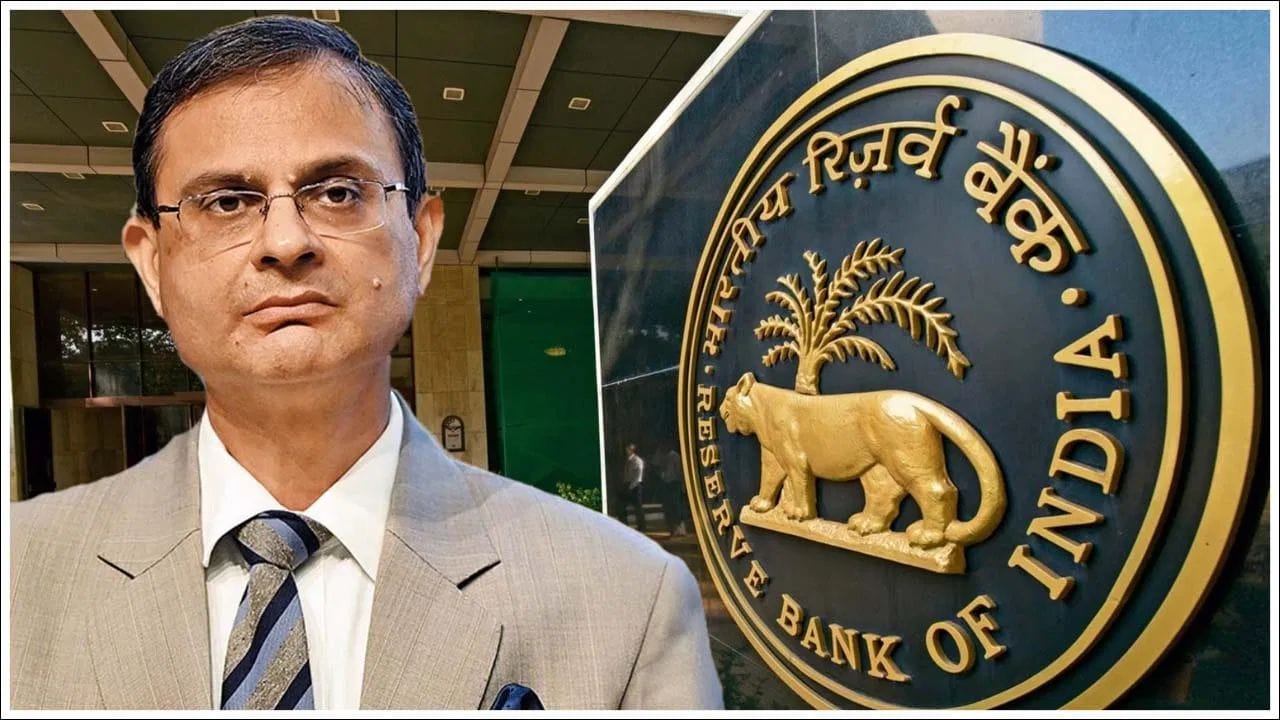

Reserve Bank of India

Reserve Bank of India (RBI) Governor Sanjay Malhotra believes that the weakness in the rupee in recent months will not have any major negative impact on the Indian economy. He says that the current level of decline in rupee is not much different from the trend of the last 1020 years and it cannot be called unusual.

In an interview, the RBI Governor said that in the last 10 years, the rupee has weakened by about 3 percent every year on an average, whereas in the period of 20 years this decline has been about 3.4 percent annually. In such a situation, the current decline should not be considered extraordinary. He says that currency fluctuations over time are a natural process.

Why did the rupee come under pressure this year?

This year the pressure on the rupee has increased due to many reasons. The strengthening of the US dollar, foreign investors withdrawing money from India and uncertainty over a possible trade tariff agreement between India and the US have weakened the rupee. The rupee reached a record low against the dollar in mid-December. The rupee has been among the weakest performers among Asian currencies so far in 2025.

RBI strategy

RBI’s strategy regarding the movement of rupee looks different from before. According to the Governor, the central bank is now giving more importance to market forces. RBI intervenes only when there is excessive volatility or speculative atmosphere in the currency market. He says that the objective of RBI is not to fix any fixed value of rupee, but to prevent instability.

India’s external position is strong

Even amidst the weak rupee and global tension, RBI has full confidence in India’s external economic situation. According to recent data, the country has foreign exchange reserves equal to about 11 months of imports. Moreover, about 92 percent of India’s total external debt is covered by foreign exchange reserves.

Relief from trade deficit and foreign exchange reserves

India’s trade deficit fell to a five-month low in November, largely due to the decline in imports of gold, oil and coal. A good increase was also recorded in exports to America. The RBI Governor said that India’s total external debt is around $750 billion, while the foreign exchange reserves are around $690 billion, due to which the country can easily fulfill its international responsibilities.

Also read- Journey from stove to cylinder, this is how the picture of your kitchen changed in 25 years