Heading into 2026, record electricity demand across the U.S. utility landscape is being driven by rising electrification and AI-fueled growth in data center power consumption.

With 2025 drawing to a close, the U.S. utility sector is at a critical juncture marked by rising demand, grid modernization, and the ongoing energy transition.

Heading into 2026, record electricity demand across the U.S. utility landscape is being driven by rising electrification and AI-fueled growth in data center power consumption.

Unprecedented capital spending plans, acquisitions, and grid upgrades are pushing utilities to transition away from traditional defensive yield profiles toward more growth-oriented infrastructure investments, even as regulatory and competitive challenges persist.

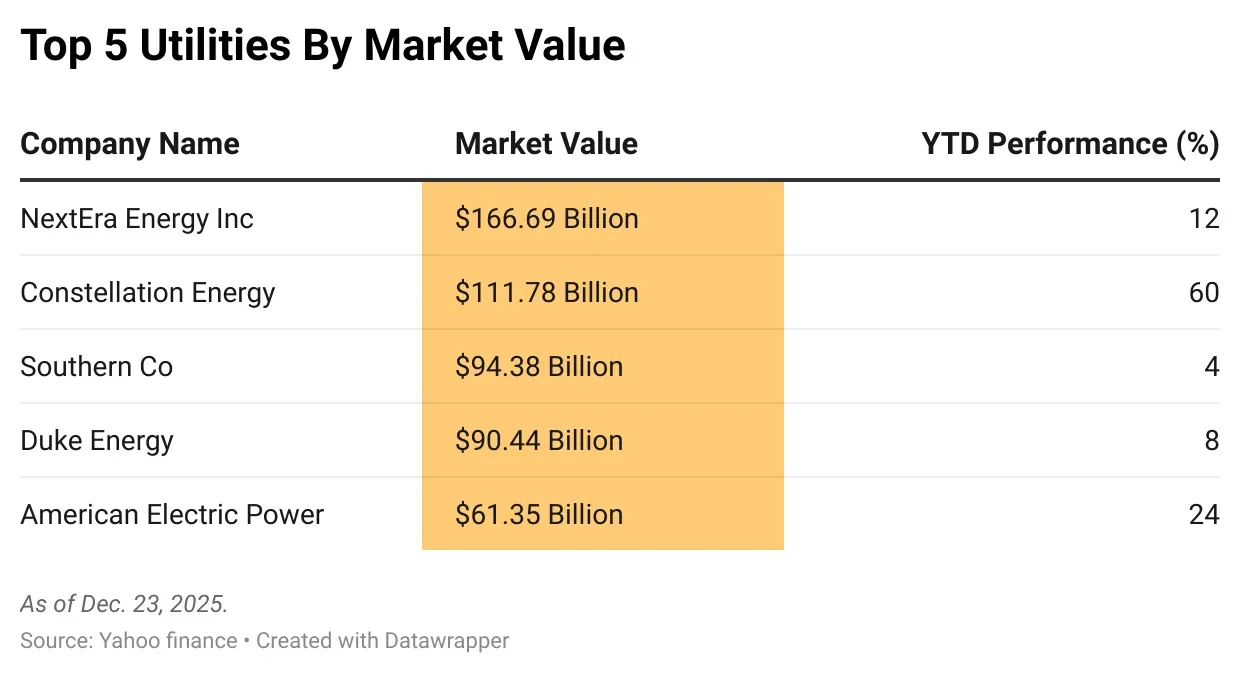

Stocktwits takes a look at the top five U.S. utilities by market value:

NextEra Energy Inc.

Market Value: $166.69 Billion

YTD Performance: 11.7%

NextEra Energy, Inc. is the largest electric utility holding company in America by market value, providing regulated power distribution through subsidiaries such as Florida Power & Light and clean energy generation through NextEra Energy Resources. The company supplies electricity and develops renewable and conventional energy generation throughout the United States and Canada.

NextEra Energy is slated to build 15 gigawatts (GW) of power for data center hubs by 2035 to support increased gas origination.

The company has continued to build out its energy portfolio, partnering with technology firms like Alphabet’s Google on significant projects and increasing capital investment to support load growth. However, broader grid and regulatory challenges persist as power demand accelerates into 2026.

Constellation Energy

Market Value: $111.78 Billion

YTD Performance: 60%

Constellation Energy Corp. is a leading U.S. clean energy company that provides electric power, natural gas services, and energy management solutions to approximately two million customers. It has operated as an independent public company since 2022 following its separation from its former parent and owns competitive generation assets, including nuclear and gas plants.

In December, Constellation Energy reached a settlement with the U.S. Department of Justice that would allow it to complete its $16.4 billion acquisition of Calpine Corporation, one of the largest power-sector transactions of the year, provided the merger preserves competition in wholesale power markets.

Southern Co

Market Value: $94.38 Billion

YTD Performance: 4.1%

Southern Company is among the leading U.S. gas and electric utility holding companies, serving millions of customers across the southeastern United States through subsidiaries focused on power generation, transmission, and distribution.

Southern Co topped third-quarter profit estimates as electricity demand surged, partly driven by commercial and industrial users. The company has significantly increased its capital expenditure plans to upgrade infrastructure and add capacity to keep pace with growing load demand. The company has said it projects continued demand growth of around 8% annually through 2029, reflecting higher data center load and residential expansion.

Duke Energy

Market Value: $90.44 Billion

YTD Performance: 8%

Duke Energy is a major U.S. electric power and natural gas holding company headquartered in Charlotte, North Carolina. The company serves millions of customers across several states and is engaged in the generation, transmission, and distribution of electricity and natural gas.

The company has asked regulators to approve the consolidation of its two largest Carolina utilities into a single entity, aiming to streamline operations and generate more than $1 billion in customer cost savings over the next decade. Meanwhile, heavy capital spending on grid upgrades and electrification continues to pressure balance sheets.

American Electric Power

Market Value: $61.35 Billion

YTD Performance: 24.3%

American Electric Power is one of the largest electric utilities in the United States, operating one of the nation’s largest transmission systems and providing generation, transmission, and distribution services across an 11-state region.

The company projected a system peak demand of 65 gigawatts within its service territory by 2030, especially in Indiana, Ohio, Oklahoma, and Texas. It also expects a long-term operating earnings growth rate of 7% to 9% for 2026 to 2030.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<