking at funding trends at the seed stage level. In 2025, AI and advanced hardware and technology dominated seed stage funding, with startups in this segment securing the highest $161 Mn and $108 Mn, respectively.

Funding for the deeptech sector is expected to go up in the near future, in line with the government’s push. In 2025, Union minister Piyush Goyal announced significant government initiatives for deep tech funding, including committing a substantial part of the Startup Fund of Funds (INR 10,000 Cr) exclusively to deeptech startups and the launch of INR 1 Lakh Cr Anusandhan Fund for long-tenure R&D.

As a result, VC firms are showing heightened interest in the deeptech sector. The likes of 888VC, Riceberg Ventures, and Chiratae Ventures launched new funds for the deeptech sector this year.

“India has done a fantastic job over the last 10 years in emerging as one of the frontiers of deeptech innovation. The next challenge is scaling – moving from feasibility to viability,” Speciale Invest’s general partner Vijay Jacob said at the launch of the firm’s INR 1,400 Cr deeptech fund earlier this month.

Bengaluru, Delhi Continue To Lead Funding Charts

India’s Silicon Valley Bengaluru continued to be at the forefront of the country’s startup boom this year. Startups in the city bagged $4.5 Bn across 300 deals this year, up 33% from $3.4 Bn raised across 285 deals in 2024.

Notably, Mumbai overtook Bengaluru to become the most funded startup hub last year on the back of Zepto’s over $1 Bn fundraise across three tranches. Later, Zepto shifted base to Bengaluru and raised $450 Mn this year.

Mumbai’s total funding slid to $2 Bn across 146 deals in 2025, taking it to the third spot in terms of startup funding. Delhi NCR moved up to the second spot, with startups in the city raising $2.2 Bn across 224 deals this year.