New Delhi: The Delhi High Court addressed a Public Interest Litigation (PIL) over air purifiers to grant exemption from taxes and directed the GST Council to reduce or abolish the GST on air purifiers, citing air quality in the national capital in the emergency situation, when the air quality Index (AQI) is ‘severe.’

In the PIL, an air purifier was classified as a ‘medical device.’

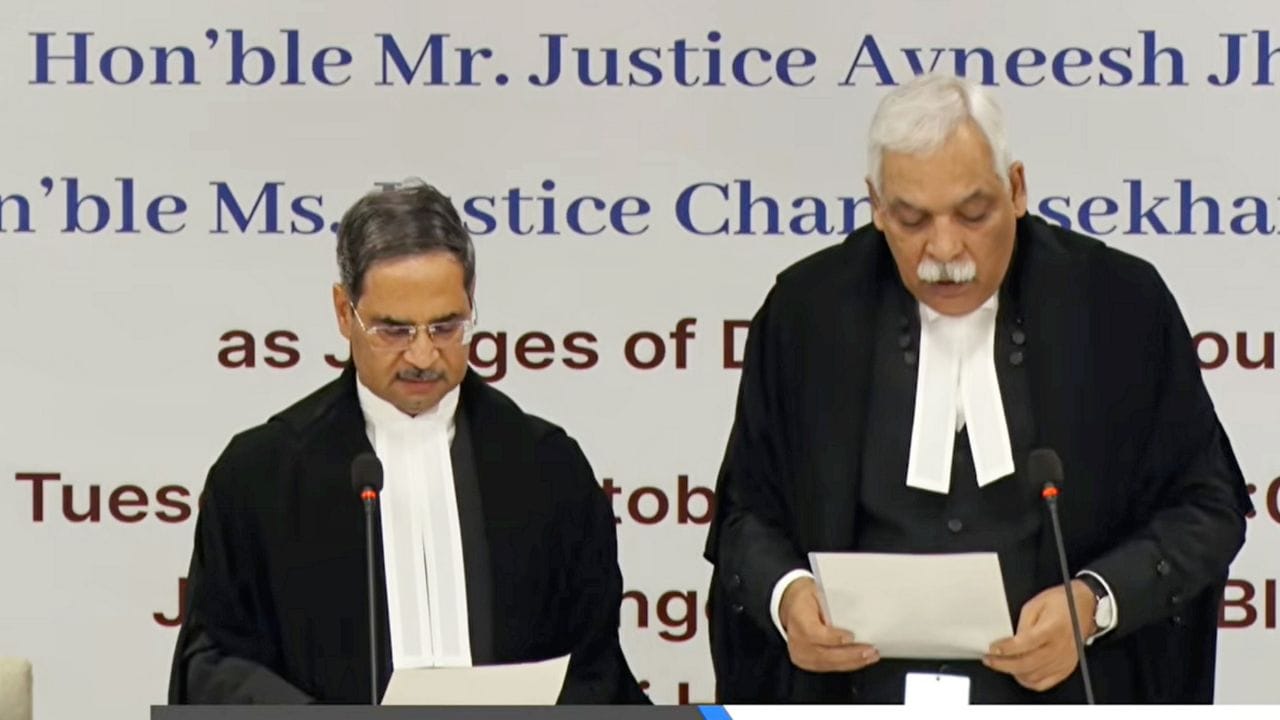

A bench of Chief Justice Devendra Kumar Upadhyaya and Justice Tushar Rao Gedela slammed the authorities, saying that nothing has been done till now in the matter. The Bench added that every citizen requires fresh air, and the authorities haven’t stepped up to provide any help to the residents.

“Let the purifiers be provided. That’s the minimum you can do. When will you come back?…. Even if it is… temporary, give exemption for next one week or one month… Consider this an emergency situation, only for temporarily. Take instructions and come back,” the bench stated.

“We will place it before the vacation bench only for compliance. As we speak, we all breathe. You know how many times we breathe in a day, at least 21,000 times a day. Just calculate the harm you are doing to your lungs just by breathing 21,000 times a day, and that’s involuntary,” the bench added.

Advocate Kapil Madan filed the petition and stated that air purifiers cannot be treated as a luxury item in the extreme emergency crisis caused by air pollution in the national capital.

“Imposition of GST at the highest slab upon air-purifiers, a device that has become indispensable for securing minimally safe indoor air, renders such equipment financially inaccessible to large segments of the population and thereby inflicts an arbitrary, unreasonable, and constitutionally impermissible burden,” the plea added.

Currently, air purifiers are in the 18% GST slab, and the petition urged the panel to put purifiers in the 5% slab so that everybody can afford the medical device in an emergency situation.