Bank of America reiterated a ‘Buy’ rating on Nvidia and maintained a price target of $275 on the company’s shares, as per TheFly.

- The analyst also noted that Groq’s language processing unit is a different kind of hardware compared to Nvidia’s graphics processing units.

- BofA also compared the latest deal to the company’s 2019 acquisition of Mellanox, which now serves as the foundation of Nvidia’s networking “scaling moat.”

- Baird has also reiterated an ‘Outperform’ rating on the stock with a price target of $275, calling the deal in line with Nvidia’s push into AI inferencing.

Bank of America (BofA) believes Nvidia’s (NVDA) recent non-exclusive licensing agreement with Groq is strategic, even if a bit pricey.

The analyst said that Groq’s language processing unit is a different kind of hardware than Nvidia’s “well-regarded” graphics processing units, as per TheFly. BofA also cited similarities to Nvidia’s 2019 acquisition of Israeli chip designer Mellanox, which now forms the foundation of the American chipmaker’s networking “scaling moat.”

BofA maintained a ‘Buy’ rating on Nvidia, with a price target of $275 on the company’s shares.

The Groq Deal

On Wednesday, AI startup Groq announced in a blog post that it was entering into a non-exclusive licensing agreement with Nvidia for its inference technology. While the company did not disclose a price, a later report from CNBC pegged the deal value at $20 billion.

As per the deal, Nvidia will onboard Groq’s senior management team, including founder Jonathan Ross and President Sunny Madra ,to assist with advancing and scaling the licensed technology.

If structured as reported, the latest agreement will mark Nvidia’s largest deal to date, surpassing its $6.9 billion Mellanox acquisition in 2019, which helped advance the company’s high-performance computing capabilities and acquire end-to-end technologies.

Earlier, Baird said Nvidia’s deal with Groq is in line with the company’s push into AI inferencing and reiterated its ‘Outperform’ rating on the stock while maintaining a price target of $275.

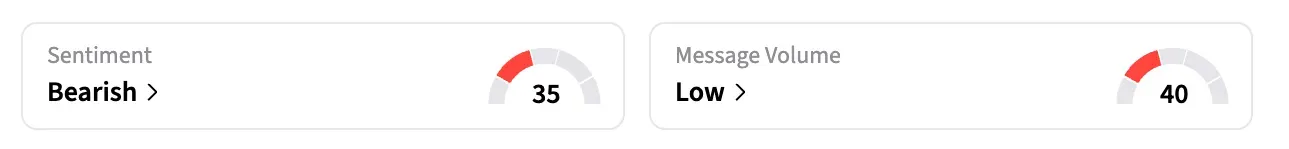

What Are Stocktwits Users Saying?

On Stocktwits, retail sentiment around NVDA stock has remained in the ‘bearish’ territory over the past 24 hours, and message volume stayed at ‘low’ levels. The ticker was top-trending on Stocktwits at the time of writing.

One user noted that the reiteration of price targets for Nvidia by several banks could be a sign that institutions are buying the company’s shares again.

Shares of NVDA are up over 36% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

Also Read: Does Nvidia’s Groq Licensing Mega-Deal Expose A Quiet Weak Spot In Its AI Chip Empire?