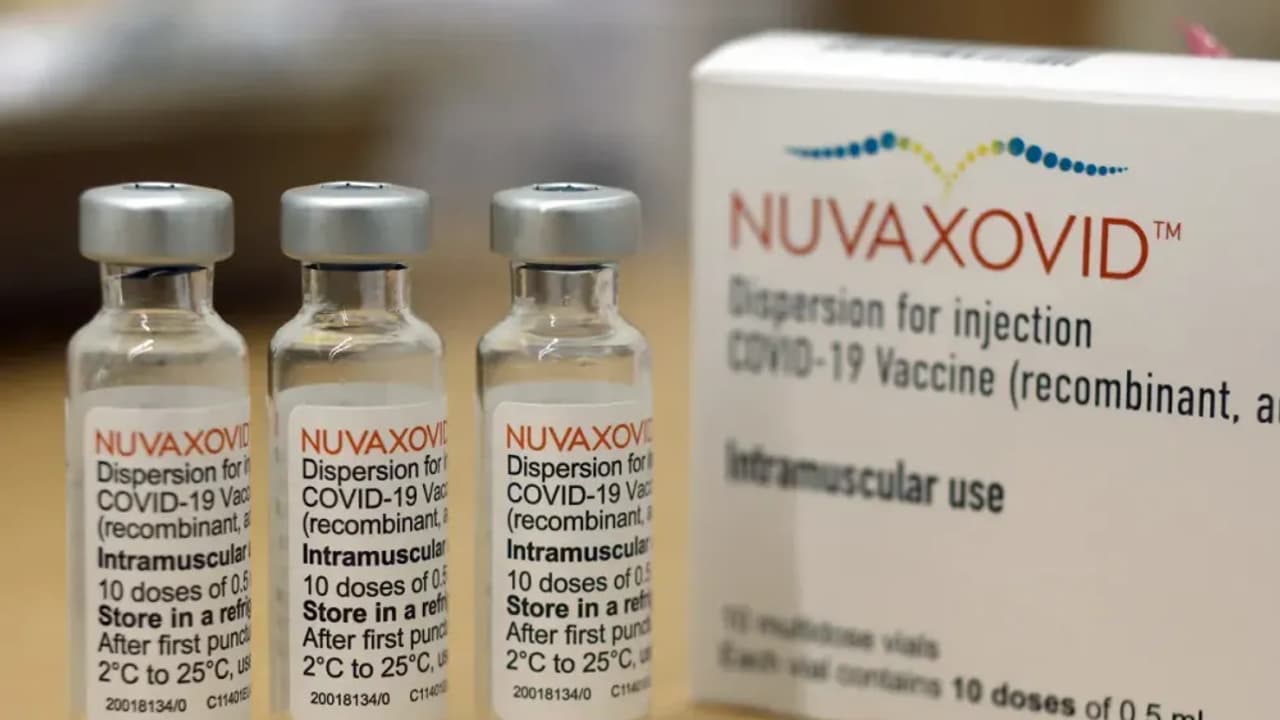

Bank of America’s downgrade to ‘Underperform’ with a $7 target deepened concerns over Sanofi’s limited commercialization of Nuvaxovid and higher hurdles for future partnerships.

Novavax slid Thursday in its worst session in more than four months after laying out plans to refinance $225 million of debt, a move that piled onto fresh concerns from a Bank of America downgrade and ongoing uncertainty around its COVID-19 vaccine business.

The company said it worked out agreements with some of the holders of its 2027 convertible notes and new investors to replace them with new notes maturing in 2031.

The deal covers about $175 million of new 2031 notes swapped for $148.7 million of existing 2027 notes, along with $50 million in fresh cash.

The new notes can be converted at $11.14 a share, marking a 27.5% premium to Wednesday’s close, and are expected to be completed by Aug. 27, leaving just $26.5 million of the 2027 notes still outstanding.

Novavax said the refinancing strengthens its balance sheet by pushing most debt out to 2031, but investors worried about fresh funding needs and share dilution, fueling the selloff.

The drop came a day after Bank of America cut its rating to ‘Underperform’ from ‘Neutral’ and lowered its price target to $7 from $9, warning of an “increasingly murky outlook” for growth.

The bank argued that Sanofi’s commercialization of the Nuvaxovid vaccine in the U.S. may face limits with a restricted label and fading demand for COVID shots even as new FDA rules could make future partnerships more expensive and harder to secure.

Novavax reassured investors earlier this month, saying a postmarketing study requested by the FDA for Nuvaxovid won’t affect its 2025 operating profit because Sanofi is covering most of the cost.

CFO Jim Kelly said Sanofi is “picking up the vast majority of expenses.” The study, expected to run through 2025 and 2026, will cost an estimated $70 million to $90 million, with Sanofi reimbursing about 70%.

On Stocktwits, retail sentiment toward Novavax was bullish with high message volume, placing it among the platform’s top-trending stocks.

One retail trader on Stocktwits argued there was nothing fundamentally wrong with Novavax securing $50 million in fresh funding and refinancing its debt at a lower rate.

The user added that partnership news was always the real potential catalyst and said the pullback into the $7 range should not have come as a surprise, given the spike seen earlier this week.

Another user said they were holding firm, noting they had not sold a single share of Novavax and continue to own 35,000 shares.

Novavax’s stock has declined 5.1% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<