MetaPlanet shares rose nearly 5% after shareholders approved a slate of capital restructuring and dividend proposals.

- MetaPlanet plans to use Bitcoin as a hedge against the yen’s declining value.

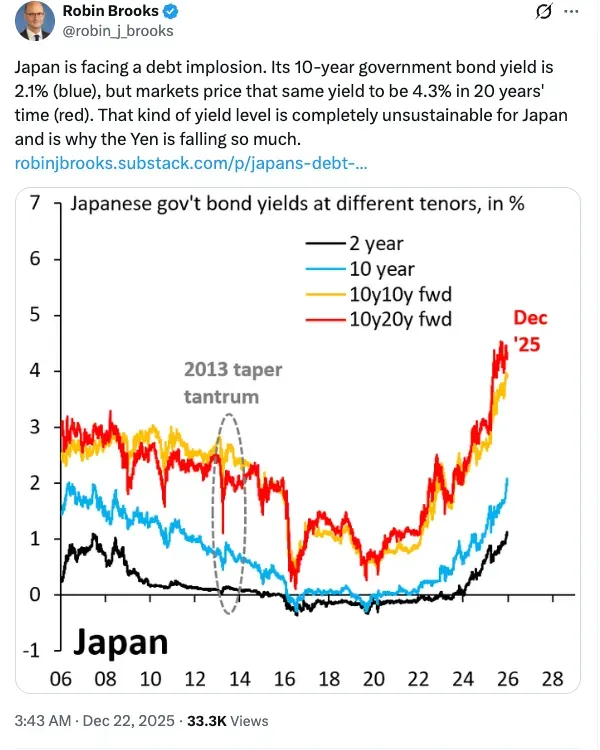

- Japanese economic conditions are concerning, with the 10-year government bond yield at 2.1% and predicted to rise to 4.3% over the next two decades.

- The company’s stock closed up 4.16% at 451 yen, reaching an intraday high of 458 yen on Monday.

MetaPlanet, Japan’s largest corporate Bitcoin (BTC) shareholder, saw a rise in its share price by nearly 5% on Monday after shareholders approved a series of capital and dividend-related proposals.

MetaPlanet’s Tokyo-listed stock closed up 4.16% at 451 yen, after touching an intraday high of 458 yen. The stock has risen notably year-to-date, implying investor optimism in the company’s Bitcoin-focused treasury strategy and capital restructuring plans. MetaPlanet shares reversed a multi-year downtrend in 2024 after the company adopted a Bitcoin-centric treasury strategy.

Meanwhile, Bitcoin was trading at $89,774.65, up 1.3%. On Stocktwits, retail sentiment around Bitcoin was in ‘extremely bearish’ territory over the past day, accompanied by ‘low’ levels of chatter.

MetaPlanet Approves Preferred Share Expansion

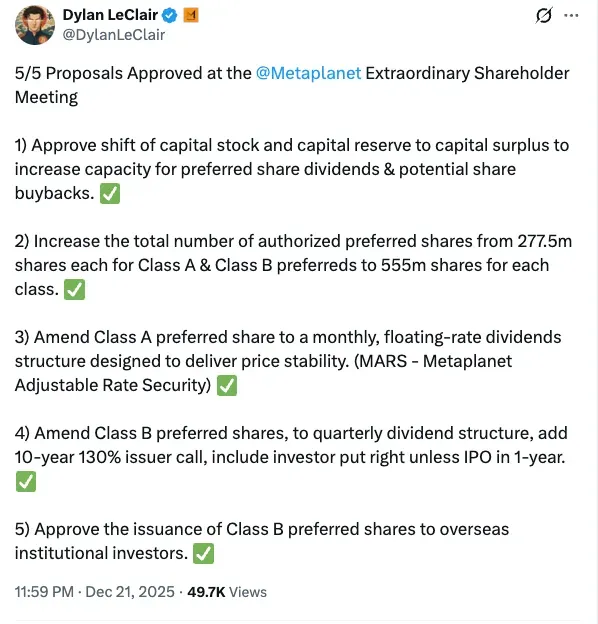

The move followed disclosures from company director Dylan LeClair on an X post, detailing the outcomes of an extraordinary shareholder meeting. LeClair explained that the new proposal will expand the company’s ability to issue preferred shares, pay dividends, and raise funds from overseas institutional investors.

According to LeClair, the approved measures include a reclassification of capital reserves into capital surplus, which “increase[s] capacity for preferred share dividends & potential share buybacks.”

Shareholders also approved an increase in the number of authorized preferred shares, with MetaPlanet doubling the authorized count for both Class A and Class B preferred shares from 277.5 million to 555 million.

The approved measures also amended the dividend structures of both preferred share classes. Class A preferred shares will move to a monthly, floating-rate dividend structure, which LeClair described as being “designed to deliver price stability” under the company’s MARS (MetaPlanet Adjustable Rate Security) framework.

Class B preferred shares were amended to pay dividends quarterly. Additional terms include a 10-year issuer call option at 130% and an investor put right that applies unless MetaPlanet completes an initial public offering within one year.

Bitcoin As A Hedge Against Yen Devaluation

Metaplanet is often regarded as the Bitcoin proxy in Japan, similar to Strategy’s (MSTR) position in the United States. Metaplanet Inc. began its Bitcoin-focused treasury strategy in April 2024 when it acquired its first Bitcoin. The company claimed the initial acquisition was part of a plan to use Bitcoin as a treasury reserve asset due to concerns about yen devaluation, inflation, and the long-term erosion of buying power in Japan’s low-rate environment.

Japan’s debt dynamics remain under scrutiny, with the 10-year government bond yield at 2.1%, according to Goldman Sachs Chief Forex Strategist Robin Brooks. Markets expect yields to approach 4.3% over the next two decades, reinforcing concerns over the yen’s long-term purchasing power.

Read also: Citi Cuts Targets On Four Crypto Stocks, Says Move Is About Valuation — Not Risk

For updates and corrections, email newsroom[at]stocktwits[dot]com<