Markets regulator Sebi chairperson Tuhin Kanta Pandey on Thursday proposed the creation of a regulated platform for pre-IPO share trading to replace the largely unregulated grey market.

The proposed framework would allow investors to buy and sell shares during the three-day gap between IPO allotment and listing within a formal, transparent environment and thereby curb the risks associated with grey market dealings.

SEBI Plans To Raise Tenure Of Equity Derivatives

Pandey also indicated that Sebi is exploring steps to extend the tenure and maturity of equity derivatives products in a phased manner. The move is expected to discourage excessive speculative trading in these instruments, where 91% of individual traders suffered losses in FY25.

Speaking at the FICCI Capital Market Conference 2025, Sebi chief said pre-listing information is often not enough for investors to make an investment decision.

In a bid to further deepen the capital market and protect investors, he hinted at “an initiative, on a pilot basis – for a regulated venue where pre-IPO companies can choose to trade, subject to certain disclosures”.

On equity derivatives, Sebi is seeking ways to deepen cash equity markets, while enhancing the quality of derivatives through longer-tenure products.

SEBI On Platform For Pre-IPOs

Currently, there is a gap of at least three trading days when the IPO closes for subscription and opens for trading, and during this period trading in the grey market happens.

In the unlisted space, which largely remains unregulated, is getting a lot of traction among investors despite carrying significant risk for a lot of investors.

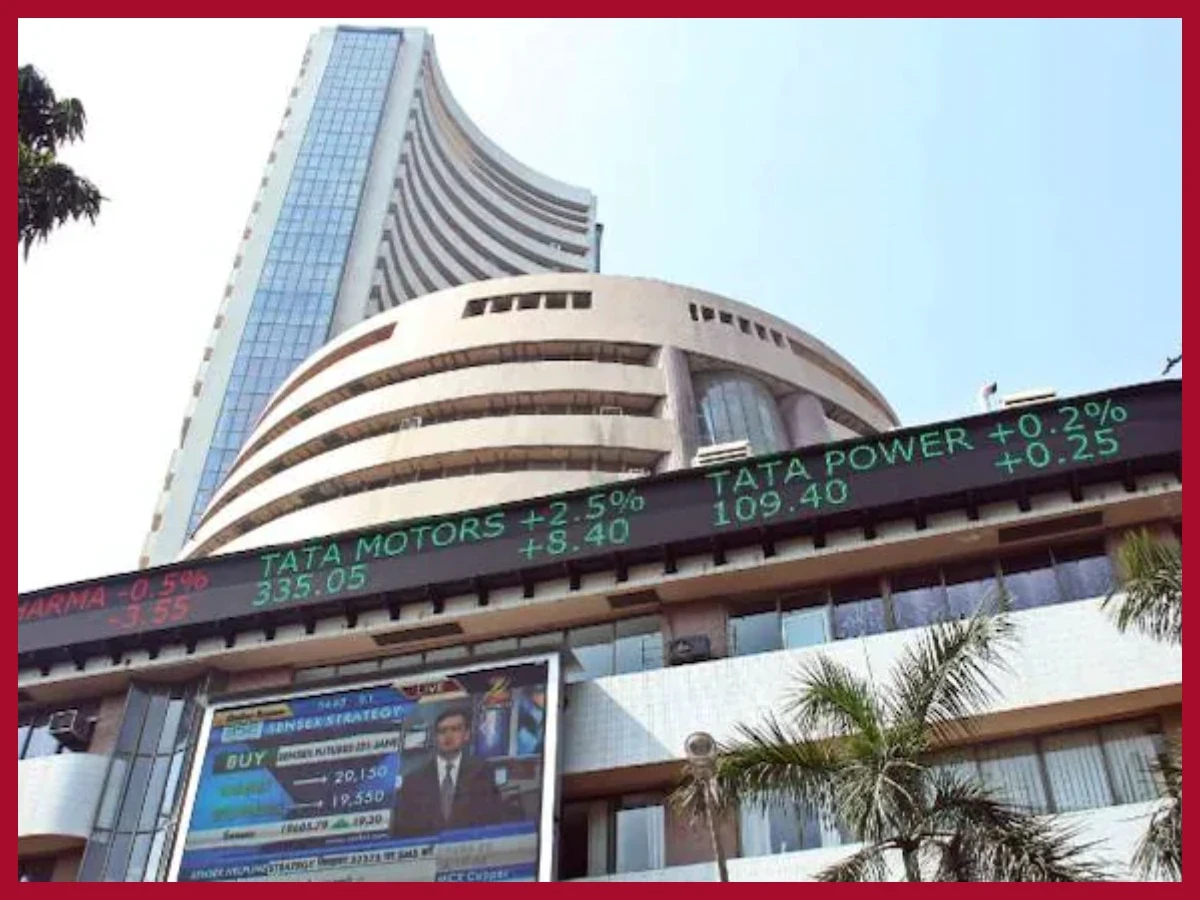

The remarks come at a time when the Indian IPO market has become very active with the listing of 48 main-board companies so far in 2025.

When asked whether there is any discussion with depositories on the pre-IPO trading platform, he said, “This is only in-principle with what I’m stating”.

Story Highlights

- SEBI chief on platform for Pre-IPOs

- SEBI to raise tenure of equity derivatives

- SEBI on regulated platform for Pre-IPOs

- SEBI on tenure for equity derivatives

Pandey said challenges that could confront the regulator range from unnecessary processes, pain points that cause avoidable friction in fundraising, disclosures, and investor onboarding, emerging areas, products and asset classes for creating both demand and supply of capital.