Retail sentiment on Stocktwits around the token has strengthened even as AAVE’s new governance proposal sparked controversy.

- Stani Kulechov purchased 32,660 AAVE worth about $5.15 million, lifting his total accumulation over the past week to more than 84,000 tokens.

- Kulechov’s recent purchases have left him with a $2.2 million unrealized loss based on current prices.

- The purchases come during a sensitive period for Aave’s governance following the closure of its U.S. SEC investigation.

Aave (AAVE) founder Stani Kulechov added to his holdings of the protocol’s native token this week, purchasing another 32,660 AAVE worth about $5.15 million on Monday amid community backlash over the control of brand assets.

According to data on Arkham Intelligence, the buy brings his week-long accumulation to 84,033 tokens valued at roughly $12.6 million. Data also showed Kulechov is currently sitting on an unrealized loss of about $2.2 million across the recent buys.

The purchases come amid a prolonged slide in AAVE’s price. The token fell more than 5% over the past 24 hours to around $152.66, extending losses of more than 7% over the past month and over 50% in the past year. On Stocktwits, retail sentiment around the altcoin rose to ‘extremely bullish’ from ‘bullish’ over the past day, as chatter rose to ‘extremely high’ from ‘high’ levels.

Aave’s Focus On Growth After SEC Probe Shuts Down

Kulechov’s accumulation coincides with a turbulent period for Aave’s governance. The protocol is attempting to refocus on longer-term growth plans for 2026 following the closure of the U.S. Securities and Exchange Commission (SEC) investigation into whether any securities laws were violated. The probe was closed last week with no enforcement action.

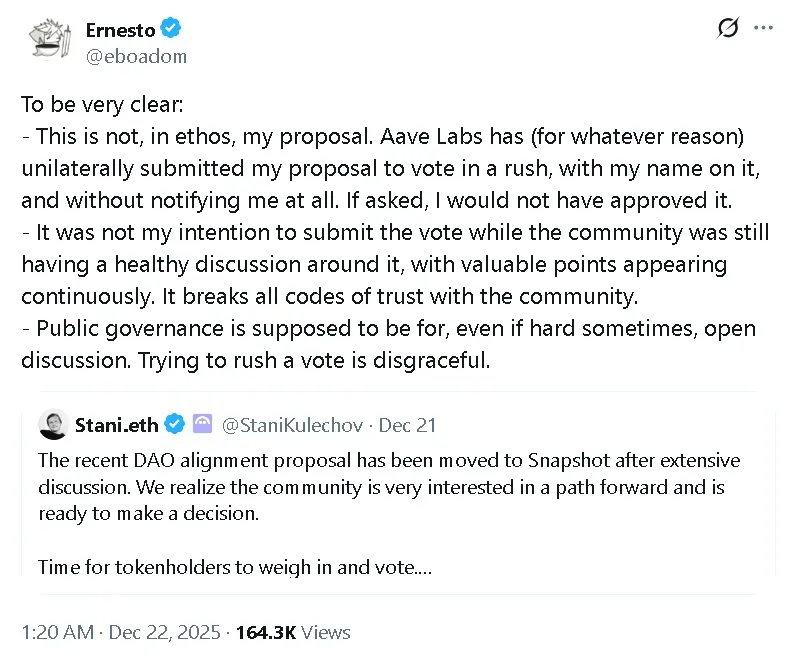

Following the closure, a governance vote was launched on the Snapshot platform that had led to community unrest. The proposal centers on transferring control of Aave’s brand assets, including domain names, social media accounts, naming rights, and other identity elements, to a legal vehicle controlled by the DAO.

Governance Vote Sparks Internal Pushback

Kulechov defended the decision to move the proposal to a vote, saying in a post that “the community is very interested in a way forward and is ready to make a decision.” He added that the discussion had reached a point where voting was appropriate.

The move drew immediate criticism from Ernesto Boado, the former chief technology officer of Aave Labs, whose name appears as the proposal’s author. On X, Boado said “this is not, in spirit, my proposal,” adding that he would “never have approved its submission to vote while community discussion was still ongoing.”

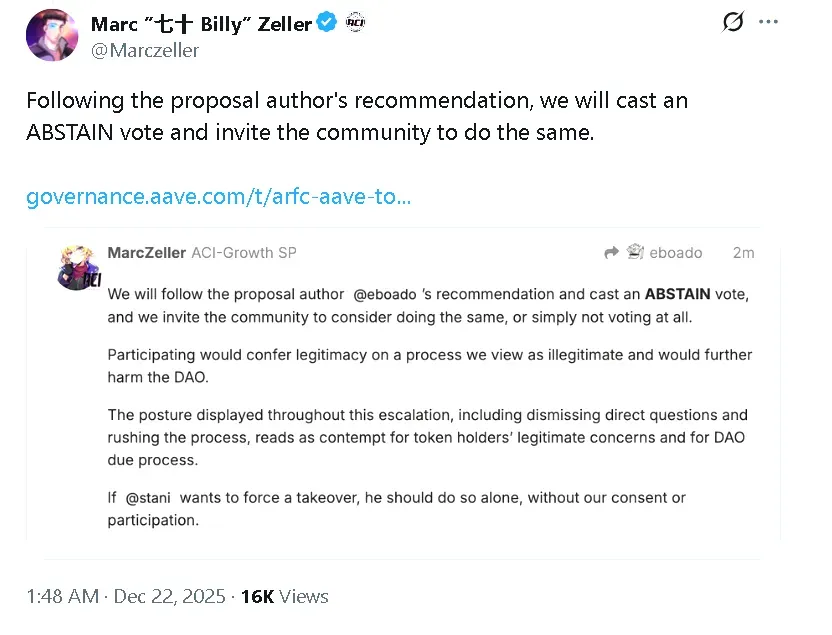

Criticism extended beyond the proposal’s origin to the process used to advance it. Marc Zeller, a prominent figure in the Aave ecosystem through the Aave Chan Initiative, described the move as a “unilateral escalation,” arguing that key questions raised by delegates and token holders remained unresolved.

Zeller also questioned the timing of the vote, noting that it was initiated during a period when “major stakeholders, investors and institutions are less active.” He said this reduced participation risked limiting the diversity of viewpoints expressed in the decision-making process.

Even as governance tensions persist, Aave continues to push product development. The protocol recently launched a public savings application offering yields of up to 9% APY, part of a broader effort to bolster user engagement and reinforce its position within decentralized finance.

Read also: Bitcoin’s Price Dip Sparks Biggest Corporate Buying Spree Since July As ETP Investors Pulled Back

For updates and corrections, email newsroom[at]stocktwits[dot]com.<