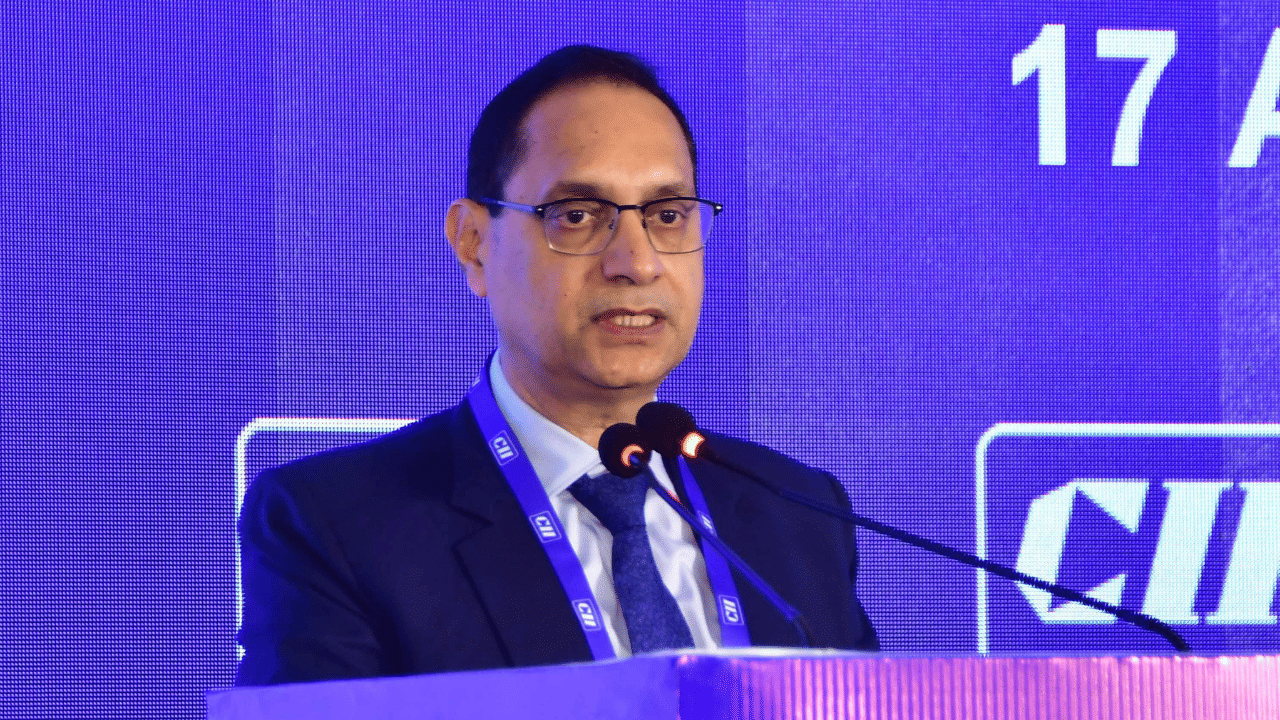

New Delhi: SEBI is planning to come up with additional incentives in order to help and encourage the first-time female investors to participate in the mutual funds, said SEBI Chairman Tuhin Kanta Pandey on Friday.

“Financial inclusion will remain incomplete unless women are equally represented,” said Pandey while speaking at an event organised by the Association of Mutual Funds in India (AMFI).

“We are thus also envisaging to introduce an additional distribution incentive for investments from first-time women investors,” he added further.

Incentives for First-Time Women investors in B30 Cities

He said that SEBI is taking a slew of measures to facilitate and encourage the industry, and one such proposal is to incentivise the distributors for investment from first-time individual investors in B30 cities, which comprise tier 2 and tier 3 cities.

The move is set to bring new investors into the mainstream equity market while simultaneously extending the reach of mutual fund into underrepresented and underserved regions, which will therefore contribute to financial inclusion.

Additionally, to address legacy issues of the mutual fund industry, such as overlap in the portfolio schemes, SEBI is reviewing the categorisation of mutual fund schemes.

He further said that based on the feedback from various industry stakeholders and from the consultation process, further steps will be taken.

“These measures are expected to facilitate the industry to become more transparent and investor-friendly,” the Sebi chairman said.

Lately, SEBI has reviewed reports and filings submitted by mutual funds in order to promote ease of doing business measures and to streamline the compliance process.

Based on the review, the regulator has decided to discontinue the requirement of filing over 52 reports, notices, and addendums with it by the asset management companies (AMCs).

SEBI’s Future Roadmap

The future roadmap of SEBI includes the regulator working towards a comprehensive simplification of mutual fund regulations. The end goal is to ease the compliance burden for the industry players while continuing to safeguard the investor interest, said Pandey.